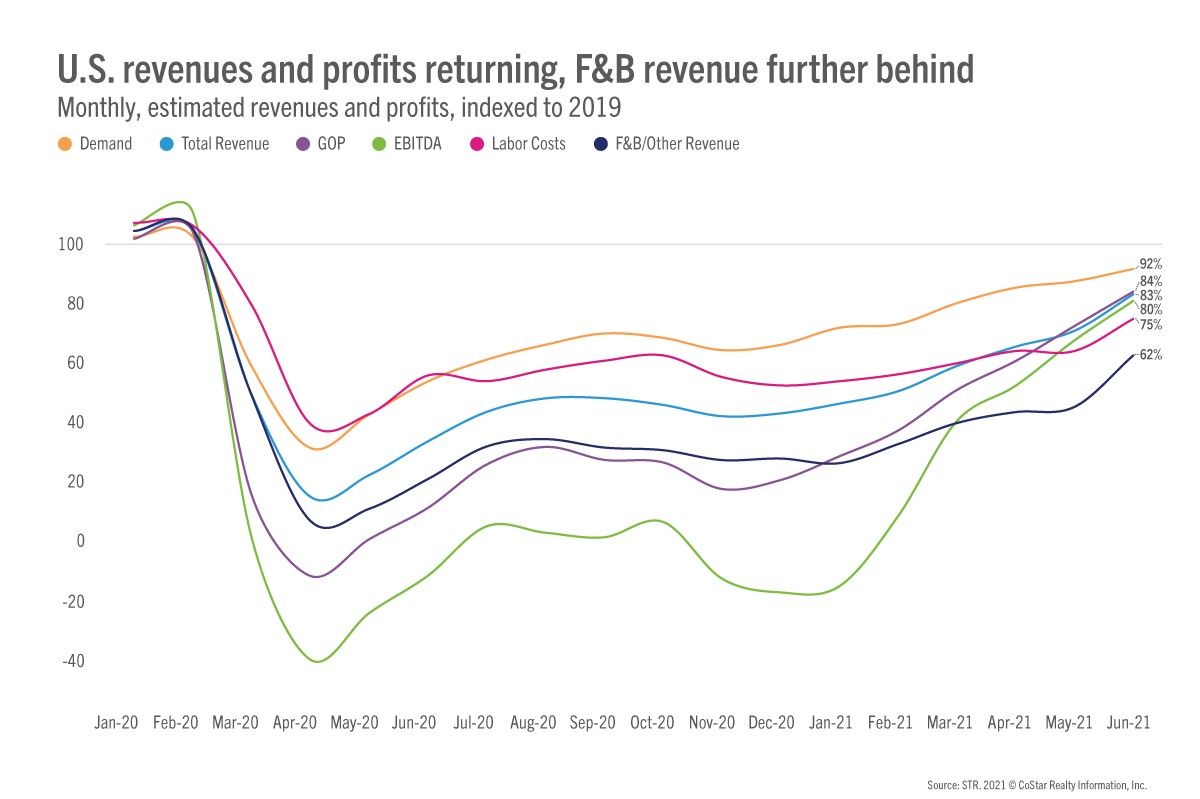

U.S. HOTELS REPORTED higher profitability on a per-available-room basis in June 2021 when compared to any month since February 2020, according to STR. But labor costs were at the highest level since March 2020.

Gross operating profits reached 84 percent of 2019 levels, according to STR‘s June 2021 monthly P&L data release. Labor costs also rose in June when compared to May this year. In comparison with 2019, a similar trend has been witnessed in people cost, the report added.

However, New York City, San Francisco and Oahu Island are still realizing negative GOP, and most top markets are reporting less than 50 percent of 2019 revenues, according to STR.

GOPPAR for June was $50.67, the profitability metrics was $37.30 for May. TRevPAR was $131.81 and EBITDA PAR was $33.10 during the months. Labor costs was $37.39 during June this year. It was $30.96 a month ago.

U.S. hotel profits rose between April and May and crept closer to 2019 levels in May, an earlier STR report said.

“After the industry recorded its highest top-line metrics since October 2019, it is no surprise that profitability followed suit,” said Joseph Rael, STR’s senior director for financial performance. “Market leisure demand is driving profitability, as F&B revenues remain weak due to the continued lack of group travel. While profits have improved immensely, levels still remain well below 2019 comparables. We can expect to see profits return at accelerated levels as demand and revenues rebound.”

Rael said that many hotels are still being hit hard financially, and labor costs remain depressed when compared with pre-pandemic levels as hotel staffs are doing a lot more with a lot less help.

“One monthly trend that is still ongoing is that properties in the major metros are still struggling. New York City, San Francisco and Oahu Island are still realizing negative GOP, and most top markets are reporting less than 50 percent of 2019 revenues. Beach destinations such as Miami, Norfolk/Virginia Beach, and Tampa, on the other hand, are experiencing better overall performance,” he said.

The U.S. hotel industry recorded its highest monthly occupancy and RevPAR since October 2019 in June, a recent report said. Oahu Island recorded the highest ADR, $227.22, and RevPAR, $171.40. Overall, the top 25 markets showed lower occupancy but higher ADR than all other markets.