APRIL FINISHED FLAT for U.S. hotels, according to STR. However, the NFL Draft provided a boost for the host city of Cleveland.

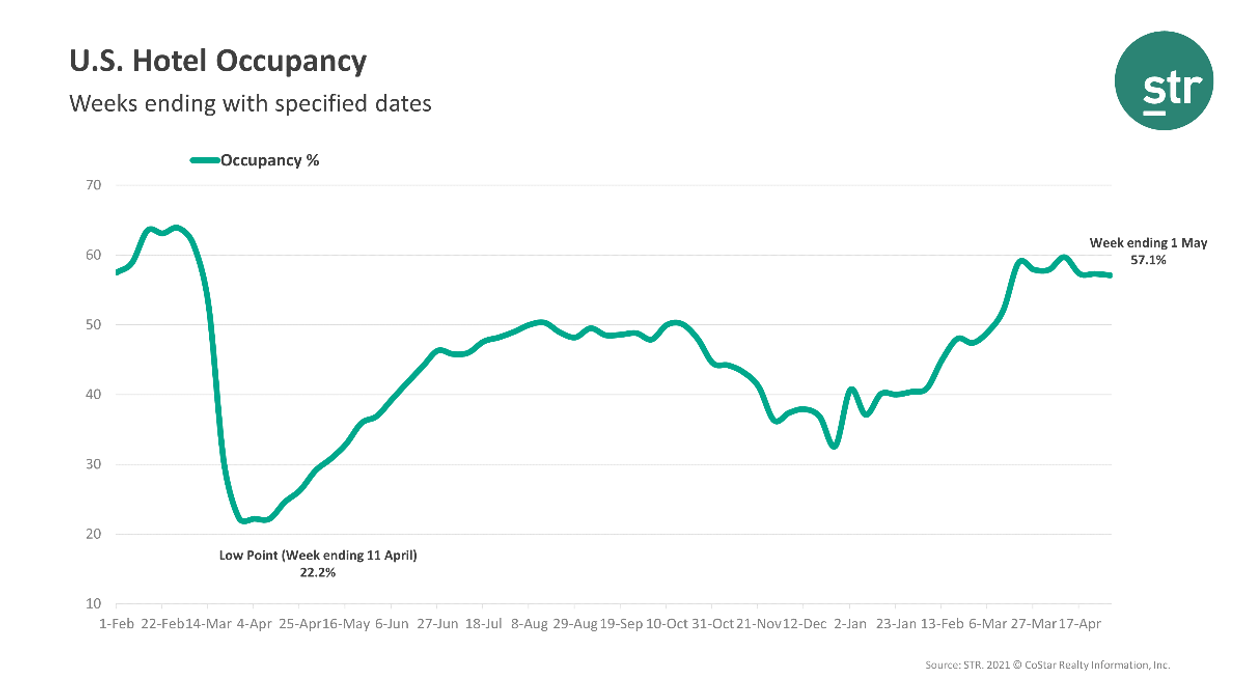

Occupancy for the week ending May 1 was 57.1 percent, down a little from 57.3 percent the week before. ADR for the week was $108.80, compared to $108.10 the week before, and RevPAR was $62.13 compared to $61.93.

“While the overall weekly data was stagnant, weekend occupancy rose modestly and came in above 70 percent for the fourth straight week,” STR said. “However, the top 25 markets showed a lower occupancy level in aggregate with more properties reopening on top of lower demand.”

The aggregate occupancy for the top 25 markets was 54.6 percent, and ADR was $117.38, higher than the average. Tampa had the highest occupancy among the top 25 with 72.4 percent, followed by Miami with 70.8 percent. Boston and Minneapolis had the lowest with 40.6 percent and 41.4 percent respectively.

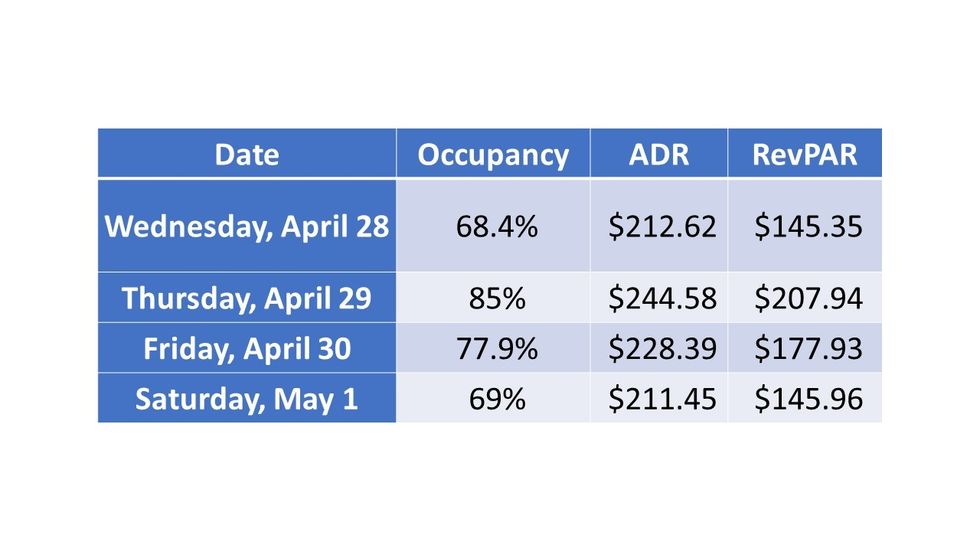

However, occupancy for some Cleveland hotels maxed out at 85 percent on the Thursday of the week, April 29, the opening night of the NFL Draft. The surge, observed in26 hotels in the four zip codes that comprise the immediate downtown area and nearby University Circle, was similar to the boost Tampa, Florida, saw when that city hosted the Super Bowl in February. ADR for that day was $244.58 and RevPAR was $207.94.

It was a 532-day high for the hotels. That RevPAR level was more than 14 times higher than the comparable Thursday in 2020 and more than double the comparable Thursday from 2019, according to STR. Also, RevPAR for the area hadn’t approached the $200 mark since Nov. 14 2019, the night the Cleveland Browns hosted the Pittsburgh Steelers and RevPAR hit $220.90.

“An in-person event the size of the draft, which was one of the largest in North America since the beginning of the pandemic, is a beacon for hotels struggling through the earliest stages of recovery,” said Carter Wilson, STR’s senior vice president of consulting. “Cleveland hotels enjoyed a pretty solid week after more than a year of RevPAR not touching $100. That reaffirms that as events come back with attendance, the corresponding hotel boost will be there in proximity. Additionally, Cleveland was able to showcase itself on the national stage, which further bolsters the city’s resume for hosting other major events down the road.”

For the full week, the downtown Cleveland area recorded a RevPAR of $135.49, which if compared with full STR-defined markets, would have ranked fourth behind the Florida Keys, Maui Island and Miami.