CoStar hotel performance update

THE U.S. HOTEL industry reported higher performance in the second week of July compared to the previous week, but lower year-over-year results, according to CoStar. The first hurricane of the season impacted one top 25 market.

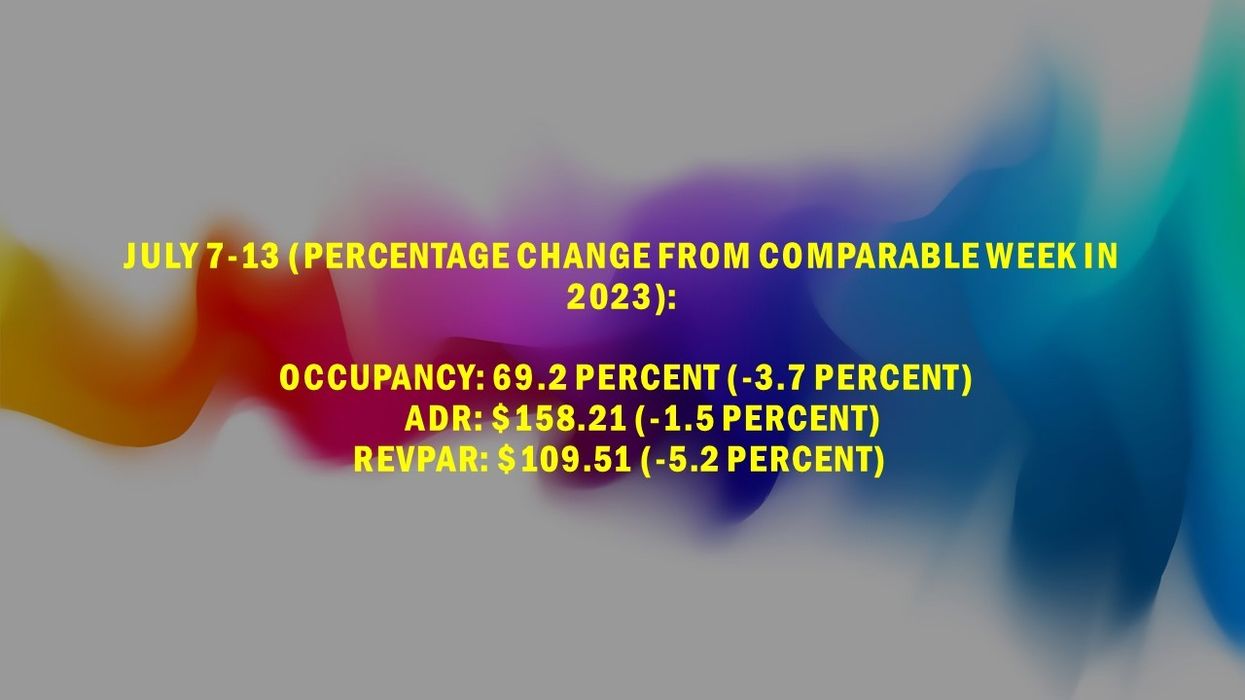

Occupancy climbed to 69.2 percent for the week ending July 13, up from 61.3 percent the previous week, but down 3.7 percent year-over-year. ADR increased to $158.21 from $157.27, marking a 1.5 percent decline compared to last year. RevPAR increased to $109.51 from $96.35 the previous week, reflecting a 5.2 percent decrease from the same period in 2023.

Among the top 25 markets, Houston recorded the highest year-over-year increases in key performance metrics: occupancy rose 13.4 percent to 72.2 percent, ADR increased 22.4 percent to $137.17, and RevPAR grew 38.8 percent to $98.97. The market's performance was impacted by Hurricane Beryl.

The steepest RevPAR declines were in Denver, down 29.4 percent to $125.40, and San Diego, down 26.7 percent to $188.40.