THE BAIRD/STR HOTEL Stock Index dropped in May, after rising continuously for five months. Investors grew concerned about macroeconomic slowing and inflationary pressures which led to the broader stock market volatility.

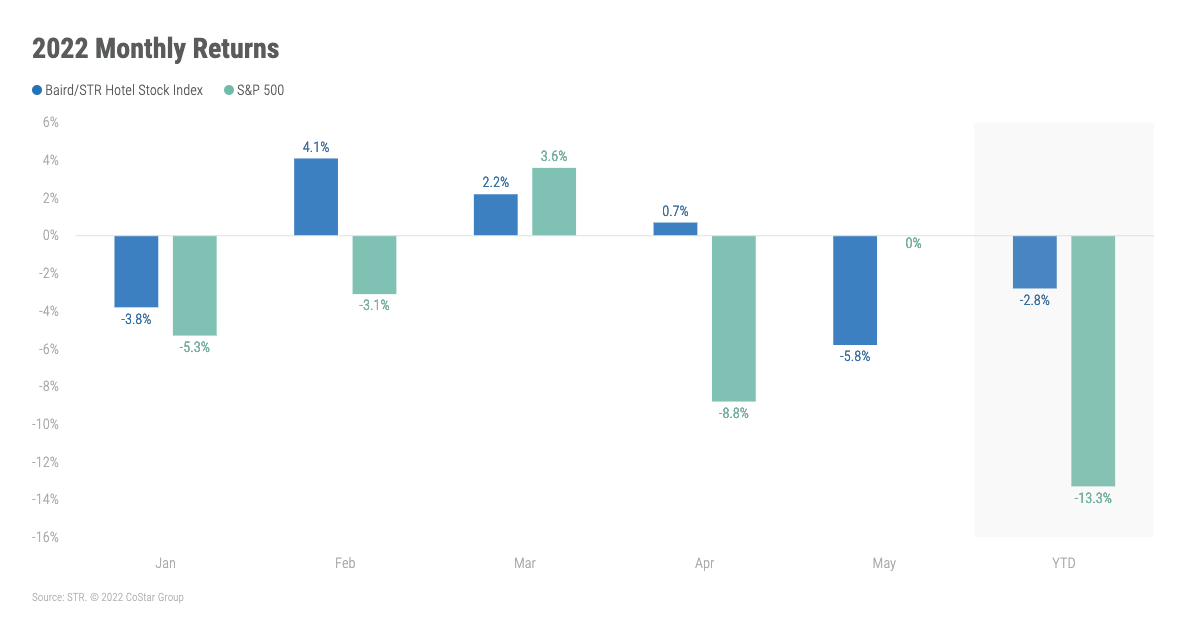

Baird/STR dropped 5.8 percent during the month, according to STR. Baird/STR went up 0.7 percent during April. The index decreased 2.8 percent over the first five months of 2022. It increased 2.2 percent in March after rising 4.1 percent in February.

Baird/STR index fell behind the S&P 500, which was flat from April, but surpassed the MSCI US REIT Index, which was down 6.3 percent. The hotel brand sub-index fell 6 percent from April, while the Hotel REIT sub-index dipped 4.9 percent during the month.

“Hotel fundamentals have continued to improve and are showing no signs of slowing; the demand recovery is broadening, the harder-hit urban markets are rebounding, and midweek business travel is coming back at a strong pace. Despite the positive fundamental momentum, investors remain a bit skeptical and are focused on the health of the consumer amid a slowing growth backdrop,” said Michael Bellisario, senior hotel research analyst and director at Baird.

“Despite macroeconomic uncertainty, consumer spending on travel and hotel rooms has continued,” said Amanda Hite, STR president. “In-person graduation ceremonies drove May performance in many university-based markets, such as New York City, which reached an occupancy level of nearly 90 percent – its busiest week of the pandemic-era. Leisure markets continue to show strong performance levels, with room rate growth as the prominent bright spot for the industry. Our latest forecast, released early last week at NYU, upgraded the recovery timeline for nominal RevPAR. We expect both nominal ADR and RevPAR to surpass 2019 levels in 2022. Due to increases in new supply and slower corporate demand recovery, occupancy is not forecasted to reach 2019 levels until 2024.”