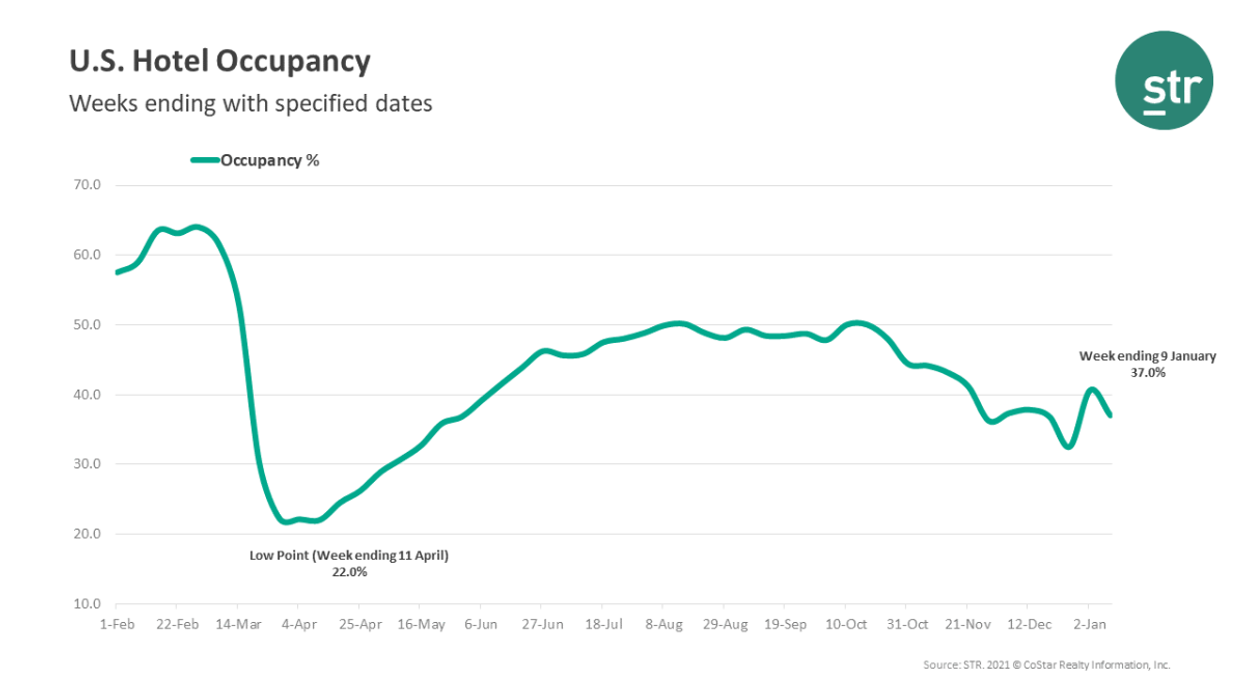

U.S. HOTEL PERFORMANCE continued its downward spiral in the second week of January, according to STR. It’s a sign that the holiday travel boost is over and business travel continues to remain down, driving occupancy below 40 percent.

Occupancy for the week ending Jan. 9 was 37 percent, down from 40.6 percent the prior week and 28.3 percent less than the same time the previous year. ADR was $87.97 compared to $107.93 the week before and down 27.1 percent year over year. RevPAR was $32.59, down from $43.81 the week before and 47.7 percent from last year.

“The previous week’s occupancy was lifted by New Year’s travel,” STR said. “As that holiday travel dissipated, TSA checkpoint counts and hotel room demand each declined by roughly 1.3 million in a week-over-week comparison.”

Occupancy for the top 25 markets defined by STR was 35.8 percent, lower than the national average, but ADR was higher at $93.85. Miami saw the highest occupancy among the top 25 at 51.4 percent, a rise attributed to the College Football Playoff National Championship.

“Of note, Washington, D.C.-Maryland-Virginia, reported two days, Tuesday and Wednesday, with occupancy above 50 percent amid the unrest in the capital,” STR said. “For the week, occupancy reached 36.9 percent.”

Oahu Island, Hawaii, remained last in occupancy among the top 25 with 22.1 percent, followed by Minneapolis/St. Paul, Minnesota-Wisconsin, with 24.2 percent.