PROJECTIONS FOR THE recovery of U.S. hotels from the COVID-19 pandemic remain basically the same in the latest forecast from STR and Tourism Economics. However, the outlook for the future in 2022 is less bright as the summer vacation surge begins to dwindle and business travel levels remain uncertain.

As evidence of that concern, performance metrics were down for the first week of August on a week-over-week basis.

STR and TE released their latest forecast Thursday during STR’s 13th Annual Hotel Data Conference. The firms upgraded the U.S. hotel forecast for 2021 as a whole, expecting occupancy of 54.7 percent, ADR of $115.50 and RevPAR of $63.16.

The occupancy and RevPAR figures use STR’s total-room-inventory methodology, which assumes no closures due to the pandemic. In 2019, the recovery benchmark, 66 percent occupancy, ADR of $130.91 and RevPAR of$86.35, were all at or near all-time highs.

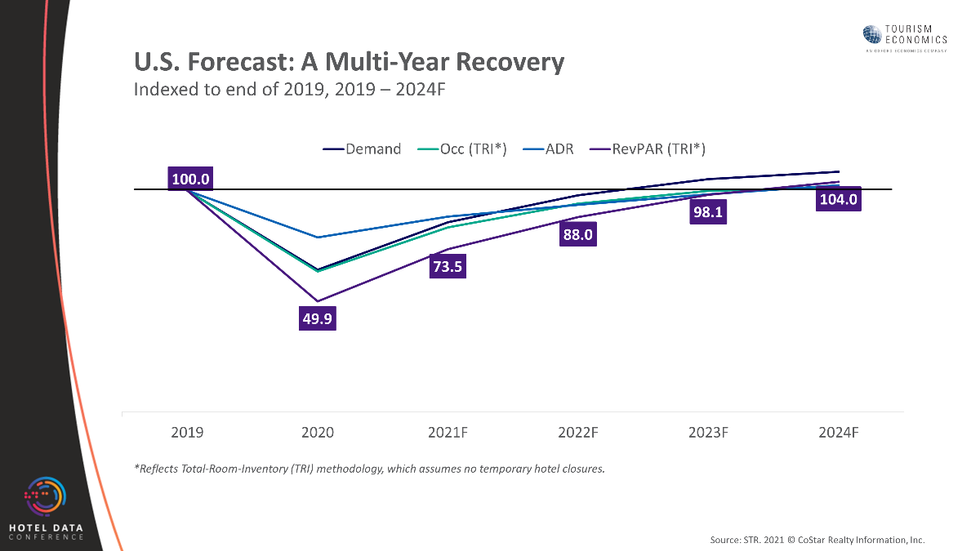

The firms lowered growth projections for 2022, but full recovery of demand remains on the same timeline for 2023, while RevPAR is projected to surpass 2019 levels in 2024. STR and TE’s forecast released after the Hunter Hotel Conference in May set the same year for recovery.

“Rather than improved expectations for the coming months, our upward revision for 2021 more reflects the surge in demand that has already occurred as well as room rates hitting an all-time high on a nominal basis,” said Amanda Hite, STR’s president. “As we have maintained, there is concern once the summer officially wraps up and the industry loses what has been its primary demand source. In normal years, summer leisure demand would be supplanted by business travel and large corporate events, but with more concern around the Delta variant as well as delays in companies returning their employees to offices, it’s possible that businesses wait until early 2022 to put their people back on the road.”

STR and TE expect some of the new business travel demand to shift into 2022, Hite said, but a stronger-than-expected 2021 led them to lower their projections for next year. The agencies still expect full recovery to take place in 2023 and 2024, though that recovery may be uneven as some leisure-driven markets already are ahead of where they were pre-pandemic and most of the major markets are still lagging. The ongoing labor shortage also have an impact, but Hite said they remain optimistic.

Aran Ryan, TE’s director, shared that optimism.

“The economic recovery has considerable momentum, underpinned by quite strong consumer demand and ongoing fiscal stimulus,” Ryan said. “Though it is challenging to look through the current virus wave, we expect as public health conditions stabilize, the recovery in leisure travel demand will remain intact and the corporate travel recovery will resume its climb later this year.”

Among STR’s top 25 markets, Norfolk/Virginia Beach and Miami are the only ones with 2021 RevPAR results exceeding their 2019 levels, more so because of ADR rather than occupancy. San Francisco, New York City and Boston are expected to be the furthest from their 2019 levels by the end of the year.

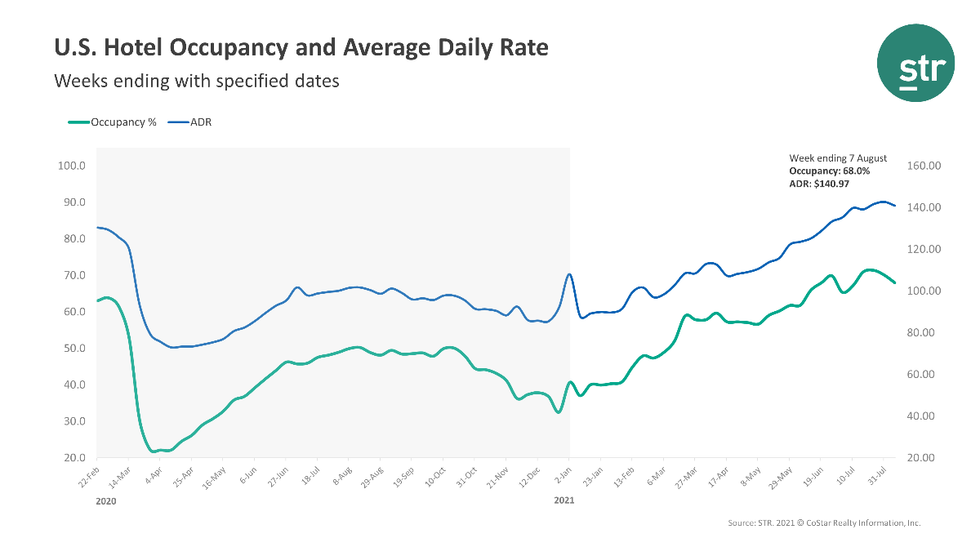

During the week ending Aug. 7, occupancy for U.S. hotels reached 68 percent, down from 70.1 percent the previous week and down 8.3 percent from 2019 levels. ADR was $140.97, down from $142.76 the previous week and up 5.1 percent from 2019. RevPAR was $95.89 compared to the previous week’s $100.07 and down 3.6 percent from 2019.

Houston saw the highest occupancy increase over 2019 among the top 25, up 4.3 percent to 62.5 percent. San Francisco/San Mateo experienced the steepest decline in occupancy from 2019, dropping 38.6 percent to 55.9 percent.

Miami reported the largest ADR increase over 2019, up 31.6 percent to $198.61, while Tampa, Florida, registered the largest RevPAR increase comparatively, up 21.6 percent to $98.81, while San Francisco/San Mateo, California, and New York City saw the largest RevPAR drops, down 59.2 percent to $93.96 and 41.2 percent to $131.82 respectively.