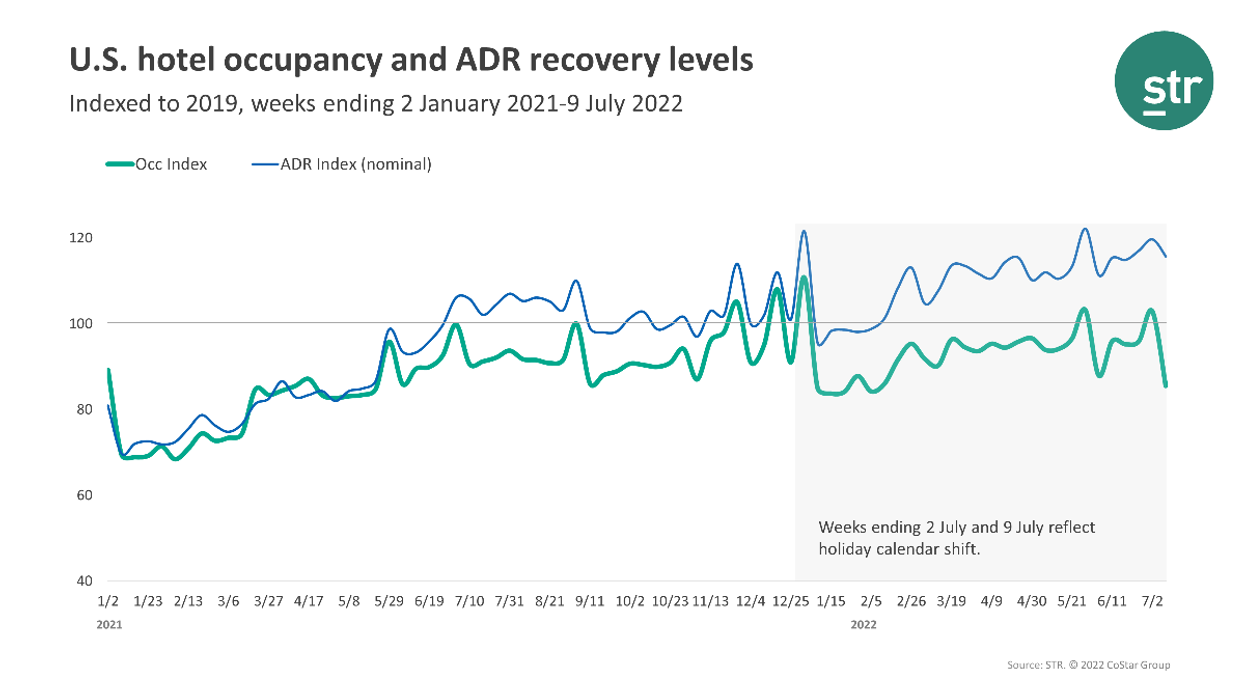

U.S. HOTEL PERFORMANCE dropped in the second week of July, as expected due to a holiday calendar shift, according to STR. The performance was skewed downward due to a comparison with a non-holiday week in 2019.

STR said that performance is expected to improve for the remaining weeks of July after two consecutive weeks of lower demand around the Independence Day holiday.

Occupancy was 63.3 percent for the week ending July 9, down from 67.3 percent the week before and dropped 14.5 percent from 2019. ADR was $153.71 for the week, slightly up from $153.32 the week before and increased 15.7 percent from three years ago. RevPAR reached $97.37 during the week down from $103.24 the week before and down 1.1 percent from 2019.

Oahu Island reported the highest levels of occupancy (86.2 percent), ADR ($315.57) and RevPAR ($271.92) among STR's top 25 markets during the week.