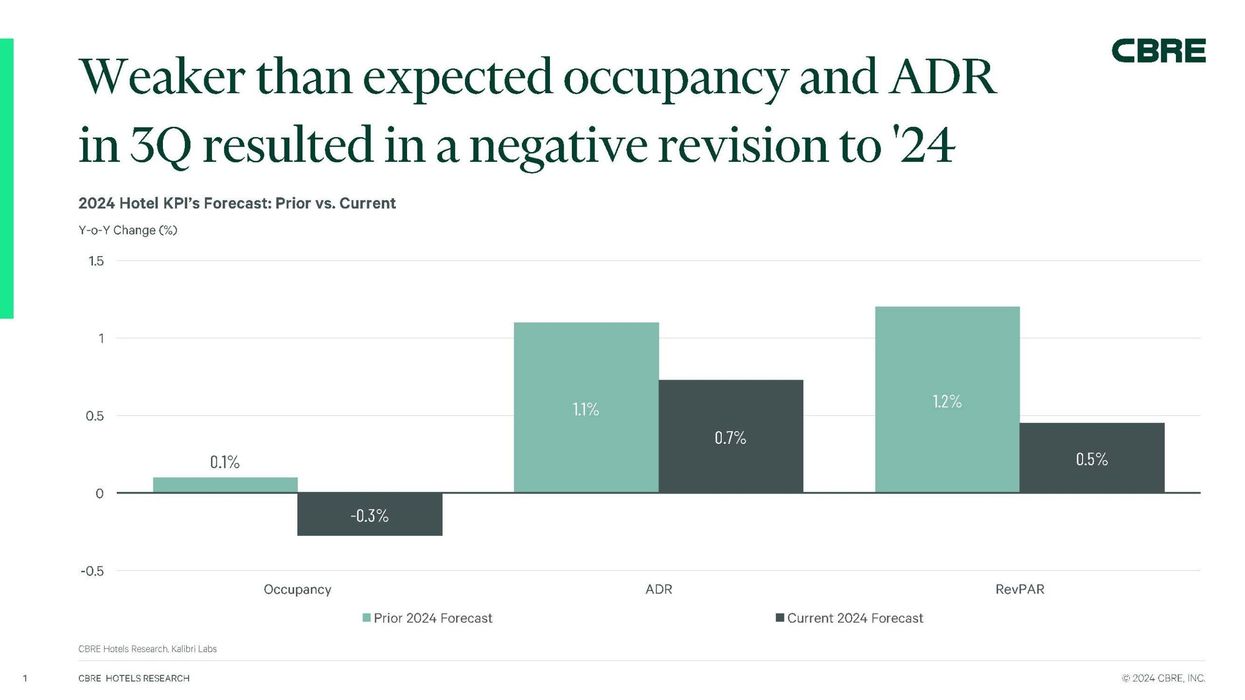

U.S. HOTEL PERFORMANCE is expected to rebound in the fourth quarter and continue into 2025 despite subdued summer demand and a sluggish third quarter, according to CBRE. RevPAR growth for 2024 is now projected at 0.5 percent, down from 1.2 percent in August, due to a 40 bps drop in expected occupancy.

Occupancy is forecast to decline 30 bps year-over-year while ADR is projected to rise 0.7 percent, 40 bps below earlier forecasts, the report said. RevPAR growth is expected to rebound in the four quarter of 2024, driven by rate cuts, easing inflation and stock market gains.

“U.S. hotels performance was softer-than-expected during the summer months, partly due to Americans traveling overseas in record numbers,” said Rachael Rothman, CBRE’s head of hotel research and data analytics. “At the same time, the slow recovery in inbound international travel has created an imbalance in U.S. leisure demand. Despite this, continued improvements in group and business travel served as relative bright spots in the third quarter.”

Hotel demand declined 0.1 percent year-over-year in the third quarter of 2024, coupled with a 0.6 percent increase in supply, resulting in an approximately 0.8 percent decline in occupancy, CBRE said. Modest ADR growth of 0.6 percent fell short of CBRE's previous expectation of 1.6 percent, leading to a 0.2 percent decrease in RevPAR for the quarter.

“The breakdown in the historical correlation between hotel demand and GDP growth continued into the third quarter, but we expect a normalization of this relationship due to interest rate cuts, lower CPI growth, and improving GDP indicators,” said Michael Nhu, CBRE’s head of global hotels forecasting. “These trends are forecasted to strengthen the fundamentals of the U.S. hotel market, leading to reaccelerated RevPAR growth heading into 2025.”

CBRE forecasts a 1 percent compound annual supply growth over the next five years, below the long-term average of 1.6 percent. The forecast assumes 2.6 percent GDP growth and 2.9 percent average inflation in 2024. Lodging performance remains closely tied to economic strength, with a strong correlation between GDP growth and RevPAR.

Amid macroeconomic and geopolitical uncertainties, CBRE recommends clients assess and integrate various economic and hotel performance scenarios into their models, tailored to their risk tolerance and probability weightings.

In October, CBRE projected U.S. RevPAR growth of 1.2 percent for the year, down from the earlier forecast of 2 percent. Second-half growth is expected to reach 2 percent, compared to 0.5 percent in the first half.