U.S. Hotel Industry RevPAR Growth in Q1 2025

THE U.S. HOTEL industry recorded year-over-year RevPAR growth in the first quarter, despite economic uncertainty and rising competition from alternative accommodations, according to CBRE. While remaining mostly positive, experts said the hospitality industry’s forecast could take a turn for the worse depending on external politics.

RevPAR increased 2.2 percent from the first quarter of 2024, driven by a 1.9 percent rise in ADR and a 0.4 percent increase in occupancy.

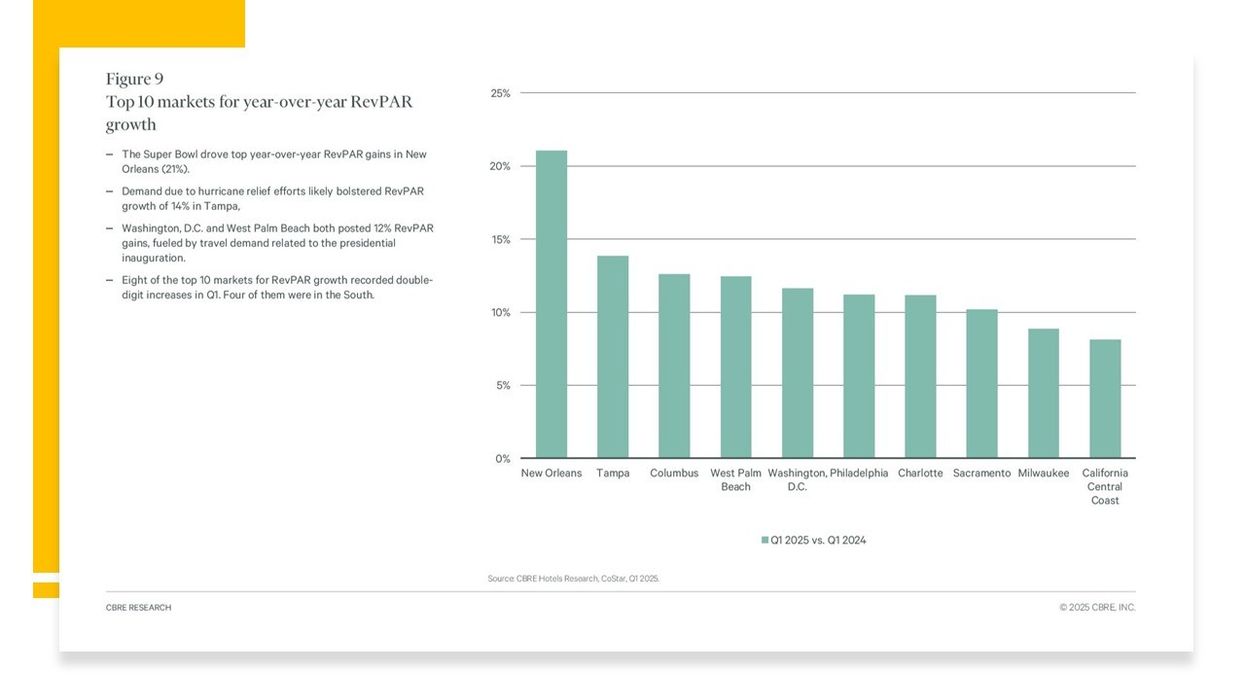

Regionally, New Orleans led RevPAR growth, boosted by the Super Bowl, followed by Tampa, Florida, which benefited from hurricane relief efforts, the report said. Columbus, Ohio; Washington, D.C.; and West Palm Beach, Florida, also ranked among the top five RevPAR growth markets, likely driven by travel tied to the presidential inauguration. Eight of the top 10 RevPAR growth markets posted double-digit increases, with four located in the South.

Business travel in March gained from Easter falling in the second quarter, but that momentum was tempered by an 11.6 percent year-over-year decline in inbound international travelers, CBRE said.

Hotel demand grew 1 percent in the first quarter, outpacing a 0.6 percent increase in room supply. However, demand for lodging alternatives—especially short-term rentals and cruise lines—grew faster, up 45 percent and 9 percent, respectively, from first-quarter 2019 levels.

Occupancy rates across all hotel location types continued to lag pre-pandemic levels. Urban hotels reached 92 percent of 2019 occupancy, and interstate properties neared full recovery at 99.5 percent. Resorts were the only segment to post a year-over-year decline.

Labor pressures eased during the quarter, the report said. Job openings per hotel fell nearly 9 percent, from 17 to 15, while average hourly hotel wages rose 4 percent year over year—matching the national growth rate but still nearly $11 below the U.S. average.

While the quarter closed on a positive note, analysts caution that geopolitical developments, including trade and travel policies, could challenge hotel pricing power and international demand in the months ahead.

In February, CBRE forecasted steady U.S. RevPAR growth in 2025, driven by stronger group and business travel in urban markets and a recovery in inbound international travel. The firm expects a 2 percent increase, with occupancy up 23 basis points and ADR rising 1.6 percent.