Summary:

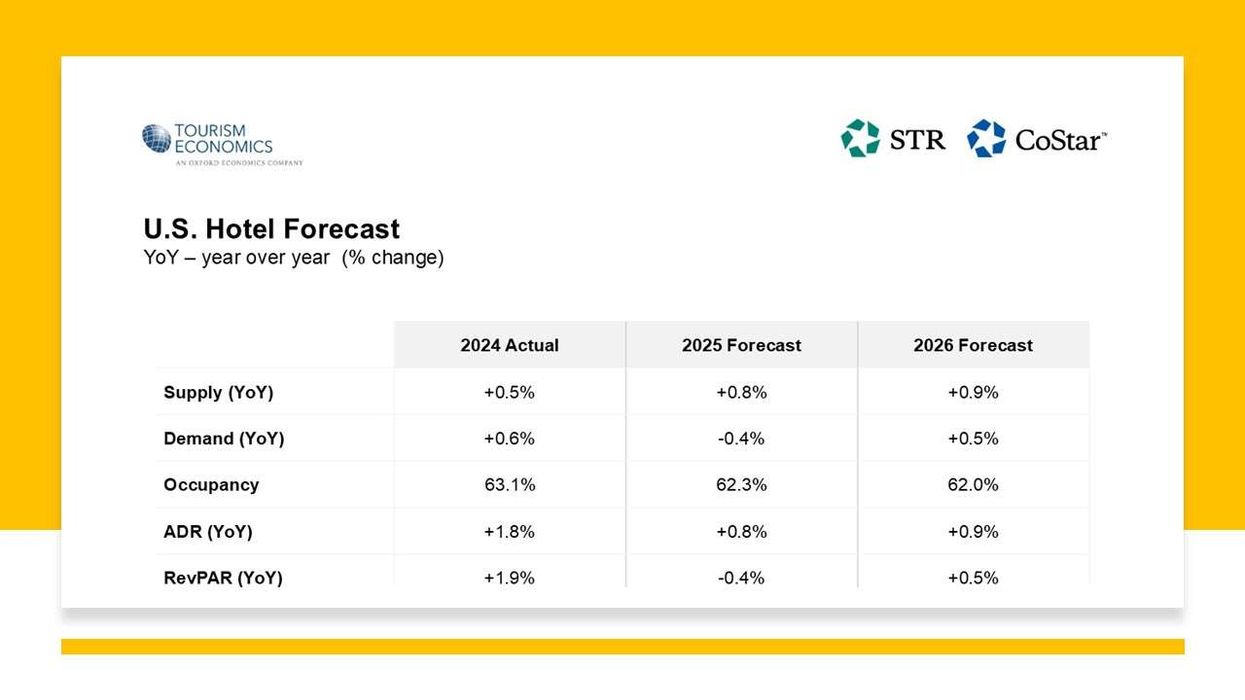

- CoStar and TE downgraded the 2025 U.S. hotel forecast.

- Occupancy fell 0.2 points to 62.3 percent.

- RevPAR dropped 0.3 points to -0.4 percent.

COSTAR AND TOURISM Economics downgraded the 2025 U.S. hotel forecast, with occupancy falling 0.2 points to 62.3 percent and ADR holding at +0.8 percent. RevPAR was downgraded 0.3 percentage points to -0.4 percent.

The last full-year U.S. RevPAR declines were in 2020 and 2009, the research agencies said in a statement.

“We expect little change in the macroeconomic environment as unemployment and prices continue to rise,” said Amanda Hite, STR president. “As a result, our hotel performance outlook for the remainder of this year and next was lowered once again. ADR is growing well below the rate of inflation, which in turn will put more pressure on margins.”

Similar adjustments were made for 2026: occupancy -0.3 points, ADR -0.1 points and RevPAR -0.3 points.

Aran Ryan, TE’s director of industry studies, said a softening job market, policy uncertainty and tariff costs remain near-term drags on consumers.

“However, heading into 2026, we expect the U.S. travel economy to firm up moderately," he said. "Household income growth will continue, accompanied by tax cut benefits, resumed hiring and less policy instability. Expanding global long-haul travel and World Cup interest will bring improved international visitation."

In June, CoStar and TE lowered the 2025–26 U.S. hotel forecast. First-quarter underperformance and macroeconomic factors pushed growth down: supply -0.1 percent, demand -0.6 percent, ADR -0.3 percent and RevPAR -0.8 percent.

“[Gross operating profits per available room] projections have been lowered from our previous forecast, with the decrease in 2025 being mainly due to higher expenses, especially in the F&B department, as well as increased costs in other operated departments, marketing and utilities,” said Hite. “Labor costs will be slightly higher in 2025, likely due to the increase in the aforementioned F&B department, which is traditionally more labor-intensive.”

In January, CoStar and TE made minimal changes to the 2025 U.S. hotel forecast: ADR and RevPAR remained at 1.6 percent and 1.8 percent, while occupancy rose 0.1 percentage points to 63.1 percent.