U.S. hotel construction trends

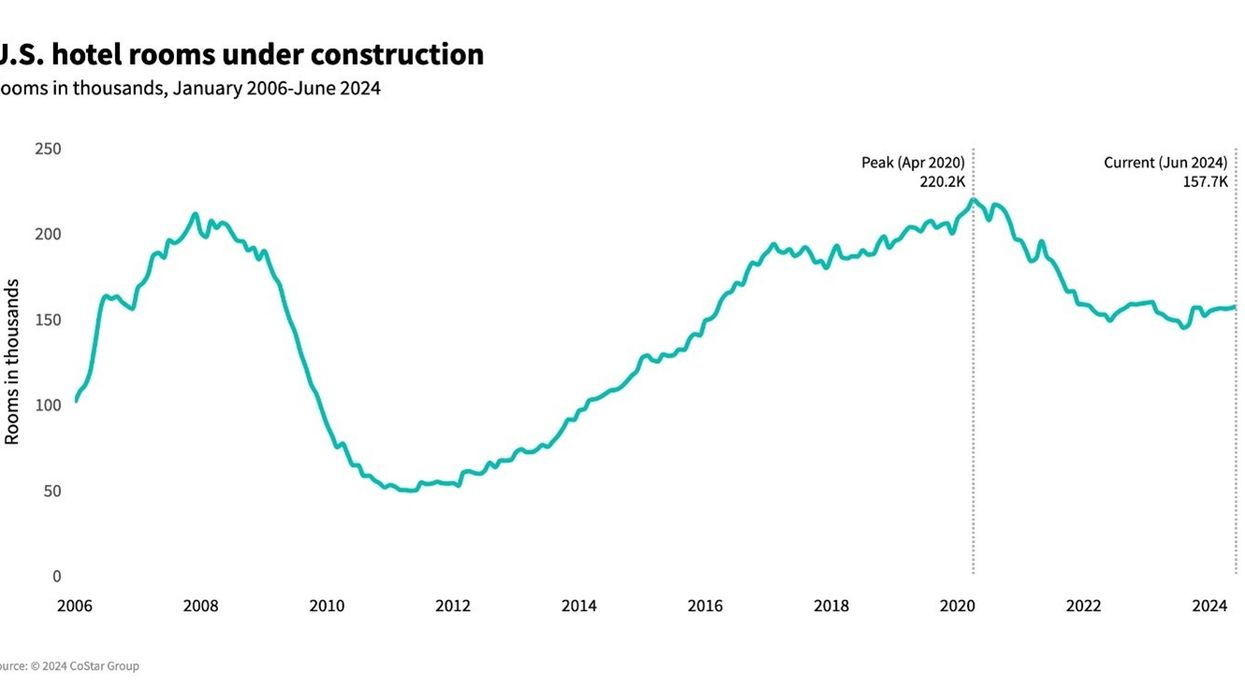

THE NUMBER OF U.S. hotel rooms under construction in June reached its highest level in 16 months, according to CoStar. The construction volume increased year-over-year for four consecutive months, with upscale and upper midscale segments dominating pipeline activity.

“The number of rooms in construction has grown year-over-year for four consecutive months,” said Isaac Collazo, STR’s vice president, analytics. “While upscale and upper midscale continue to dominate, accounting for about 50 percent of all rooms in the final phase of the pipeline, the pace of activity in these segments has slowed compared to last year. Midscale and economy have shown the most growth, up 42 percent and 34 percent, respectively, with newer brands and extended-stay accounting for most of the new construction across the midscale segment.”

Approximately 157,713 rooms were under construction in June, up 5.5 percent from the same month last year. Additionally, 266,619 rooms were in the final planning phase, a 9.8 percent increase from June 2023. The planning stage saw 333,827 rooms, a rise of 38.7 percent compared to the previous year.

Across chain scale segments in June, the luxury segment had 6,760 rooms under construction, up 4.5 percent, while upper upscale had 19,023 rooms, up 2.7 percent. The upscale segment saw 36,806 rooms, a 4 percent increase and upper midscale recorded 40,954 rooms, marking a 3.5 percent increase compared to last year.

The midscale segment had 14,900 rooms under construction, reflecting a 2.9 percent increase and the economy segment saw 8,384 rooms, up 1.3 percent compared to June 2023.

In May, the U.S. hotel industry showed improved performance year-over-year compared to the same month last year, according to CoStar. Occupancy, ADR, and RevPAR all increased. The top 25 markets reported higher occupancy and ADR than other markets.