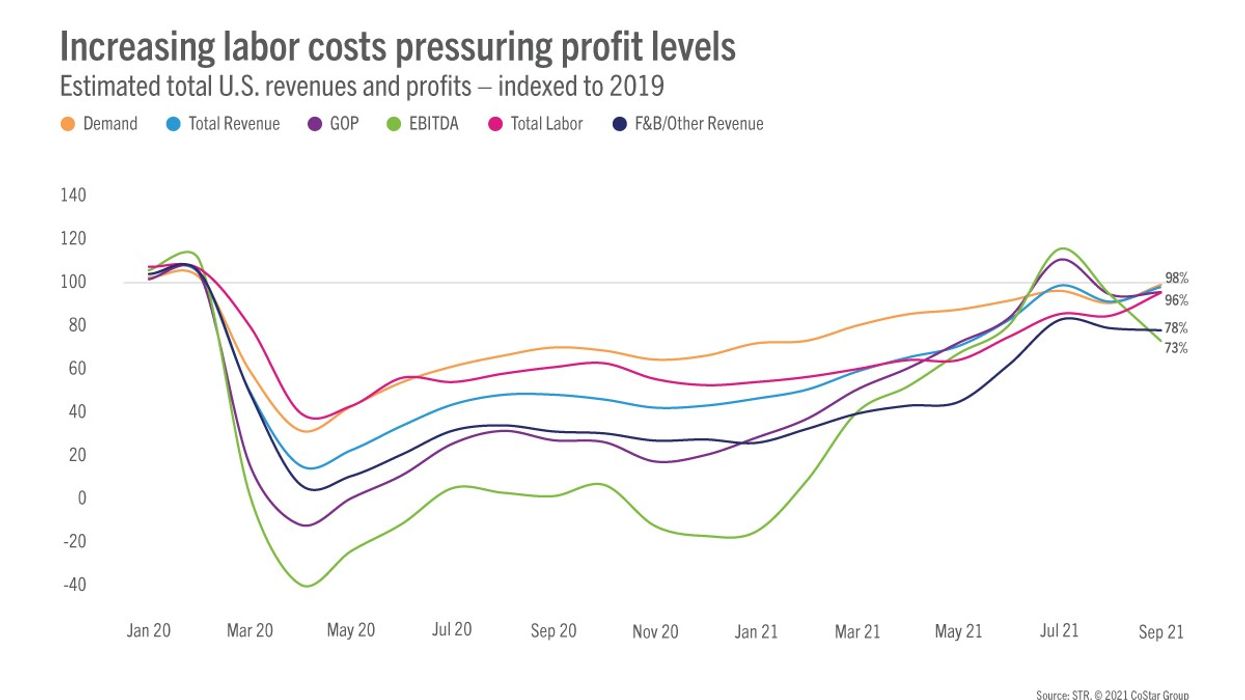

RISING LABOR COST again pulled U.S. hotel profitability down in September for the second consecutive month, according to STR. Estimated labor costs came in at 96 percent of the level it reached in the same time period in 2019, making it the highest index of the pandemic-era.

At the same time, a decline in COVID-19 cases and the easing of restrictions on international travel could lead to a much needed performance boost, according to HotStats.

All the key profitability metrics fell in September from the month before, according to STR‘s Sept 2021 monthly P&L data release. Gross operating margins fell 33 percent.

GOPPAR was $46.29 in September versus $49.31 a month ago. TRevPAR was $140.94 and EBITDA PAR was $30.47 during the month under review. These metrics were $146.22 and $32.13 in August respectively.

Labor costs averaged $47.50 per available room during September this year. It was $47.99 a month ago.

“Higher labor margins meant less room for profits, and the GOP margin fell for the second consecutive month to 33 percent,” said Raquel Ortiz, STR’s assistant director of financial performance. “Like we noted last month, September P&L data was going to be interesting because the earlier reported top-line metrics were showing some return of business travel and groups. To accommodate that demand, hotels reopened F&B operations and increased their overall staffing levels in an inflationary environment with higher wages.”

According to STR, only San Francisco remained in negative GOP through the first nine months of the year among the major markets.

A recent STR report said that US hotel occupancy dipped a percentage point in the third week of October, though room rates rose slightly.

HotStats reported GOPPAR for September came in at $51, 44 percent lower than in the same month in 2019. The travel research firm said a 60 percent drop in COVID-19 cases since a September spike, along with the Biden administration’s recent decision to allow vaccinated travelers from Canada and Mexico to enter the U.S. are signs the situation is improving.

“September was also a second consecutive month of flat profit growth, actually down over August, after a steady escalation throughout summer,” HotStats reported. “Part of the reason was the strong leisure travel demand that characterized the first three quarters of the year, something reiterated in Hilton’s Q3 earnings report.”

HotStats reported labor costs per available room at $55 for the month under review, its highest point since the beginning of the pandemic. It is $34 higher than April 2020, the low point of U.S. hotel performance.