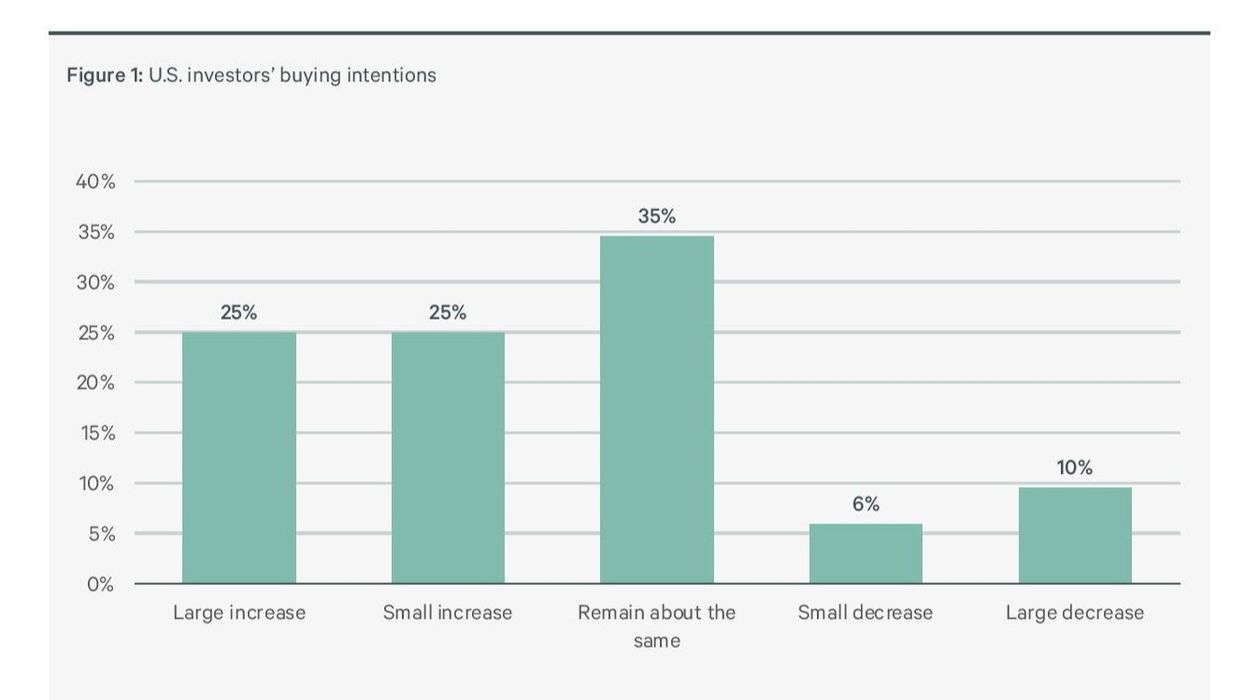

U.S. HOTEL INVESTOR sentiment remains robust, with investors indicating an increase in hotel acquisitions in 2024, according to a recent survey by CBRE Hotels Research. About 35 percent of survey respondents expect acquisition activity to remain the same as in 2023, while less than 16 percent anticipate a decrease.

Despite high interest rates, more than 70 percent are targeting value-added and opportunistic hotel investments.

CBRE’s Global Hotel Investor Intentions Survey, which included more than 130 respondents responsible for U.S. investments, found that value-added acquisitions offer opportunities to reposition assets by adding rooms, redesigning interiors, or adding amenities to increase returns and long-term value.

Among investors planning to increase hotel acquisitions this year, nearly 40 percent cited lower prices and better total return prospects as primary reasons, CBRE said. More than one-third cited more distressed-asset opportunities and decreasing debt costs as reasons to boost acquisitions. Of those investors planning to reduce their hotel allocations this year, 64 percent cited strengthening their balance sheets and difficulties in securing and servicing debt as the primary reasons.

The survey revealed that heightened borrowing and labor expenses pose the primary challenges for hotel investors this year, closely trailed by elevated insurance costs and all anticipated to diminish margins. Least concerning to investors were competitive pressures from alternative sectors such as cruise lines, short-term rentals and glamping.

Investor split on global brands

CBRE noted a division among investors regarding globally branded hotels, with more than half planning to sell such assets and over one-third intending to acquire them. Similarly, more investors are looking to sell independent hotels compared to those interested in acquiring them.

The survey revealed a higher percentage of investors planning to sell and buy branded hotels this year compared to independent hotels. This trend is expected, considering branded properties make up more than 70 percent of the total room supply.

According to CBRE, independent hotels, comprising 30 percent of room supply, demonstrated a more bearish divestiture-to-investment ratio of 186 percent, whereas globally branded hotels showed a slightly lower ratio at 165 percent.

The survey also found that despite limited supply, soft brands (affiliated with a global brand but retaining an independent name) and hotels eligible for conversion to other brands upon sale had a higher percentage of investors favoring acquisitions over dispositions. Soft-branded hotels were targeted for acquisition at a rate more than two-thirds higher than for dispositions.

Top picks

More than 40 percent of investors find resorts most attractive, followed by CBD locations at 26 percent, CBRE said. Investors anticipate urban locations benefiting from recovering international travel and robust meetings and events. Resorts are expected to see steady leisure demand and modest ADR increases, supporting 1.6 percent RevPAR growth.

According to the survey, 42 percent of investors favor upper-upscale assets, with upscale/upper-midscale close behind at 40 percent. Luxury assets are favored by 31 percent, while midscale/economy properties are less favored, possibly due to RevPAR declines last year.

Despite strong interest in extended-stay hotels during the pandemic and recent expansions by major hotel brands, these assets are the top choice for only 21 percent of investors.

The survey revealed that 40 percent of investors prioritize acquiring and developing limited-service hotels due to rising concerns over labor costs and narrower margins. Full-service hotels were favored by 32 percent of respondents.

NYC, DC lead market sentiment

New York City and Washington, D.C. are forecasted to show the strongest hotel market fundamentals this year, with Austin, Charleston and Miami following closely behind, according to the survey.

New York City stands out as the top market for hotel investment due to limited supply and strict short-term rental regulations. San Francisco, despite ongoing challenges, remains a promising investment option for 2024. Additionally, leisure destinations such as Miami and Charleston are also attractive to investors.

CBRE recently reported that U.S. hotels are poised for stronger RevPAR growth in the latter half of 2024 following a slow first quarter. The forecasted RevPAR growth for the year is 2 percent, a slight decrease from the earlier estimated 3 percent in February. However, a 3 percent growth is anticipated for the remainder of the year, driven by international tourists, holiday travel, and constrained supply growth.