ON DAY TWO, the theme for AAHOACON 2020 was “Where do we go from here?” The main topic of discussion in the day’s general sessions was how the U.S. hotel industry can recover from the COVID-19 pandemic.

After a first day of introductions and getting used to the functionalities of AAHOA’s first virtual conference, Wednesday was a series of talks ranging from how hotel associations like AAHOA, the American Hotel & Lodging Associations and the U.S. Travel Association are facing the crisis to how individual companies are being affected.

Word from the top

Cecil Staton, AAHOA president and CEO, moderated the first session, “Hospitality CEOs Converge: Advocating for the Hotel Industry.” His guests were Roger Dow, USTA president and CEO, and Chip Rogers, AHLA president and CEO.

“It's the most difficult time any of us have ever seen, 10 times worse than Sept. 11,” Dow said in answer to Staton’s question on the state of the country and travel industry.

Rogers said the associations are doing what they can to keep hoteliers afloat.

“There are a lot of folks out there talking about recovery, promotion, stimulus, and those things, and those are clearly important, no question about it,” he said. “But right now, so many in our in our industry are just trying to keep the doors open and make sure that there's a job for those employees to come back to.”

One of the most important issues AAHOA, USTA and AHLA have advocated for is an expansion of the federal Paycheck Protection Program. Refunding PPP is part of two stimulus packages under debate in Congress, the Republicans’ Health, Economic Assistance, Liability Protection and Schools (HEALS) Act and the Democrats’ Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act.

“The problem is the PPP was originally created to last about eight to 10 weeks,” Rogers said. “We now know that this problem is going to exist for the rest of this year and well in the next year and probably many years in our industry. So the notion that an eight to 10 week fix will fix the problem is a little short sighted.

“We're asking specifically for another round of PPP funding for those businesses that have lost 35 percent or more of their revenue. The current HEALS Act offers that at a 50 percent or more revenue loss, we believe that that should go down to about 35 percent.”

Dow said helping the travel industry recover is key to a national recovery from the pandemic. Six more months of the current situation could mean another $70 billion and another 800,000 jobs lost for the travel industry.

“And if we don't get that going, if we let [the pandemic] take its own path that's a problem,” he said. “That's why it's so important to bring this thing back, because we will bring back the U.S. economy.”

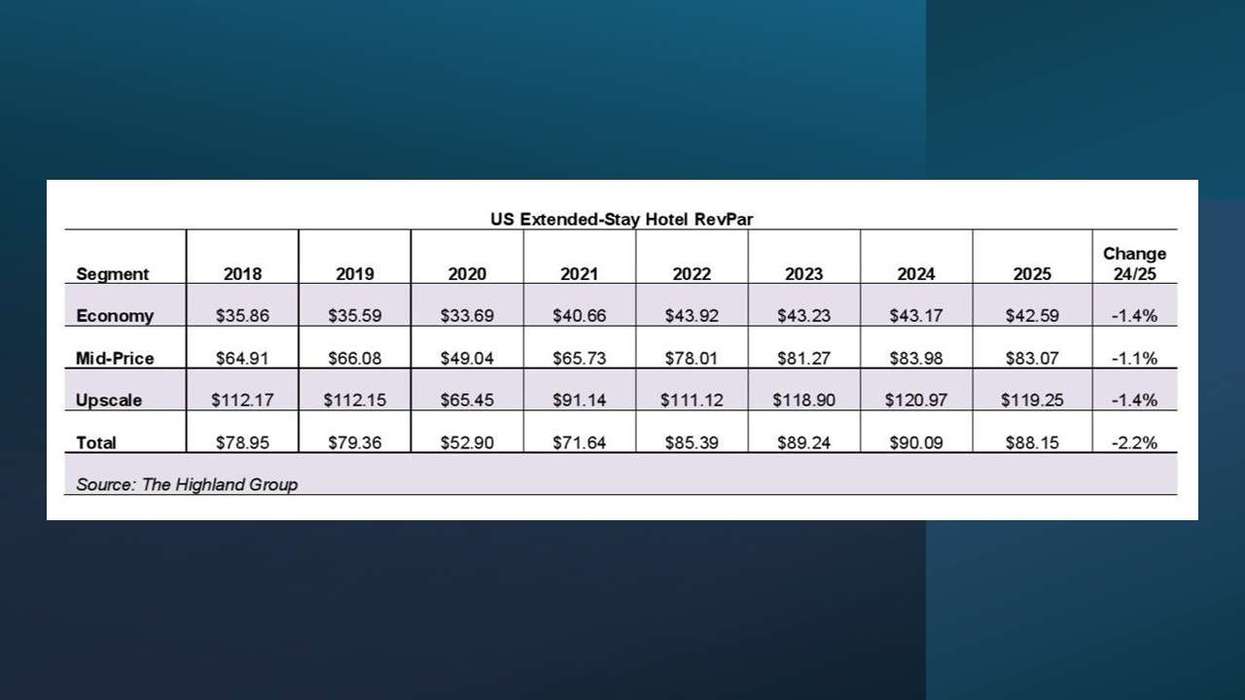

The numbers don’t lie

The next session, “What the Data Says: Before, During, and After the Pandemic,” laid out the good and bad in the current economic crisis. Moderator Christina Trauthwein, editor-in-chief of Hotel Business, started with the July results.

“There were gains in the leisure sector in particular and the hospitality industry in general,” CBRE’s Jamie Lane said in response. “But, the pace of growth has slowed. It’s great that jobs are returning, but we haven’t seen a rebound.”

In the early days of summer, as states started to reopen, there was a growth spurt, said Cindy Estis Green, CEO and co-founder of Kalibri Labs.

“But I think, with the [COVID-19] cases starting to spike, it had a muting effect on the growth,” she said.

Demand remains sluggish, said Amanda Hite, STR president and CEO.

“[The pandemic] had a huge negative impact,” Hite said. “There is improvement week over week, but the big gains we saw over April and May have waned. The real question is [what happens] after Labor Day. What will happen to demand?”

There are some signs of recovery, Estis Green said.

“Leisure is split between brand loyalty programs and OTAs and that’s a big thing. We also are seeing signs of life in the corporate sector,” she said.

Some hotels are in some markets are doing better than last year, Hite said.

“So, there are positive stories out there,” she said. “By 2023, we’ll be back to our 2019 levels of demand."

The voices of the future

Panel members for the general session “A View from Young Professional Hoteliers: Driving the Future of the Industry Beyond COVID-19” were young executives from some top hotel development and investment companies. Joining moderator Teague Hunter, president and CEO at Hunter Hotel Advisors, were J.R. Patel, president and CEO of Helix Hotels; Harshil Patel, vice president, Champion Hotels; Jatin Desai, managing principal and CIO/CFO of Peachtree Hotel Group; Raj Patel, chief development officer, Hawkeye Hotels.

Hunter asked Desai about the state of the investment world in the pandemic.

“Our investor appetite in this current market obviously shifted,” Desai said. “Our investors have traditionally been high net worth individuals with not really large institutions. The profile of our investors has not changed since we first started the company back in 2007. Our investors are always looking for risk adjusted returns with capital appreciation. Obviously, that's different today than it was six months ago.”

J.R. with Helix said his company’s hotels, mostly in secondary and tertiary markets, were doing better than at the outset of the pandemic.

“I think we definitely saw the bottom as I would imagine most of us on here have. It’s improving but I think July 4 weekend was a bit of an acid test for our properties and our industry as a whole,” he said. “I think the number of [COVID-19] cases rising nationwide we're starting to see a bit of a plateau across our portfolio and I think the industry is speaking that way as well.”

Champion Hotels’ Harshil gave a similar report.

“We've had to obviously go in and just try to minimize all the costs,” Harshil said. “We have owner operators at most of our locations, so it's almost like running like a mom and pop again, where you're literally watching every single check being written, every invoice coming in.”

The impact of COVID-19 had exceeded Hawkeye Hotels worst-case scenarios, Raj said.

“When we build and operate hotels, we shock test for 30 percent drop in revenue,” he said. “When overnight, you have an 80 to 90 percent drop and the bottom falls out, even if you have done every single thing, right, when that day comes you can you can never be prepared for it.”

The crisis has affected their decision making toward future projects, Raj said. They probably won’t break ground on another project until the second or third quarter of 2021.

“Any project that's underway, anything that we've broken ground on, it's a freight train, you can't stop it. So, we are committed to looking forward on any project that's underway, and we've been able to do that on the projects that we just closed our loans on. And those dozen are all under way and we are cutting costs right now,” he said. “Any project that is not underway and is in the planning phases, we are certainly looking at the time when we should start the project. Once we can start seeing that recovery, once lending comes back around in a strong way and once we can feel 100 percent confident and comfortable with moving forward on those projects. We don't have any plans to scrap the projects but we’re just waiting for the right timing to maximize value and costs.”