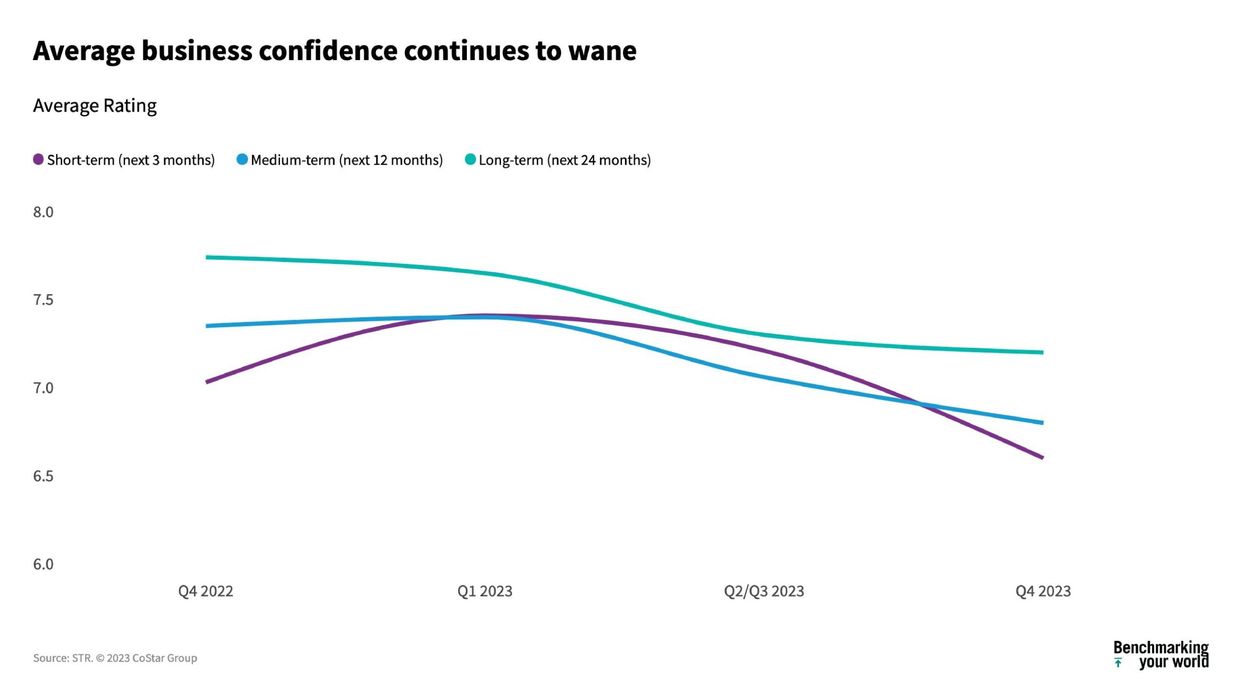

APPROXIMATELY 51 PERCENT of hospitality industry professionals participating in STR's Hospitality Industry Sentiment survey expressed optimism about their business confidence over the next two years. Respondents rated their confidence at “8” or higher on a 10-point scale. Analyzing the results over the survey's first year reveals a gradual, consistent decline in confidence ratings for each time span.

Meanwhile, global recession fears have diminished since the last survey, STR said. Among various industry challenges, “concerns regarding a potential recession” saw the most significant drop between the last two surveys, ranking third behind labor costs and supply issues. Energy and utility costs are slightly increasing, while supply chain challenges and group demand issues are gradually diminishing.

Regarding hotel performance, outlined trends influence demand forecasting expectations, the survey said. The percentage of respondents anticipating “strong improvement” or “some improvement” is gradually declining across all three hotel demand segments. A majority of experts still foresee growth in both business transient and group demand.

Apart from demand considerations, projections for pricing power appear resilient to concerns about occupancy growth, recession fears, and other factors, the survey revealed. Over 60 percent of respondents expect at least 1 to 2 percent year-over-year room rate growth in the first quarter of 2024, with nearly a third predicting 3 to 4 percent growth or higher. By the end of 2024, the majority expands to 70 percent of experts anticipating rate growth.

Despite waning expectations in demand segments, occupancy predictions remain positive, although not as robust as ADR forecasts, STR further added.

“Whether these positive occupancy expectations persist, especially if hopes for leisure, business, and group demand continue to decline, remains uncertain,” it said.

In a recent AHLA study, the outlook for the remainder of 2023 appears positive, driven by increased business travel and a clear preference among both business and leisure travelers for hotel stays. The study also forecasts a robust holiday travel season to conclude the year.