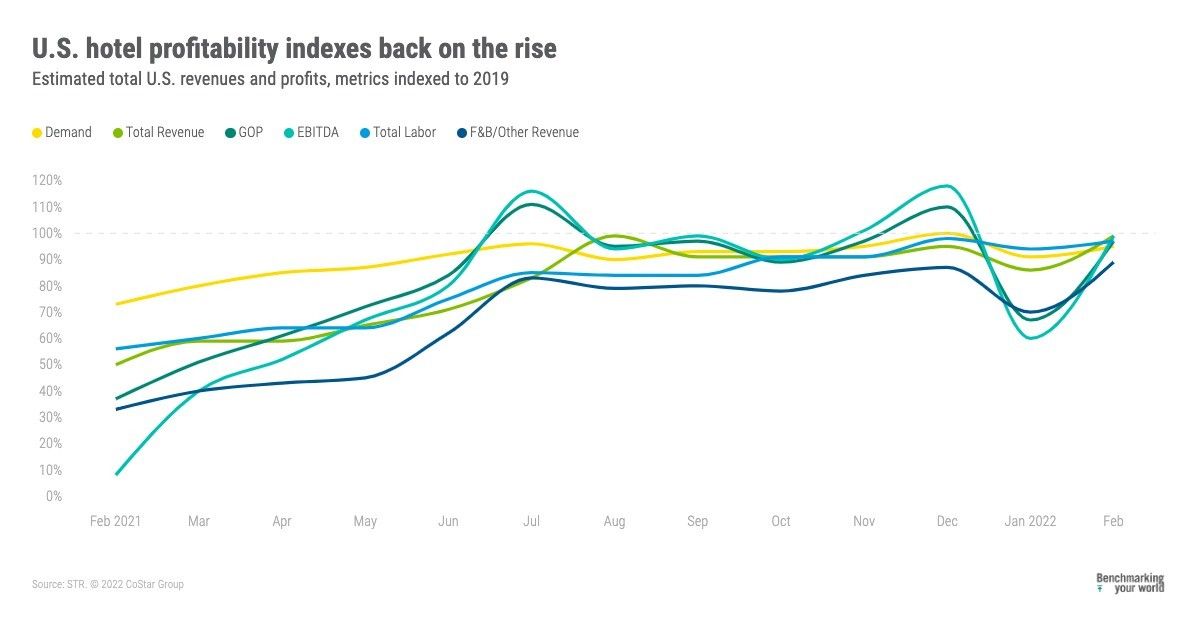

THE OMICRON VARIANT of COVID-19 has come and, for now, gone, and U.S. hotels are recovering quickly according to STR. The recovery does come after a slight dip in GOPPAR.

That dip was a $20 decline in January, but GOPPAR rose to $58.88 in February, the highest since October, according to STR’s P&L report for the month. TRevPAR for the month was $169.77, EBITDA PAR was $39.29 and labor costs were $56.63. All also were increases over January. In 2021, U.S. hotel profits reached 52 percent of pre-pandemic levels, according to STR.

“Following trends in top-line performance, U.S. profitability levels are recovering more quickly from Omicron than with previous variants,” said Raquel Ortiz, STR’s director of financial performance. “February GOPPAR was roughly 77 percent of the 2019 comparable, but independents (108 percent), luxury (94 percent) and midscale (88 percent) chains were far above the national average. The upper upscale (67 percent) and upscale (70 percent) segments are where the largest deficits persisted.”

Some of STR’s top 25 markets exceeded pre-pandemic levels in GOPPAR, Ortiz said, including Miami with 135 percent and Phoenix at 118 percent. New York, down 340 percent, and Chicago, down 187 percent, were the only two markets in that group with negative profit levels.

“Fortunately, recent improvements in top-line performance have us expecting gains in profitability for those and many more markets when we process March P&L data,” Ortiz said.

Total labor costs were up to 97 percent of the pre-pandemic comparable, according to STR, the second-highest index to 2019 of the pandemic-era, behind December 2021.

“As we look toward the spring and summer months, a further rise in labor costs might be expected due to increased demand,” Ortiz said. “However, our February data shows labor margins leveling out, which is likely due to those increased costs being absorbed by the increase in room rates.”

HotStats recently reported that GOPPAR for U.S. hotels hit $65.98 in February, its highest point since October last year and more than $40 more than in January, but down from $90 in February 2019.