ALL RECOVERY INDICES of U.S. extended-stay hotels were lower compared to 2019 in May than in April, according to hotel investment advisors The Highland Group. The demand for economy extended-stay hotels declined 1.3 percent for the second consecutive month in May compared to same period last year mainly due to sharp increase in ADR in last few months, the report said.

The U.S. Extended-Stay Hotels Bulletin: May 2022 by The Highland Group said that the extended-stay room supply growth was just 1.9 percent during the month. It is the second successive month that the growth was below 2 percent since 2013, and the eighth consecutive month of 4 percent or lower supply growth.

The report added that the supply increase will be well below pre-pandemic levels during the near term. According to STR, all hotel room revenue was up 43 percent in May 2022 compared to last year.

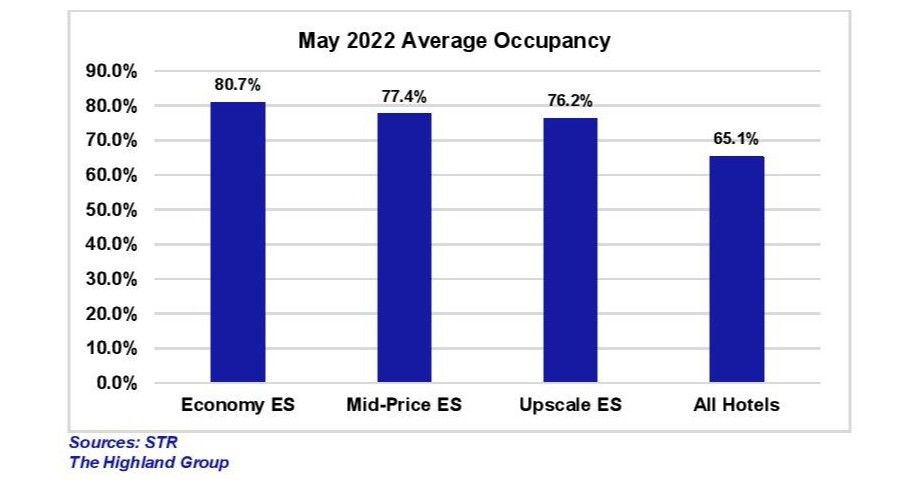

“In May, mid-price and upscale extended-stay segments reported their lowest monthly change in demand in 2022. Except for February 2021, due to the leap year in 2020, economy extended-stay hotels reported only the second monthly fall in demand in 23 consecutive months,” the report said. “Overall hotel occupancy gained more than extended-stay hotels in May compared to one year ago, decreasing extended-stay hotel’s occupancy premium to 12 percentage points, and remains within its long-term average range.”

In May, ADR recovery was led by mid-price and upscale extended-stay hotels though it was lower than in April. For the second successive month, upscale extended-stay hotels more than fully regained ADR back to its nominal 2019 values,” the report said. “Mid-price and upscale segments continued posting the strongest RevPAR growth over the last year. The upscale extended-stay segment’s RevPAR recovery index slipped back below 100 percent in May. Because the overall hotel industry lost far more RevPAR than extended-stay hotels in 2020, its RevPAR growth in May compared to last year was considerably greater.”