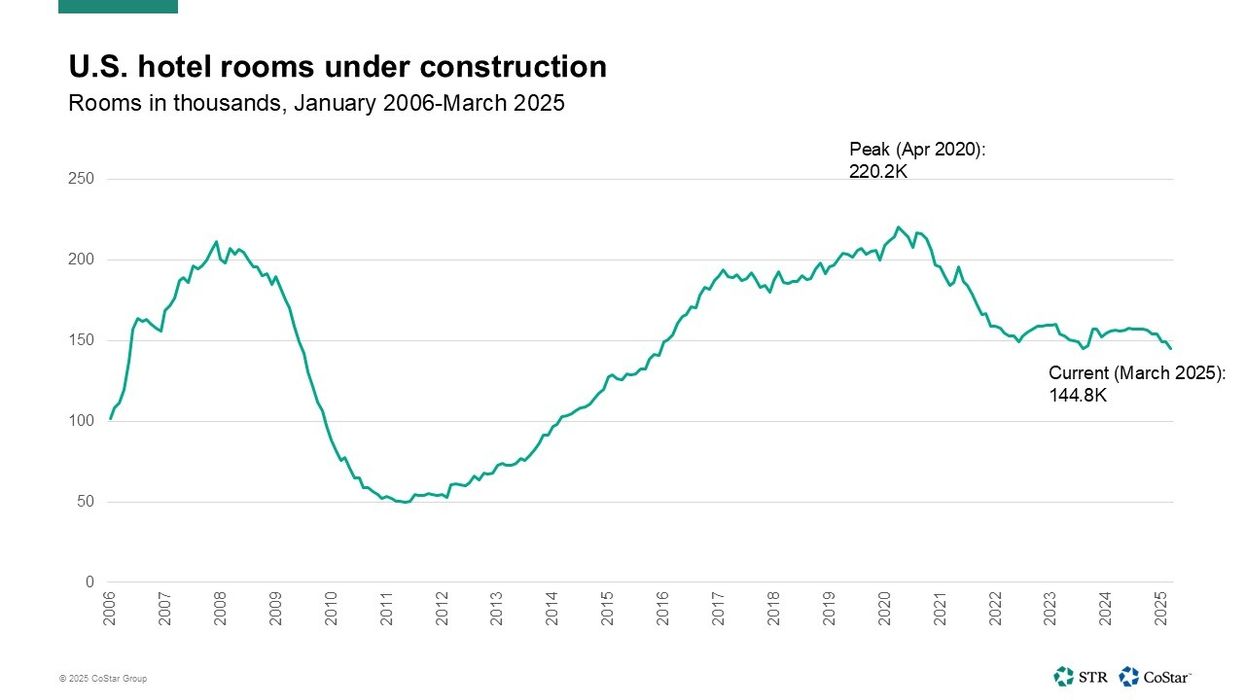

U.S. Hotel Construction Declines 7.5% in March 2025

THE NUMBER OF U.S. hotel rooms under construction declined year over year for the third consecutive month in March, according to CoStar. Construction was down by 103 projects compared to last year.

About 144,760 rooms were under construction in March, a 7.5 percent decrease from the same month in 2024, CoStar found. Final planning included 273,068 rooms, up 3.7 percent, while 359,878 rooms were in the planning stage, a 10.9 percent year-over-year increase.

“With increased uncertainty and the potential for rising construction costs, it’s not surprising that fewer projects have broken ground,” said Isaac Collazo, STR’s senior director of analytics. “The decline of 103 hotels means most markets are seeing one fewer project in the final phase. Still, the overall pipeline remains robust, with 6,500 hotels and 777,000 rooms including planning phases.”

“We’ll be watching those planning phases closely, as that’s where economic uncertainty is likely to have the most impact,” he added. “Projects already under construction are moving forward.”

By chain scale in March, the luxury segment had 6,421 rooms under construction, a 4.1 percent year-over-year increase. The upper upscale segment had 18,813 rooms, up 2.6 percent, upscale had 35,082 rooms, up 3.8 percent, and upper midscale had 38,217 rooms, up 3.2 percent. Midscale recorded 13,883 rooms, up 2.7 percent, and economy had 5,993 rooms, up 0.9 percent.

Collazo noted the construction decline was concentrated in upper midscale, which made up more than a third of the overall drop in room count and an even greater share of hotel count.

“Even with the decrease, upper midscale still accounts for the largest number of hotels and rooms under construction,” he said.

Separately, The Highland Group reported that U.S. extended-stay hotels outperformed the broader industry in March across all key metrics except occupancy, where their long-term premium held steady.