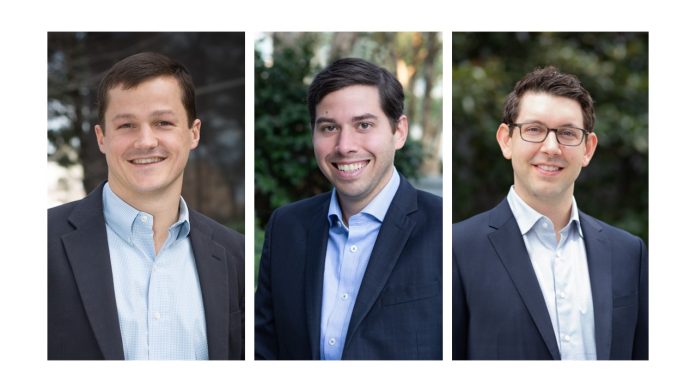

Michael Harper is promoted to president of Hotel Lending at Peachtree Group, overseeing the company’s entire hotel credit platform and guiding all aspects of the credit business.

Similarly, Jared Schlosser rises to executive vice president of hotel lending and head of CPACE, while Michael Ritz is promoted to executive vice president of investments, Peachtree Group said in a statement.

“These appointments underscore Peachtree’s commitment to its core growth initiatives in hotel lending, as well as fostering talent from within our own ranks, with an eye toward further diversifying its allocation strategies as it taps into new investment opportunities,” said Greg Friedman, Peachtree’s CEO and managing principal.

Since joining Peachtree in 2014, Harper has held a series of leadership positions, overseeing the company’s credit business with a focus on loan originations and strategic acquisition of credit portfolios, Peachtree said. He has guided the team through over 500 investments totaling more than $6 billion.

Schlosser, who joined the company in 2019, played a role in developing the CPACE program, which has now surpassed $800 million in transactions, the company said. Additionally, since assuming responsibility for hotel originations at the beginning of 2022, Peachtree has finalized more than $1.5 billion in hotel loans.

Ritz joined Peachtree in 2017 and manages a growing portfolio of investments, which is now approaching $10 billion in transaction asset value.

In December, Sameer Nair was appointed senior vice president of equity asset management at Peachtree Group. He now oversees asset management for Peachtree’s real estate portfolio and preferred equity investments.