U.S. hotel performance showed mixed results in the first week of April compared to the previous week, yet displayed positive year-over-year comparisons, according to CoStar. Occupancy and RevPAR outperformed ADR in key metrics.

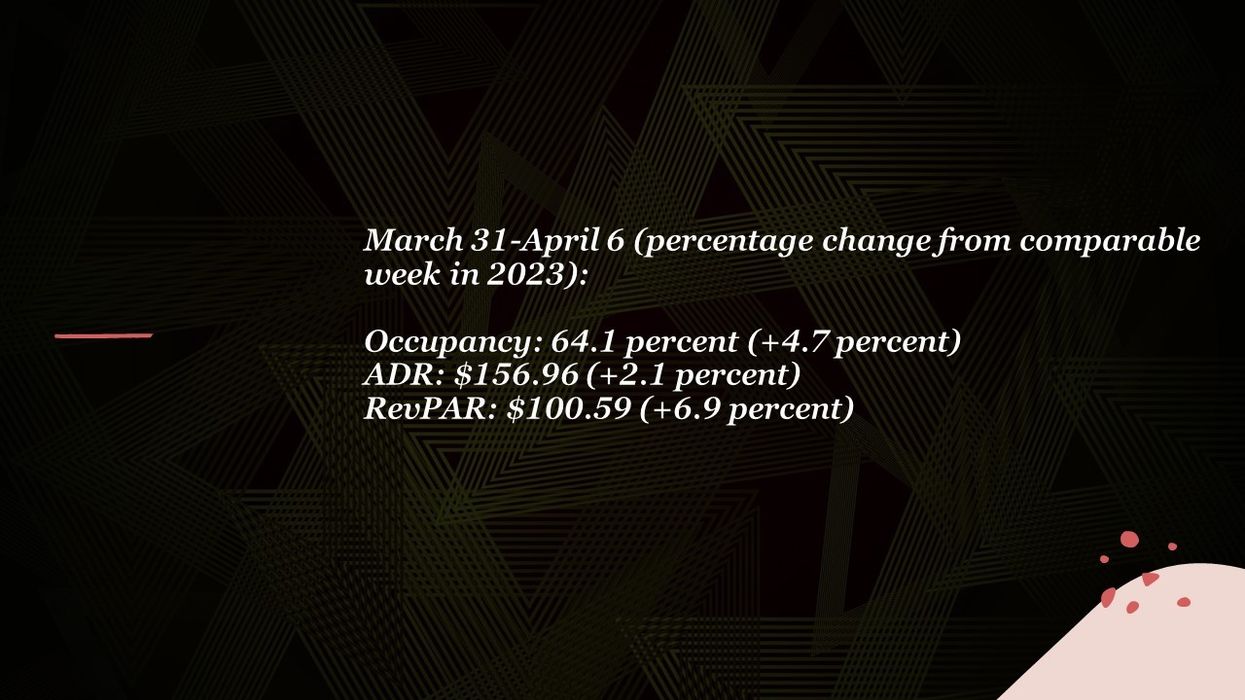

Occupancy rose to 64.1 percent for the week ending April 6, up from the previous week's 62.3 percent, marking a 4.7 percent year-over-year increase. ADR slightly decreased to $156.96 from $157.14, reflecting a 2.1 percent increase compared to last year. RevPAR increased to $100.59 from $97.83 the previous week, signaling a 6.9 percent rise compared to the same period in 2023.

Among the top 25 markets, Philadelphia reported the largest year-over-year occupancy increase, up 17.5 percent to 66.1 percent, with the second-highest jumps in ADR, rising 17.3 percent to $165.11. RevPAR also increased by 37.8 percent to $109.10, driven by WrestleMania 40.

Boosted by the NCAA Men’s Final Four, Phoenix experienced notable rises in ADR, up by 24.8 percent to $237.38, and RevPAR, which surged by 39.7 percent to $184.07.

The steepest RevPAR declines were seen in Orlando, dropping by 7.7 percent to $163.05, followed by Tampa, which decreased by 7.1 percent to $162.81.