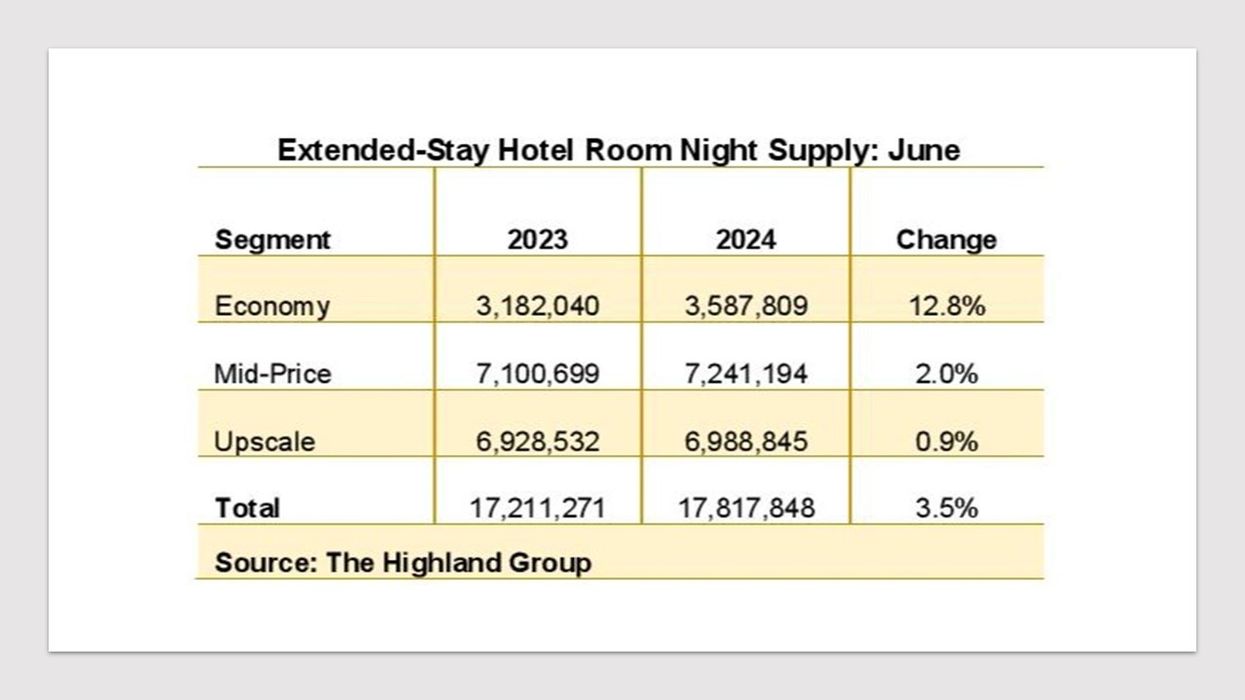

U.S. EXTENDED-STAY room supply grew by 3.5 percent in June, exceeding the average monthly increase of the past two years, according to The Highland Group. June marked the 33rd consecutive month of supply growth at 4 percent or less, with annual changes remaining below 2 percent for the past two years. However, both metrics are well below the long-term average.

The growth includes the addition of Water Walk by Wyndham, a mid-priced extended-stay brand, to the database in May following its affiliation with Wyndham, the report said.

The 12.8 percent increase in economy extended-stay supply, along with modest gains in midprice and upscale segments, is mainly due to conversions, The Highland Group said. New construction in the economy segment is estimated at about 3 percent of rooms open compared to a year ago.

The report noted that supply change comparisons have been affected by re-branding, shifting rooms between segments, de-flagging hotels that no longer meet brand standards, and the sale of hotels to apartment companies and municipalities. The trend is likely to taper off in the second half of 2024, with the full-year increase in extended-stay supply compared to 2023 remaining well below the long-term average.

Key metrics stats

Extended-stay hotels saw a 4.5 percent revenue increase in June, marking the third consecutive monthly gain of 4 percent or more and significantly outpacing the 2.4 percent increase reported by STR/CoStar for the overall hotel industry, The Highland Group said. Total extended-stay demand rose by 3.7 percent in June, marking a positive change in 18 of the last 19 months. This gain far exceeded the 0.9 percent increase reported by STR/CoStar for all hotels.

Extended-stay hotel occupancy increased in June for the third consecutive month after over a year of declines. Although modest, this gain contrasts positively with the 0.9 percent decline reported for the overall hotel industry by STR/CoStar. In June, extended-stay hotel occupancy was 9.8 percentage points higher than the overall industry, consistent with the historical summer occupancy premium.

After monthly declines in February and March—the first in three years—extended-stay hotel ADR increased for the third consecutive month in June, the report said. The economy segment's monthly increase was its first since December 2023 and contrasted with the 0.8 percent decline reported by STR/CoStar for all economy-class hotels. Compared to other hotel segments, only upscale extended-stay ADR performed worse in June.

Extended-stay hotels reversed a four-month decline in monthly RevPAR starting in April, with the trend continuing through June, though the rate of increase is slowing. In contrast, economy extended-stay hotels have experienced consistent monthly RevPAR declines for over a year. However, June's 0.6 percent contraction is among the lowest during this period and significantly better than the 2.3 percent decline reported for all economy-class hotels by STR/CoStar.

The Highland Group recently reported a 3.2 percent increase in U.S. extended-stay hotel room supply for May, slightly above the average monthly rise over the past two years, marking the 32nd consecutive month of supply growth at 4 percent or less.