Summary:

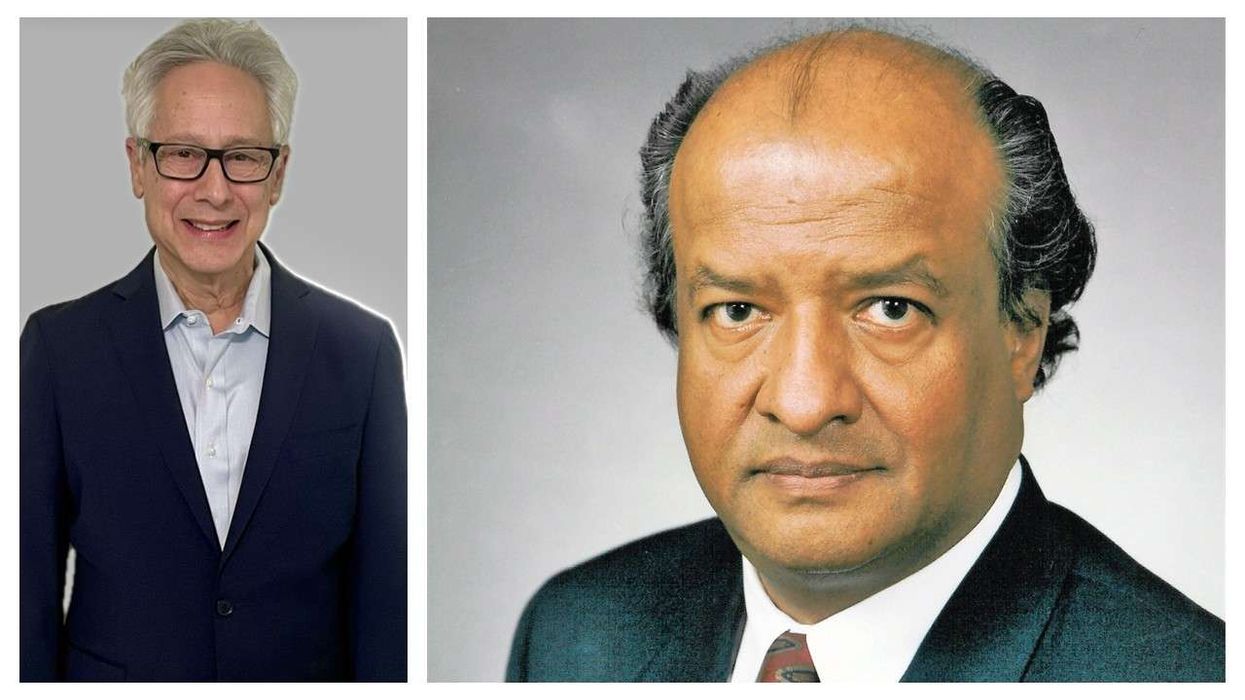

- Wyndham CFO Michele Allen is leaving to pursue a new career.

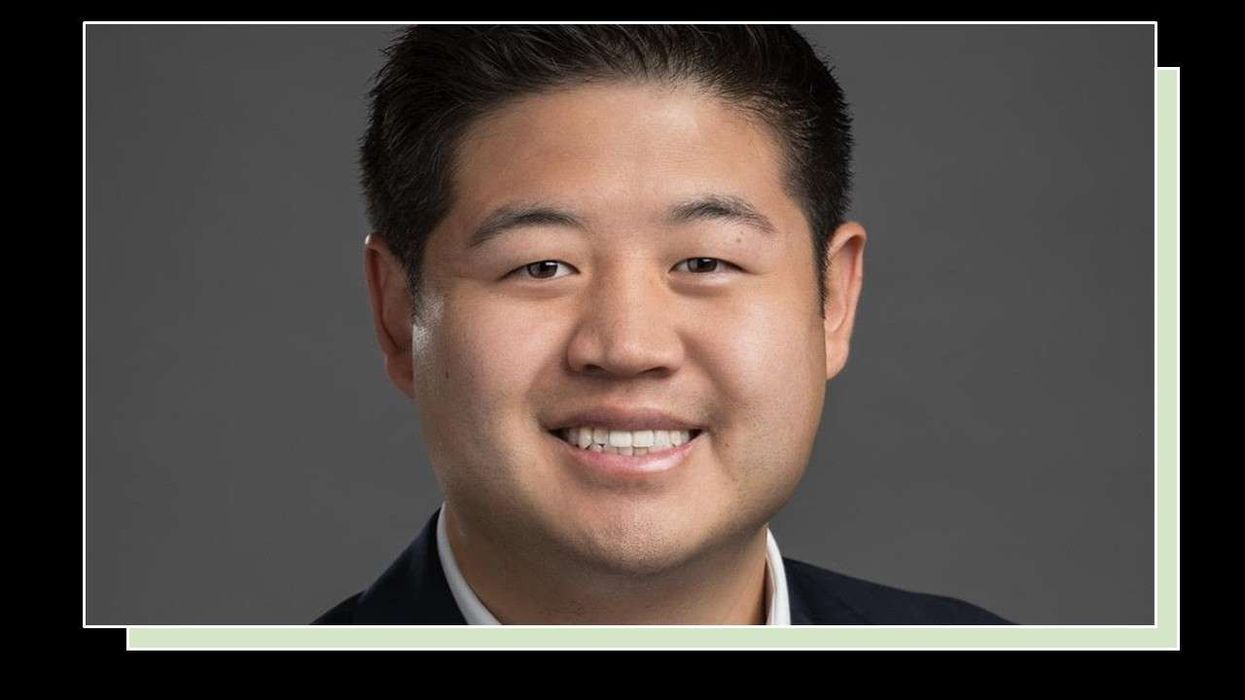

- Treasurer Kurt Albert named Interim CFO effective immediately.

- The company will search for a permanent chief financial officer.

WYNDHAM HOTELS & RESORTS Chief Financial Officer and Head of Strategy Michele Allen is leaving the company to pursue a career outside the hotel industry. Kurt Albert, treasurer and head of financial partnerships and planning, has been named interim CFO, effective immediately.

The company will conduct a search for a permanent chief financial officer, considering both internal and external candidates, Wyndham said in a statement. Meanwhile, Allen will serve as an advisor at Wyndham through the end of 2025.

"Michele has been an invaluable member of the Wyndham team for over 25 years," said Geoff Ballotti, Wyndham’s president and CEO. "Her financial acumen and strategic vision have helped steer Wyndham through many pivotal moments. The contributions she's made over the years are countless: from advancing key business priorities to nurturing a world-class finance team. On behalf of the Board and all of Wyndham's team members, we thank Michele for her dedication and leadership. We wish her every success as she embarks on a new chapter in her career."

Allen said it has been a privilege to build her career at Wyndham, working with team members, leaders and the community of franchisees who support the brands.

"Together, we've shaped a company that has thrived through change and I'm proud of all we've accomplished,” she said. “As I look ahead to a new challenge, I'll always be grateful for the relationships that have made this journey meaningful."

Albert has served in his current position since May 2024 and previously held leadership roles in treasury and financial planning and analysis. The company reaffirmed its full-year 2025 outlook, as provided in third-quarter 2025 earnings materials.

Wyndham reported a five percent decline in global RevPAR in the third quarter, with U.S. RevPAR down five percent and international RevPAR down two percent. Net income rose three percent year over year to $105 million and adjusted net income was $112 million.