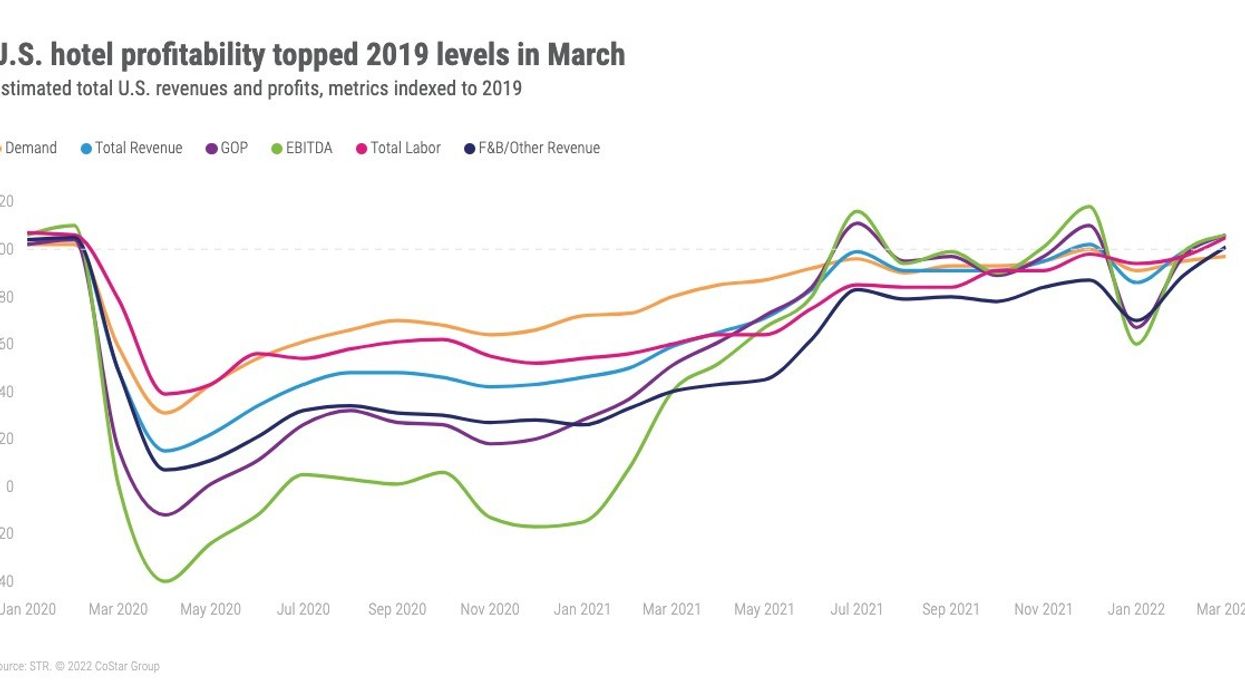

PROFITS FOR U.S. hotels reached a 28-month high in March, according to STR. Spring break travel and higher rates are pushing performance up on all levels.

GOPPAR was $83.81 for the month, the highest level for the metric since November 2019. It was less than $10 shy of reaching the pre-pandemic comparable from March 2019. In February GOPPAR stood at $58.88.

EBITDA PAR was $62.68, TRevPAR was $204.84 and labor costs per room were $61.45. For the latter two it was their highest mark since March 2020.

“Aligned with jumps in top-line performance that have continued into April, each of the bottom-line metrics showed drastic improvement in March due to spring break travel and increased room rates,” said Raquel Ortiz, STR’s director of financial performance. “Overall, the metrics indexed at roughly 90 percent of pre-pandemic levels. Also reaching pandemic-era indexed highs were meeting space rentals at 96 percent, A/V rentals at 85 percent and catering & banquets at 72 percent, which are connected to an uptick in group travel. Of course, some of the growth is inflationary, and much of the group demand is leisure-based at this point in the recovery, but there have been gains from the corporate sector as well.”

Eight of the major markets saw GOPPAR levels higher than 2019 comparables.

“Beach destinations continued to lead in both GOPPAR and TrevPAR recovery, with Miami hitting 141 percent of 2019 levels,” Ortiz said. “On the other hand, San Francisco, which has improved recently, is still trekking behind other markets in terms of both GOPPAR and TrevPAR. Overall, eight of the Top 25 Markets saw GOPPAR surpass March 2019 levels.”