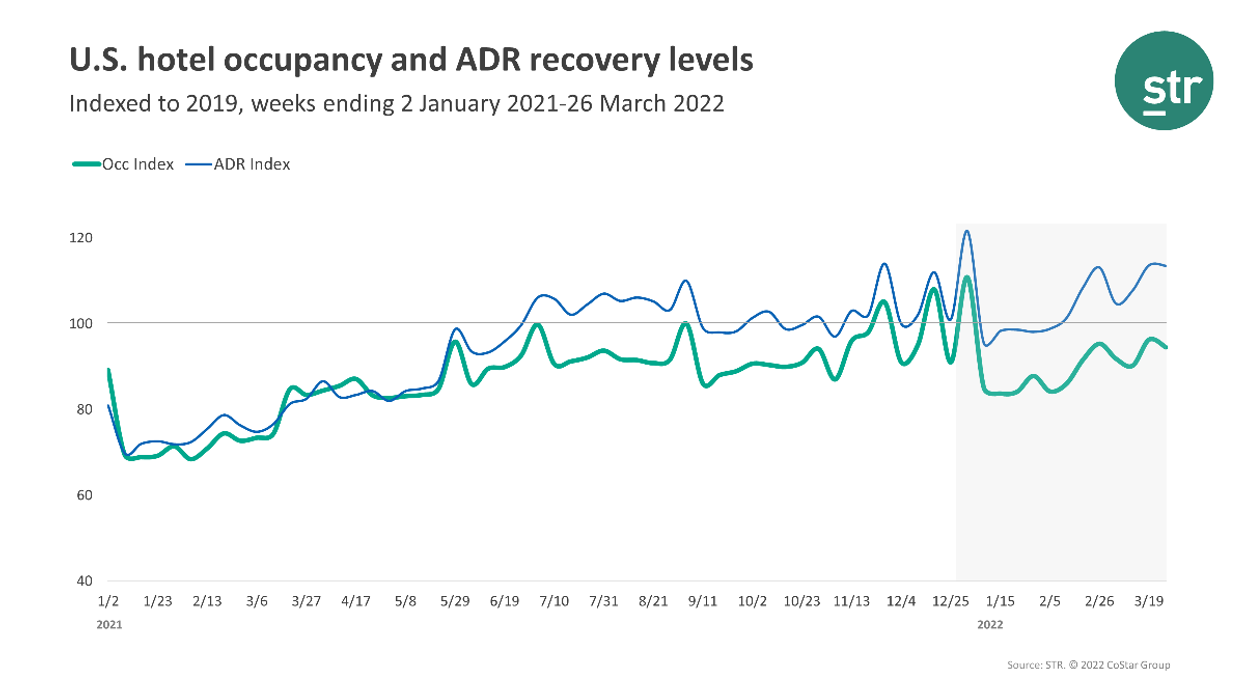

THERE WAS A slight decrease in U.S. hotel performance in the fourth week of March from the week before mainly due to lower Spring Break travel volume, according to STR. However, the ADR during the week was the third highest on record, behind the week before and the week of Christmas in 2021.

Occupancy was 65.5 percent for the week ending March 26, down from 66.9 percent the week before and down 5.5 percent for the same period in 2019. ADR was $149.38 for the week, dropped from $151.63 the week before and increased 13.5 percent from two years ago.

RevPAR was $97.92 for the week, dipped from $101.44 the week before and up 7.3 percent from the same period in 2019.

None of STR's top 25 markets showed an occupancy increase during the week over 2019. However, Tampa came closest to its 2019 comparable, down just 0.1 percent to 84.7 percent.

Spring Break aside, according to STR, the Game Developers Conference and NCAA Basketball pushed weekly group demand in San Francisco/San Mateo, up 4.8 percent over 2019, in upper upscale and luxury classes. RevPAR in the market was just down 1.4 percent during the week when compared to 2019 and it was 54.2 percent the week before.

Minneapolis experienced the largest occupancy decrease, dropped 21.8 percent to 51.8 percent, from 2019.

The steepest RevPAR deficits were in Washington, D.C, decreased 27.5 percent to $105.10, followed by Seattle, dipped 24 percent to$87.63, from two years ago.