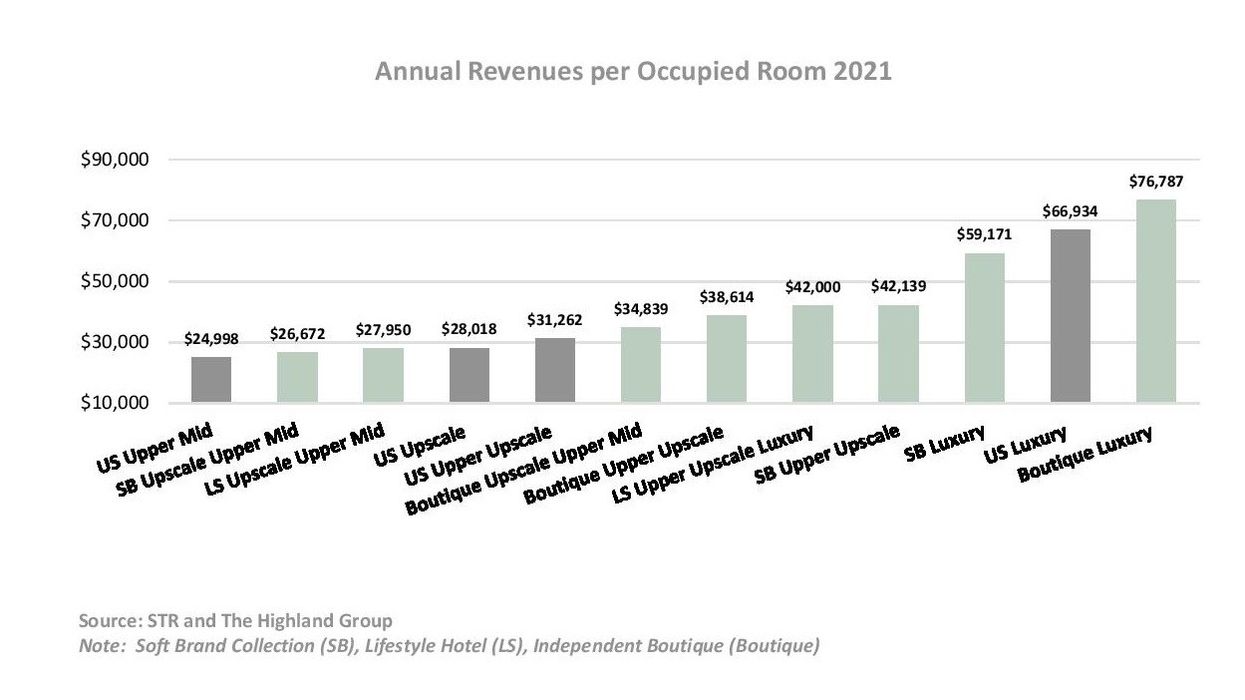

BOUTIQUE HOTELS GENERATED more annual RevPAR than traditional hotels in the U.S. last year, according to a report from consulting agency The Highland Group. Hotels focused on experiential stay, exceptional design and amenities also attracted a rate premium, the report said.

Boutique hotels are classified into independent boutique, lifestyle hotels and soft brand collections.

The Boutique Hotel Report 2022 has said that upper midscale, upscale and luxury soft brand collections recovered strongly in 2021 in performance metrics against their US upscale counterparts, while the upper upscale class was ahead in rate recovery and lagged in occupancy.

According to the report, lifestyle upper upscale and luxury hotels recovered at parity with their counterparts, while upper midscale and upscale lifestyle hotels reported slower recovery in both occupancy and average rate.

"Upper midscale and upscale independent boutique hotels in urban locations recovered at a stronger pace than all U.S. hotel in urban locations in both performance metrics.

Upper upscale independent hotels in gateway locations were ahead in rate recovery with a lag in occupancy recovery when compared to hotels in the top 25 markets," the report said. "Lifestyle hotels and soft brand collections have been two of the hotel industry’s fastest growing segments. From 2016 soft brand collections have led in new openings

at a compound annual average of 17 percent, followed by the lifestyle hotel at 12 percent. Independent boutique openings increased at a compound annual average of 5 percent during this period."

The report added that boutique hotels achieved occupancies within a range of 46 to 59 percent in 2021, compared to all U.S. hotels at 58 percent. Average rate increases averaged 25 percent compared to U.S. hotels at 21 percent, the report further said.

Highlights from the report

Lifestyle hotels

The Highland Group report said that though lifestyle hotels hold a small share of total inventory, the segment is experiencing much faster growth than the industry overall at 14.4 percent annually from 2010 compared to the U.S. at 1.1 percent.

Last year, occupancy reached 56 percent and 16 points below 2019 pre-pandemic levels. Average rate indexed at 87 percent and RevPAR at 68 percent compared to 2019. Average rate for upper midscale and upscale lifestyle hotels was $137 in 2021, above the upper midscale class for all U.S. hotels of $111 and the upscale chain average of $129, the report said.

Soft brand collections

The segment continues to attract properties that were previously independent or affiliated with traditional franchises. Additionally, design and amenity flexibility from franchise companies is appealing to developers and operators and is expected to promote development further.

In 2021, occupancy reached 53 percent which was 8 points below 2019 pre-pandemic levels. Average rate indexed at 105 percent and RevPAR at 91 percent compared to 2019. At 52 percent occupancy in 2021, this sample derives 64 percent of revenues from rooms and 26 percent from food and beverage operations.

Independent boutique

This segment increased supply annually from 2010 through 2021 at 6 percent compared to the U.S. hotel industry of 1.1 percent. Share for independent boutique properties is 1.8 percent of total U.S. inventory.

In 2021, occupancy reached 57 percent which was 15 points below 2019 pre-pandemic levels. Average rate indexed at 100 percent and RevPAR at 79 percent compared to 2019. Most segments had not fully recovered in occupancy by 2021 and some departments, such as food and beverage may still have been somewhat restricted.

Last year, The Highland Group said that boutique hotels recovered faster than other categories of hotel.