STR and Tourism Economics updated their 2023 U.S. hotel forecast this week. While top-line performance is expected to advance, growing operating expenses are projected to limit profit growth over the remainder of the year, STR said in a statement.

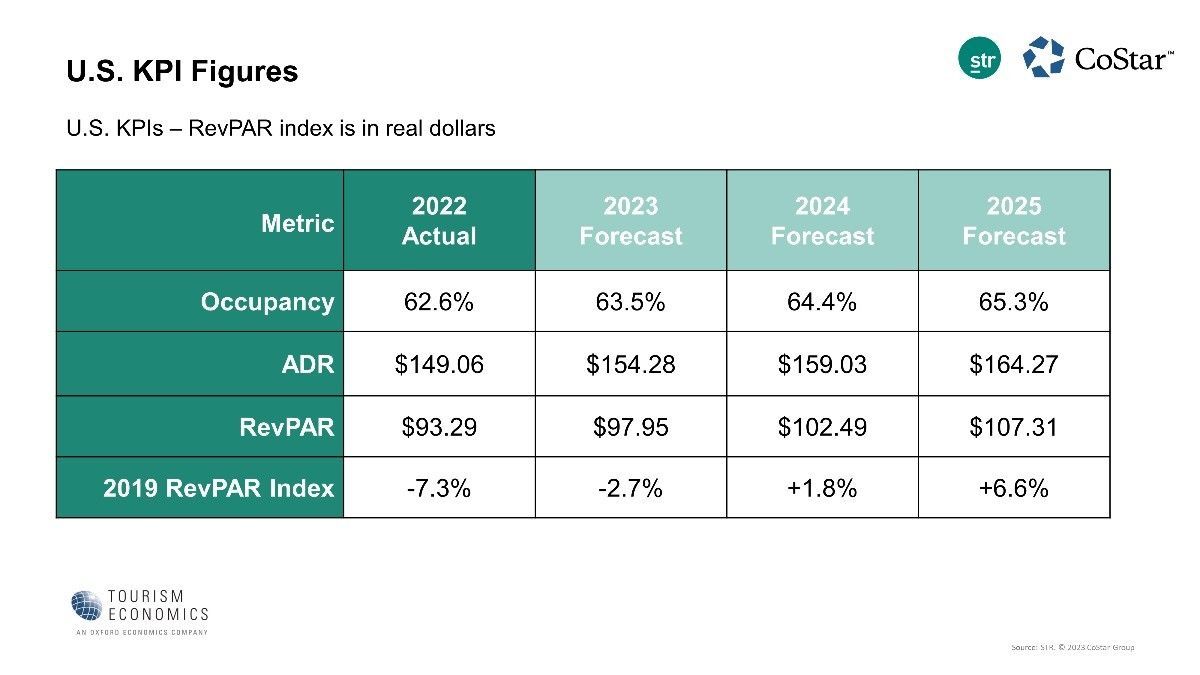

According to STR, RevPAR achieved full recovery in 2022 in nominal terms, but when adjusted for inflation (real), it is not expected to reach that level until 2025. The new forecast was delivered at the 45th Annual NYU International Hospitality Industry Investment Conference.

GOPPAR also recovered in 2022, but moderate growth is projected for 2023, with more substantial gains expected in 2024, the statement added. “The GOPPAR projection for this year was lowered by 2.7 percent compared to the previous forecast, and a further 4 percent downgrade is predicted for 2024.”

“Despite the upgrade, economic uncertainty underlines our forecast for the remainder of this year and into 2024,” said Amanda Hite, president of STR. “We have always forecasted with a mild recession in mind, but we’re now looking at a later timeline and the added concerns around the banking system. Regardless, through the first four months of the year, hotel demand improved 4.3 percent with most of the gain concentrated in the upper upscale and upscale chains. These two chains, which are the segments most associated with business travel and groups, are expected to lead industry demand growth for the remainder of 2023.”

However, Hite also sounded a warning.

“With everything considered, the industry has plenty of reasons to remain optimistic about top-line performance,” she said. “At the same time, growing operating expenses, especially labor, continue to pressure the bottom line. Profit margins, while strong, are projected to be lower this year than last.”

Aran Ryan, TE’s director of industry studies, also was cautious.

“Recent stress in the banking system and tighter lending standards will add to inflation pressures and produce a relatively mild recession in the second half of 2023,” Ryan said. “A halting economy will limit gains in lodging demand, though we continue to anticipate returning group and business activity, international travel, and consumers’ desire for travel will sustain modest growth in room nights sold.”