Why JLL Predicts Strong Investment for Select-Service & Extended-Stay Hotels 2025

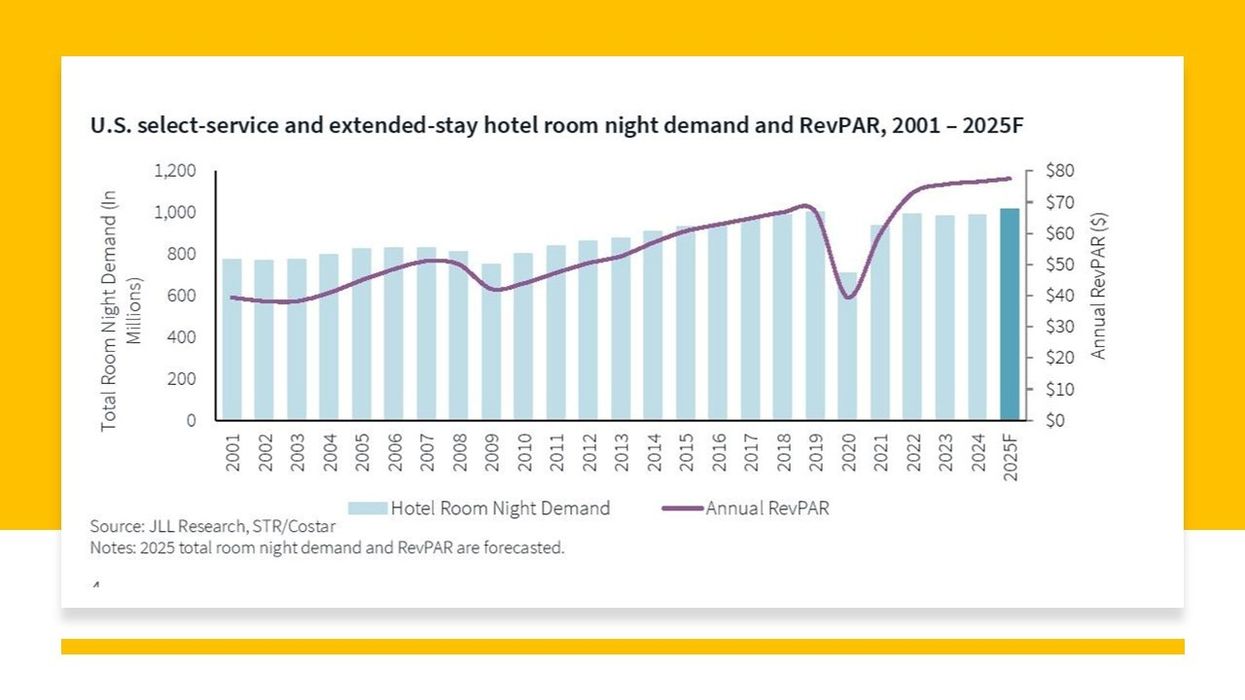

SELECT-SERVICE AND extended-stay hotels remain attractive investments due to their “durable returns in a volatile market,” according to a recent JLL study. The sector’s RevPAR hit a record $78 in 2024, 14 percent above 2019 levels, with demand up 232,000 room nights year-over-year, nearing full recovery.

JLL’s U.S. Select-Service and Extended-Stay Hotel Outlook 2025 highlights the sector’s lean operations and higher profit margins compared to full-service hotels, making it a strong investment for stable returns despite economic challenges.

"The select-service and extended-stay hotel sector remains a focal point for investors seeking durable returns in a volatile market," said Ophelia Makis, research manager at JLL’s Hotels & Hospitality Group. "The sector's adaptability, operational efficiency, and consistent yields position it well for continued success in 2025 and beyond."

Guest demand for the sector will rise in 2025, fueling further growth and investment.

JLL attributes this performance surge to the sector's shift into a unified market, catering to evolving traveler preferences with a mix of amenities. Since 2021, the sector has generated $62.6 billion in liquidity, nearly 50 percent of total U.S. hotel investment volume. Strong fundamentals, a lean operating model and higher yields than other real estate sectors drive this demand.

Investment momentum is expected to continue, as acquiring a property in top U.S. markets costs about 37 percent less than new development, the report said. The sector also has the lowest yield volatility among major property types over the past 16 years, reinforcing its stability.

The sector's brand count has risen from 184 in 2000 to 214, now comprising 74 percent of total room supply, JLL said. New brands introduced over the past five years include IHG’s Atwell Suites, Choice’s Everhome Suites, Wyndham’s Echo Suites and Hilton’s LivSmart Studios and Spark. With limited organic growth, brands are turning to mergers, acquisitions, and conversions to expand.

The U.S. select-service and extended-stay sector “maintains its allure for lenders despite higher debt costs,” the report found. Loan origination rose 6.4 percent in 2024 to $18.2 billion. While banks remain dominant, investor-driven lenders, insurers, and CMBS are expanding their presence, reflecting confidence despite market challenges.

"In the post-pandemic era, select-service and extended-stay assets have been a dominant force in the hotel investment market, primarily on a single-asset transaction basis more recently," said Dan Peek, Americas president for JLL’s Hotels & Hospitality Group. "Given the positive momentum in the financing markets and the rising tide of available equity, it's likely we will see a return of substantial portfolio transactions in 2025 and 2026."

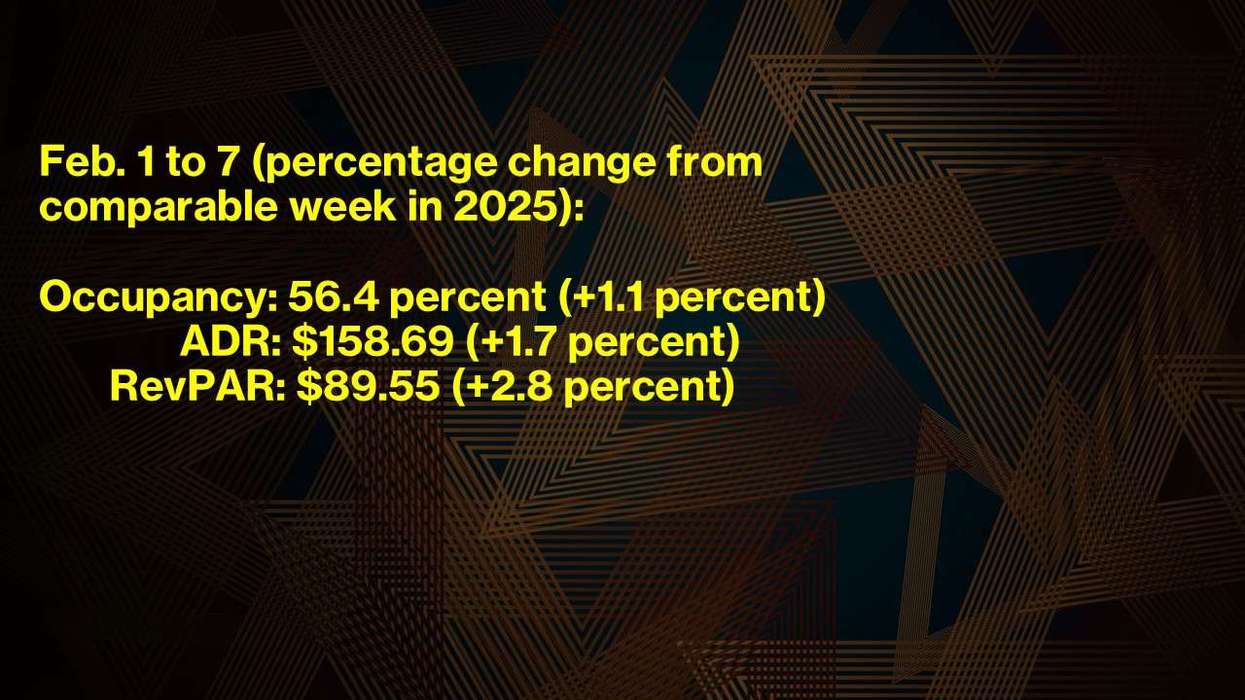

The Highland Group recently reported that U.S. extended-stay hotels ended 2024 strong after a slow start, with supply, demand, and room revenue growth outpacing the industry, while ADR and RevPAR gained momentum later in the year.