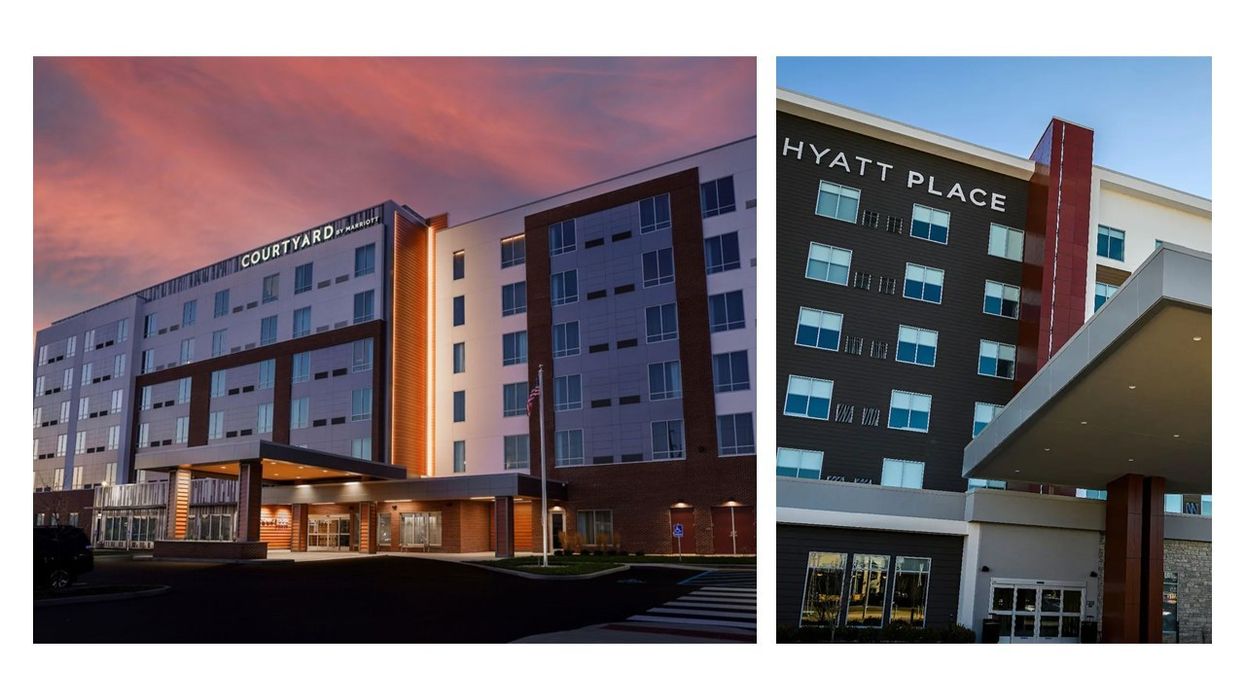

NOBLE INVESTMENT GROUP recently acquired the Courtyard by Marriott and the dual-brand Hyatt House & Hyatt Place in Fishers, Indianapolis. The newly built hotels are in the Fishers District, a 150-acre development with dining, retail and entertainment venues, Noble said in a statement.

Noble is led by Mit Shah, senior managing principal and CEO.

“Noble is excited to add these new, high-yielding hotels with in-place cash flows to our growing portfolio and capitalize on the region’s continued economic expansion,” said Ben Brunt, managing principal and chief investment officer at Noble.

Fishers is a rapidly expanding market near Indianapolis, known for strong economic growth and a business-friendly environment, the statement said. The area has seen more than $2 billion in new development recently, with more investments expected in the coming years.

In August, Noble acquired the Courtyard Jacksonville Beach Oceanfront, which includes 150 guestrooms, two F&B outlets, 2,450 square feet of meeting space, a pool, a hot tub, a fitness center, and a convenience store.

The company has invested over $6 billion in communities nationwide over the past three decades, adding value across cycles and supporting job creation.