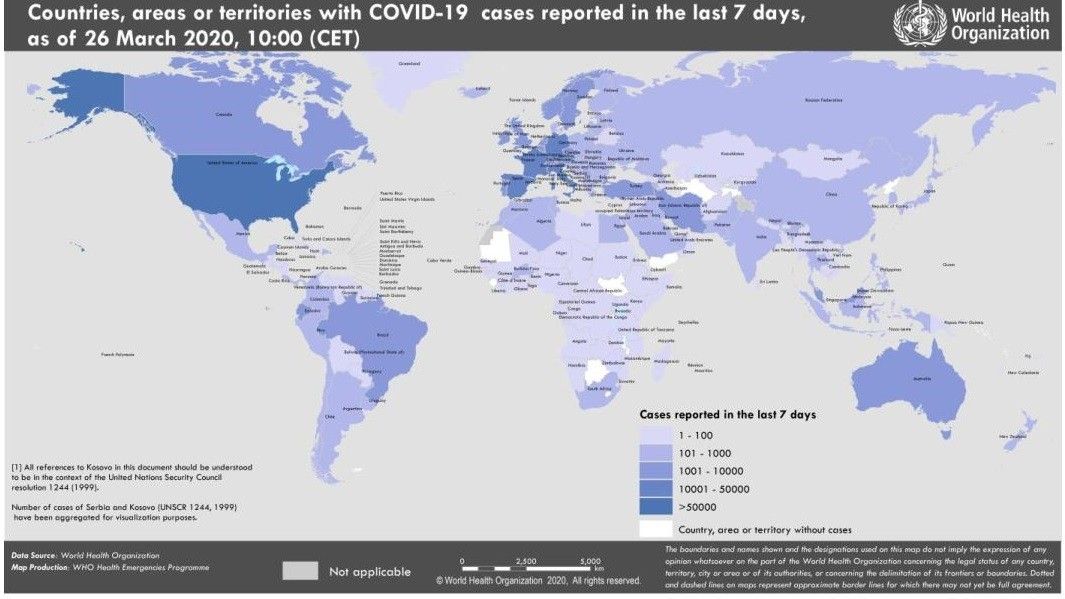

In early February, the novel coronavirus outbreak in China was only beginning to spread globally, and hospitality experts were cautious, but not necessarily concerned. By mid-March the virus that causes the disease COVID-19 was declared a global pandemic.

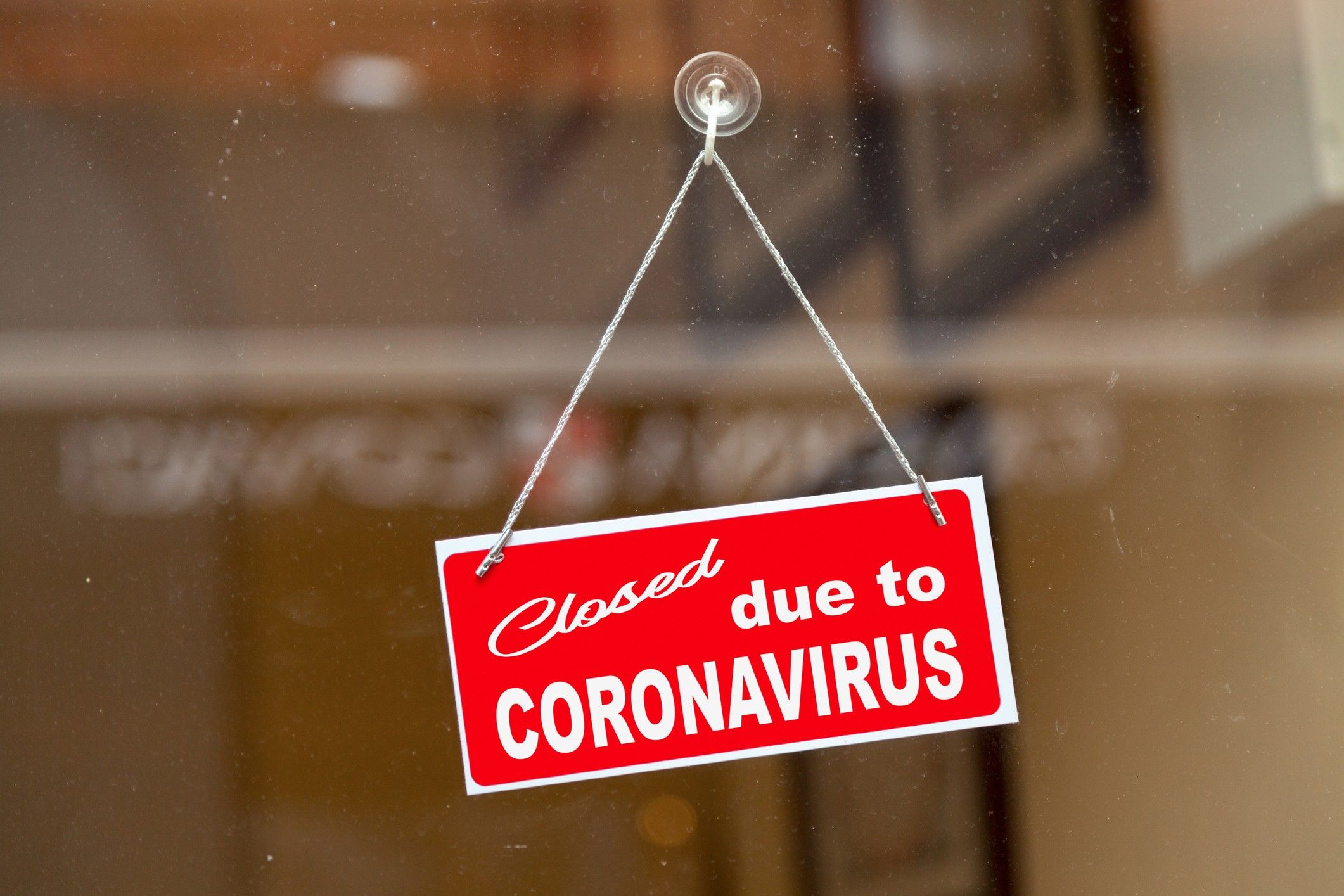

It shuttered hotels worldwide as travel slowed to a trickle and hotel occupancy plummeted. The outbreak had not yet reached its peak and was expected to be ongoing through April.

Major hotel conferences, including AAHOA and the Hunter Hotel Investment Conference, were postponed. Layoffs of hotel workers and those in related industries stood around 4 million by mid-March, according to the American Hotel & Lodging Association.

Congress on March 27 passed the Coronavirus Aid, Relief & Economic Security, or CARES, Act, offering some temporary relief. President Trump signed the measure. Included in the package is $150 billion for the hotel industry. How that aid will be allocated throughout the industry was not clear at press time.

Hotel owners and operators, however, did not wait for any grand political maneuvers and began to close hotels or scale down operations on March 16, three days after President Trump declared a national emergency. In this issue, Asian Hospitality features several stories that reveal the early impact the COVID-19 pandemic has had on the U.S. industry.

A friend in need: The pandemic is straining the relationship between franchisee and franchiser over fees and other costs

Perhaps the biggest test coming from the coronavirus pandemic has been on the relationship at the heart of the hospitality business model, that between franchisee and franchiser.

In the throes of the COVID-19 pandemic, hard-hit hotel owners are turning to their franchisers for assistance, and they have received it, in various forms.

Some companies are doing more than others, according to a new organization of owners who think more companies should waive certain franchise fees. Others say franchisees and franchisers are all in the same boat and now is not the time to worry about much more than taking care of guests and employees.

The help offered to franchisees varies from company to company, but most offered to suspend enforcement of some brand standards and to postpone PIPs. Some, not all, waived or deferred certain franchise fees.

Best Western Hotels & Resorts waived half of all monthly fees, half of property revenue management fees and delayed certain fees until November. The company’s board of directors and executives voluntarily reduced their compensation by 20 percent.

“The impact of this global pandemic has been devastating to the livelihood of our hoteliers, their families, and the employees who depend on them,” said David Kong, Best Western president and CEO, in a statement. “At Best Western, we are truly a family that stands together, shoulder to shoulder, during a time of crisis. In coming together, not only will Best Western weather this storm, but our nation and industry will emerge stronger than ever.”

Fixing the fixed fees

Best Western’s relief package is one of the best, said Maulesh Patel, a hotel owner in Tom’s River, New Jersey. His properties are mostly Choice Hotel and InterContinental Hotels Group brands.

“Best Western is leading the pack since they are a member-focused association,” Maulesh said. “Other brands, they are offering deferment, they’re not reducing any of the fixed fees.”

Maulesh is a charter member of the Fair Franchising Initiative, a group of hotel owners that held its launch conference on March 5 in Edison, New Jersey, with the intention of promoting better franchising practices in the hospitality industry through legislation.

Hotel CEOs and other industry leaders sought relief for their companies on March 17 when they met with President Trump and Vice President Pence at the White House. The meeting was taped and shared on news sites and on social media channels. Choice Hotels CEO Patrick Pacious garnered kudos when he told Trump:

“Owners have two key concerns: One, what do they do with their employees when they’ve got zero occupancy? And two, how do they pay their mortgage? So, it is this question of employee retention and liquidity so that you get through this period.”

But there are owners who are not so willing to laud Pacious. A petition was launched on March 14 the day after Pacious sent a memo to franchisees, noting quality assurance reviews would be “suspended for at least the next 30 days, after which we will review based upon conditions.” PIP reviews were also stopped for 30 days.

Owners were quick to protest with the petition campaign, calling Choice “tone deaf.”

“Choice franchisees and team members were expecting more relief than what has been offered to date,” reads the petition. It noted other franchisers such as Hilton and Marriott suspended mandated PIPs for a year and quality assurance reviews for three to six months. As of March 27, the online petition had more than 5,760 signatures. The goal is 7,500.

“It is an established fact that most franchisees will not be able to support even their most essential expenses like payroll and utilities from existing cash flow and occupancy levels, for the foreseeable future,” the petition says. “Therefore, it would not be prudent to expect your franchisees to make any franchise-related payments until there is a full and sustained recovery to the pre-crisis state.”

Maulesh said all fixed franchise fees should be waived as occupancy bottoms out during the coronavirus crisis.

“Since there’s no revenue, those fees are not justified. Percentage fees are but fixed fees are not justified,” he said.

“Every franchiser, when they underwrite a franchise agreement, they know that, when the occupancy is less than 40 or 50 percent, none of the franchisees will even have money to pay the franchise fees. That’s normal due diligence,” he said.

“Now the occupancies are in single digits. Franchisees are expected to pay their employees and keep their doors open from money out of their pockets in this crisis. Is it fair for the franchisers to ask for those fixed fees, which basically is adding to the shareholders’ value?”

He also said it would be a violation of terms to use money from the CARES Act to pay the fees.

“Many of our hotel owners will be getting [Small Business Administration] loans,” Maulesh said. “Is that money supposed to be used for the employees or should it be going toward those fixed fees? Actually, the SBA should put a provision that those loans cannot be used to pay franchise fees or fixed fees, because that’s basically an indirect bailout of shareholders.”

It’s in the hotel companies’ and the industry’s best interest to focus on the needs of the franchisees at this time, Maulesh said.

“Every franchise company has to realize that the biggest stakeholder in this industry is the franchisee. They invest millions of dollars to create the shareholder value. In the long term, by not looking after the franchisees, it will be eroding the shareholders’ value further.”

A common crisis

Ritesh Patel, president of RAM Hotels in Columbus, Georgia, has a somewhat different view of the brands’ responses to the crisis. His company primarily franchises brands from InterContinental Hotels Group, Hilton and Marriott International.

“This is a common crisis that we’re all facing and it’s all so sudden. We’ve never seen occupancy diminish so significantly so rapidly,” Ritesh said. “It’s touching and impacting indiscriminately franchisees as well as franchisers.”

Ritesh’s company includes a management department with a staff of 19 that is labor intensive. Most hotel owners have a furlough process to control variable costs from labor, but management companies and brands don’t have that option, he said.

“When [a hotel management company] really needs to step up is in times like this. If you’re furloughing people at the hotel level, then who’s going to come and guide them, and who’s going to make sure you properly close the hotels, how do you start the process?” he said. “I think the brand is no different from a hotel management company, and they’re hurting even more than hotel owners in this.”

While some of the brands in his portfolio may not be waiving fees, Ritesh said they are helping in other ways.

“They’re coming right out and saying, ‘Hey, you have flexibility on your brand standards; if there are variable costs that you feel like you’re not going to be needing right now feel free to eliminate it,’” Ritesh said. “Some brands are going further and sending checklists on how you should be doing your partial closures, this is how you should be doing your complete closures.”

Those checklists can save owners a lot of time and money, he said.

“Nobody wants to close a hotel, let’s face it. But, to close a hotel properly, we’ve never done that,” he said. “Being in the industry for nearly 20 years we’ve never closed any of our properties. There are a lot of folks that this is very new to.”

And some franchisers are waiving revenue-management fees.

“There hasn’t been any announcement from Hilton or Marriott or IHG on the royalty side of it or the marketing fees, which makes up the bulk of the fees,” he said. “But, again, I completely understand that because, if you really look at it, they’re not really earning any fees to give away any fees. If you’re running a hotel that’s at 10 or 15 percent occupancy, they’re barely generating any revenue.”

Once the crisis has passed, he said, and occupancy rises above 55 percent, the issue of fees may be addressed.

“At that point, perhaps, the dialog should change,” Ritesh said.

This, too, shall pass: Hotel owners face the pandemic

MIRAJ Patel, president of Wayside Investment Group in Houston, was planning for success when he bought a Galveston, Texas, hotel and converted it to a Red Roof Plus. His partners and he timed the opening of the new beachside property just right, they thought.

“Right now, this is the season where you make money because it’s spring break time,” Patel said. “We bought this property in November and we quickly put in more than $1.1 million into renovations. We strategically opened it within four months just so we could open during this month. But for this one property we’re walking straight into a negative slope.”

The COVID-19 pandemic’s crushing blow to the travel industry is the cause.

“We opened on Thursday and Saturday and Sunday were great, then Monday it just suddenly dropped,” he said.

Hoteliers around the country have similar stories.

Galveston turned ghost town

Over the past year and a half, Patel’s company has opened three hotels, the Red Roof property opened on March 12.

“We were supposed to hit our projections and now we’re seeing nearly 25 percent to 30 percent occupancy drop,” Patel said. “We are also seeing a lot of cancellations.”

They have been asking guests who cancel their reason for doing so, Patel said.

“We were seeing if coronavirus was the main reason, and it is,” he said. “Everybody said it’s because of the coronavirus, we’re simply not traveling.”

Galveston island is empty and local authorities have issued orders for restaurants and bars to shut down, Patel said. Typically rates at this time are more than $300 a night, but now they are setting rates around $40 a night.

“Now there’s no reason for people to travel because there’s nothing for them to do anymore,” Patel said. “These are our flagship hotels, but we also have our independent properties where most of the clientele is local. But even there we’ve seen a huge slope. People are simply just not leaving their homes.”

His fellow hoteliers on the island are being hit as hard as Patel, if not harder.

“People simply are not going to hit their projections,” he said. “At one hotel [in Galveston] one general manager told me that he’s seen, just in the month of March, for his one hotel he’s seen a $150,000 reduction on his projections.”

That owner is laying off 12 people and many of the other hotels on the island are laying off workers.

“We’re all trying to share resumes to see if we can try to save these people’s jobs by maybe hiring them at one of our hotels,” Patel said. “We’re just trying to work together to see if we can avoid laying these people off. If we do have to lay them off because we can’t afford it maybe find them a job where another hotel might need them.”

The crisis has tempered the usually competitive market, he said.

“At this point we’re just trying to help each other, trying to make sure we can pay the bills,” he said.

On a brighter note, Patel said he has not suffered from a lack of supplies as some hotels have seen.

“Two weeks ago, we actually bought extra. We had a feeling that this was going to get bad, so we were proactive,” he said.

Online shopping has helped, he said.

“We’re calling our vendor partners and they say it’s going to take this much time, that much time,” Patel said. “We’re just going on Amazon.com and right now that’s been our best friend.”

Patel also is AAHOA’s young professional director for the western division, and he said they have held weekly conference calls on helping members avoid paying unnecessary fees.

AAHOA joined other industry leaders in urging Congress to pass the Coronavirus Aid, Relief, & Economic Security Act, which was signed into law by President Trump on March 27.

“[The COVID-19 pandemic] is happening so quick and that’s what’s scaring a lot of the hoteliers, even myself,” Patel said. “It’s getting worse and worse day by day. We just don’t know what the future is going to look like.”

California collapsing

California-based hotelier Sunil “Sunny” Tolani, founder of the charity Prince Organization, said the pandemic was affecting all his hotels.

“Occupancy is decreasing at all hotels rapidly at this time. We are seeing cancelations through September or later at the hotel level from our guests,” Tolani said. “Group travel through June is at 100 percent cancelations at this time.”

Tolani has not closed any hotels yet, primarily because his staff members need the hours to pay their bills.

“As hotel owners and general managers, it is our responsibility to our associates and guests to give them the best we can, monitoring the issues and having a ‘plan of action’ in place to eliminate any fears during this stressful time in the world,” he said.

His general managers have had to use different vendors for supplies, he said.

“Toilet paper, Clorox cleaning products, Purell hand sanitizer and Lysol spray are not readily available from any vendor to us at this time, and if the vendor does have an item like toilet paper, we can only get one case at a time,” he said. “Hotels order weekly for normal operations and we order many cases of items to operate. This is very challenging at this time to even obtain one case of any item.”

Tolani said his hotel staff has to keep supplies under lock and key to avoid theft by guests.

And what are hoteliers doing to help each other get through the crisis?

“Firstly, praying, believing in the power of faith and miracles, coming together as family,” Tolani said. “This too shall pass.”

A similar attitude helped Jyoti Sarolia, principal and managing member of Ellis Hospitality Group in Temecula, California, find strength as occupancy plummeted at her hotels.

“I am staying positive, proactive while being aware of the reality of the world we are living in. I believe in the resilience of our industry and hospitality is more important than ever before,” Sarolia said.

While she thinks the large hotel companies are offering varying levels of support for owners, Sarolia said the industry as a whole should take advantage of the crisis to share best practices and make a hospitality-united pledge.

“It’s a good time to evaluate all services and amenities that select properties offer,” she said. “Going forward, our guests will be looking at us differently and we will have to step up to the plate to show we are responsible for their wellbeing during their stay with us.”

The California Hotel & Lodging Association is updating its website twice a day with information on the outbreak, including tips on dealing with potential exposure to the virus from new guests to rearranging housekeeping services, said Chairman Bijal Patel. The association also has been providing suggestions on seeking emergency bank loans, restructuring existing loans to lower interest rates and deferring payments.

“Our members have been super active on the CH&LA web portal and the WhatsApp platform,” he said. “They are sharing all sorts of suggestions – from using this time for employee training sessions to new best practices such as removing lobby or breakfast room furniture as a social distancing technique.”

Like others, Bijal’s family hotels have suffered from the crisis.

“The hotel industry has never been for the meek or the weak. It is for people who are patient and persistent – who are ‘overcomers,’” he said. “We overcame challenges such as the economic downturn of 2008 and [the Sept. 11, 2001 terror attacks] and we will overcome the coronavirus.”