EXTENDED-STAY HOTELS DISPLAYED varied performance in December compared to the overall hotel industry, with supply, demand, and room revenues showing relative gains, according to The Highland Group. Occupancy experienced a milder decline than the broader hotel sector while low ADR growth and an unexpected decline in economy extended-stay RevPAR resulted in a total extended-stay hotel RevPAR decrease versus a slight RevPAR increase in the overall hotel industry.

The 2.4 percent net increase in extended-stay room supply in December represents a modest rise compared to the average over the past 18 months and a slight gain over the most recent three months, the report said.

Supply shifts overview

December marked nine consecutive quarters with 4 percent or less supply growth, significantly below the long-term average, according to The Highland report. The 13 percent surge in economy extended-stay supply and the reduction in mid-price segment rooms are primarily attributed to conversions, with new construction in the economy segment accounting for approximately 3 percent of rooms compared to a year ago.

Supply changes are influenced by re-branding, segment reclassification in Highland’s database, de-flagging of hotels failing to meet brand standards, and the sale of properties to multi-family apartment companies and municipalities, the report added. This trend is expected to persist in the first half of 2024, primarily due to the presence of several older extended-stay hotels still available in the market.

Moreover, the overall annual rise in total extended-stay supply compared to 2022 will remain significantly below the long-term average.

Mid-price hotels see revenue decline

Mid-price extended-stay hotels experienced their first monthly revenue decline in nearly three years, according to the report. However, gains in the economy and upscale segments propelled total extended-stay revenue 1.6 percent above the December 2022 level. In comparison, STR/CoStar reported a 1.5 percent increase in revenue for all hotels during the same period.

The mid-price segment's supply contraction due to re-branding negatively affected segment demand, but the total extended-stay demand gain compares favorably to the 0.6 percent decline estimated by STR/CoStar for the overall hotel industry.

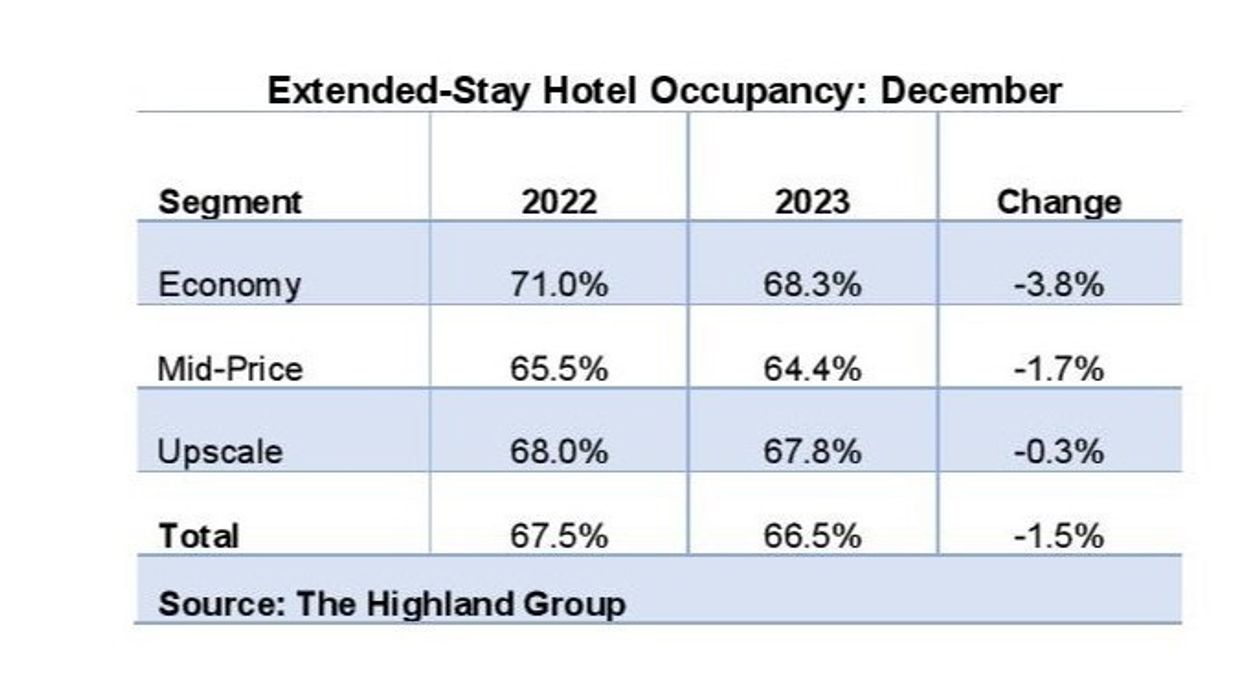

December 2022 occupancy comparison

All three extended-stay segments experienced decreased occupancy compared to December 2022, with the decline slightly below that of the overall hotel industry, according to The Highland Group. December marked the ninth consecutive month of declining total extended-stay occupancy. However, in December, extended-stay hotel occupancy stood 13.8 percentage points higher than the total hotel industry, maintaining a historical long-term average occupancy premium.

All three extended-stay segments saw ADR gains in December. However, the total extended-stay ADR increase was only about one-third of the 2.2 percent growth reported by STR/CoStar for the overall hotel industry.

The modest RevPAR increases in the mid-price and upscale segments in December were insufficient to counterbalance the decline in the economy segment, resulting in a year-over-year decrease in total extended-stay hotel RevPAR, report further said.

December also marked the ninth consecutive month of declining RevPAR for economy extended-stay hotels, with the 3.4 percent decrease being the largest in five months. However, it was significantly lower than the 6.4 percent contraction estimated by STR/CoStar for all economy class hotels.

In November, extended-stay hotels reported mixed results with an average occupancy of 58.6 percent, surpassing the overall industry, according to The Highland Group. The 2.2 percent increase in room supply, consistent with previous months, marks a slight uptick over the 17-month average. Modest ADR growth contributed to a slight increase in extended-stay hotel RevPAR.