Summary:

- More than 70 percent expect a RevPAR increase in Q4, according to HAMA survey.

- Demand is the top concern, cited by 77.8 percent, up from 65 percent in spring.

- Only 37 percent expect a U.S. recession in 2025, down from 49 percent earlier in the year.

MORE THAN 70 PERCENT of respondents to a Hospitality Asset Managers Association survey expect a 1 to 3 percent RevPAR increase in the fourth quarter. Demand is the top concern, cited by 77.8 percent of respondents, up from 65 percent in the spring survey.

HAMA’s “Fall 2025 Industry Outlook Survey” found that two-thirds of respondents are pursuing acquisitions, 80 percent plan renovations in the coming year and 57 percent are making or planning changes to brand affiliation or management strategies.

“With hopes high for a stronger fourth quarter, hotel asset managers continue to maintain an optimistic outlook,” said Chad Sorensen, HAMA president. “More than 70 percent of our members expect RevPAR to increase 1 to 3 percent and two-thirds are pursuing acquisitions. With 80 percent planning renovations in the coming year, we see an engaged community focused on performance.”

Conducted among 81 HAMA members, about one-third of the association, the survey reports expectations for revenue growth, property investments and acquisitions.

However, the top three most concerning issues were demand, ADR growth and tariffs, HAMA said.

RevPAR growth forecast

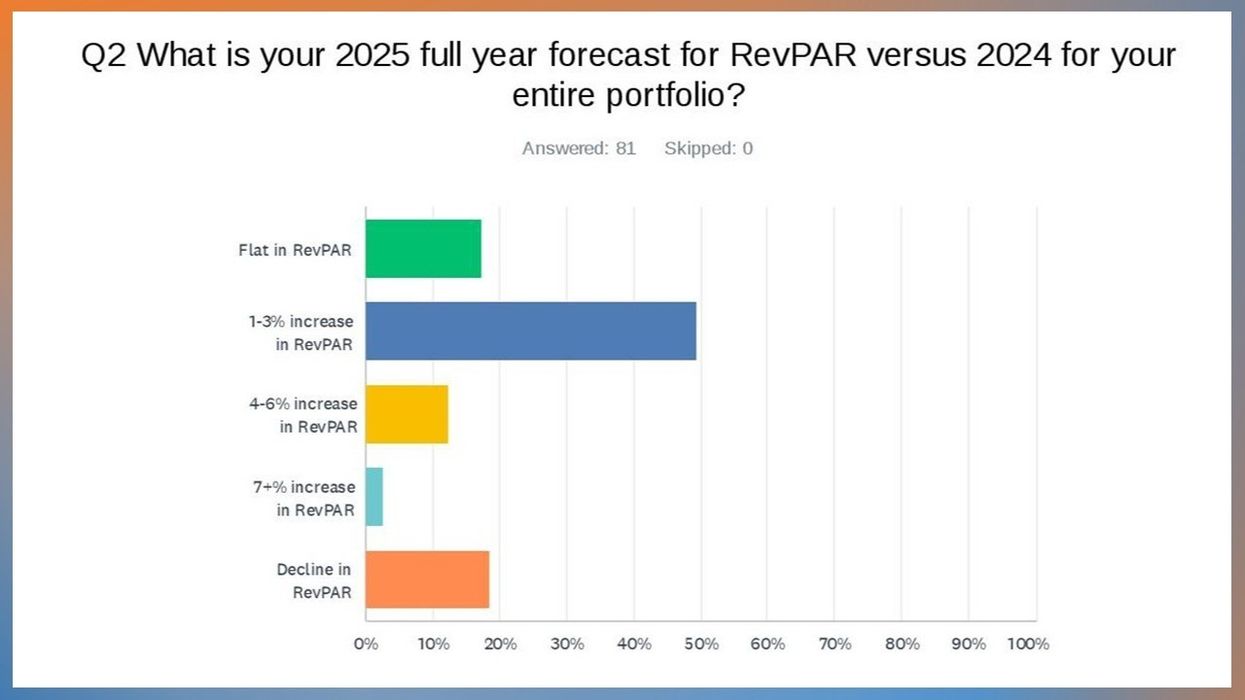

Looking into 2026, 72.8 percent expect 1 to 3 percent growth, 18.5 percent expect 4 to 6 percent, 7.4 percent anticipate flat results and 1.2 percent project a decline. Full-year RevPAR projections versus budget are more mixed: 49 percent expect 1 to 3 percent growth, 17 percent expect flat results, 12 percent expect 4 to 6 percent growth, 2 percent expect 7 percent or more and 19 percent expect declines.

Hotel asset managers note several market pressures, the report said. Other concerns include ADR growth at 51.9 percent, tariffs at 34.6 percent, wage increases at 33.3 percent and potential Federal Reserve rate changes at 32.1 percent. Management company performance at 25.9 percent, immigration and labor trends, union activity and insurance costs were also mentioned.

“The industry is at its highest level of concern around maintaining or increasing rates,” Sorensen said. “There’s pressure to build on the P&L going into 2026.”

Performance projections

Confidence in the broader economy has increased since spring, the survey found. Only 37 percent of respondents expect a U.S. recession in 2025, down from 49 percent earlier in the year.

When asked about properties exceeding gross operating profit forecasts, 59 percent of managers expect 0 to 25 percent of their hotels to surpass targets, 25 percent expect 26 to 50 percent, 10 percent expect 51 to 75 percent and 6 percent expect 76 to 100 percent. Additionally, 20 percent reported returning hotels to lenders or entering forced sales since the spring survey.