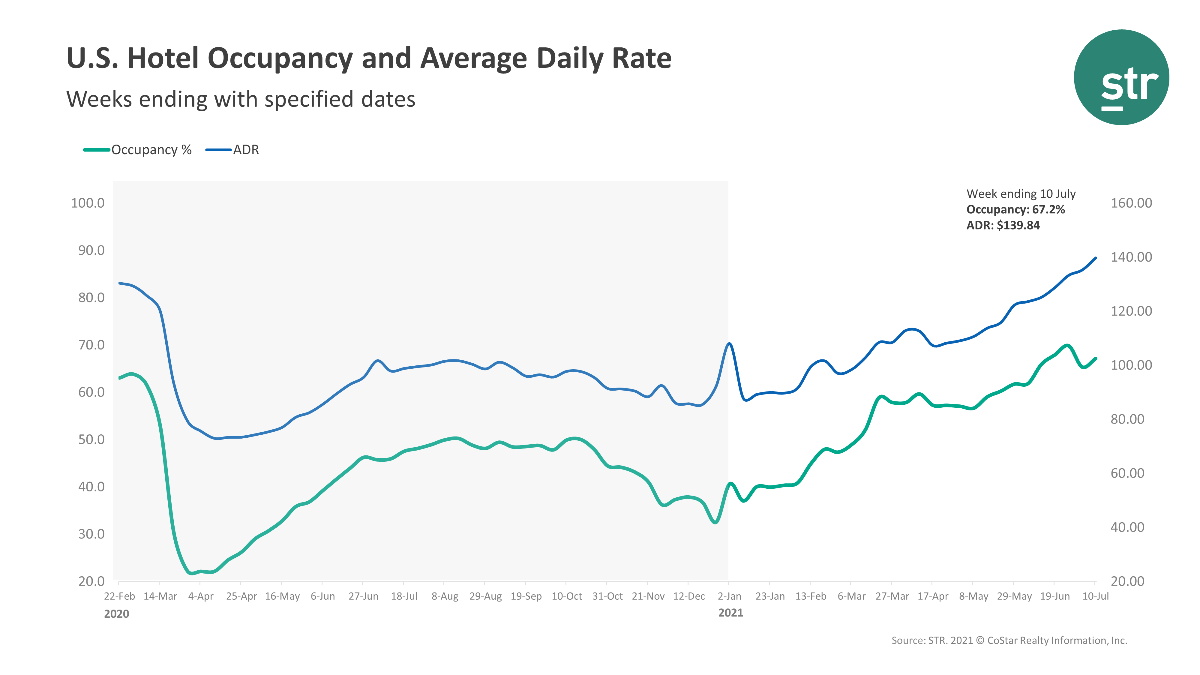

OCCUPANCY AND ADR rose for U.S. hotels in the second week of July, according to STR. Leisure travel continued to drive business with those travelers willing to spend more to escape months of pandemic-induced restrictions on movement.

Occupancy was 67.2 percent for the week ending July 10, up from 65.4 percent the week before and down 9.3 percent from the comparable time period in 2019. ADR was $139.84, a new record and up from $135.35 weekly as well as up 5.4 percent from 2019. RevPAR came in at $93.99, up from $88.51 the week before and down 4.4 percent from 2019.

“Inflation aside, STR analysts note that hoteliers are taking advantage of pent-up leisure demand and higher spending travelers while trying to counter staffing shortages and rising operational costs in some regions,” STR said. “Additionally, with demand mostly transient, there is not the usual lowering effect of discounted group rates at the higher end of the market. Most of the higher ADR performances are outside of the major metro markets.”

Norfolk/Virginia Beach, Virginia, saw the highest occupancy increase over 2019 among STR’s top 25 markets, rising 3 percent to 80.5 percent. Meanwhile, Minneapolis saw the steepest decline in occupancy from 2019, down 34.1 percent to 52.6 percent.

Miami reported the largest ADR gain, up 44.7 percent to $225.14, and RevPAR increase, up 30.7 percent to $152.45. The largest RevPAR drops were in San Francisco/San Mateo, California, down 55.2 percent to $89.11, and Boston, down 47.6 percent to $94.03.