U.S. Hotel Performance Dips in April 2025 Amid Easter and Passover Shift

THE EASTER AND Passover holiday calendar shift scrambled weekly and year-over-year performance comparisons for the U.S. hotel industry in the week ending April 19, according to CoStar. Orlando and Miami recorded the strongest performance gains among the top 25 markets.

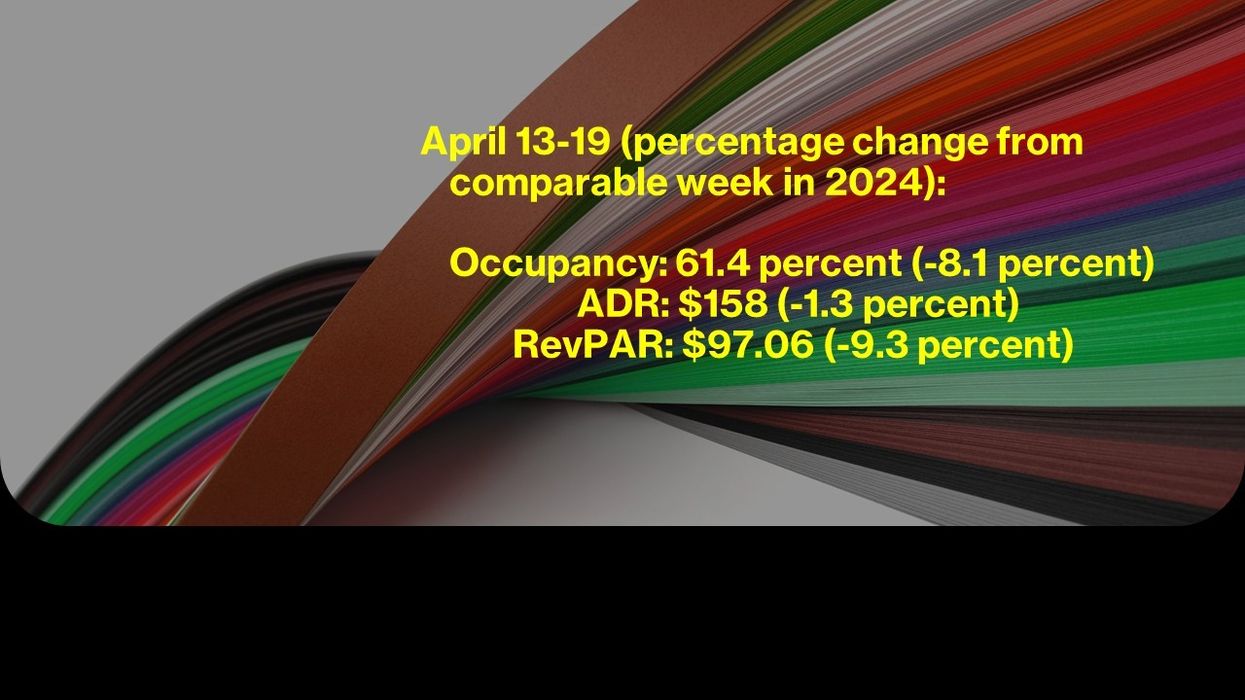

Occupancy fell to 61.4 percent for the week ending April 19, down from 65.6 percent the previous week and 8.1 percent lower than the same period last year. ADR decreased to $158 from $162.72, a 1.3 percent year-over-year decline. RevPAR dropped to $97.06 from $106.81, reflecting a 9.3 percent decrease from 2023.

Among the top 25 markets, Orlando reported the highest year-over-year occupancy increase, up 6.2 percent to 76.6 percent. Miami posted the largest ADR gain, up 17.3 percent to $274.54, and the highest RevPAR increase, rising 19.5 percent to $221.24.

The steepest RevPAR declines were in Washington, D.C., down 36.8 percent to $116.74, and Nashville, down 30.1 percent to $105.16.