Corporate travel spend 2024

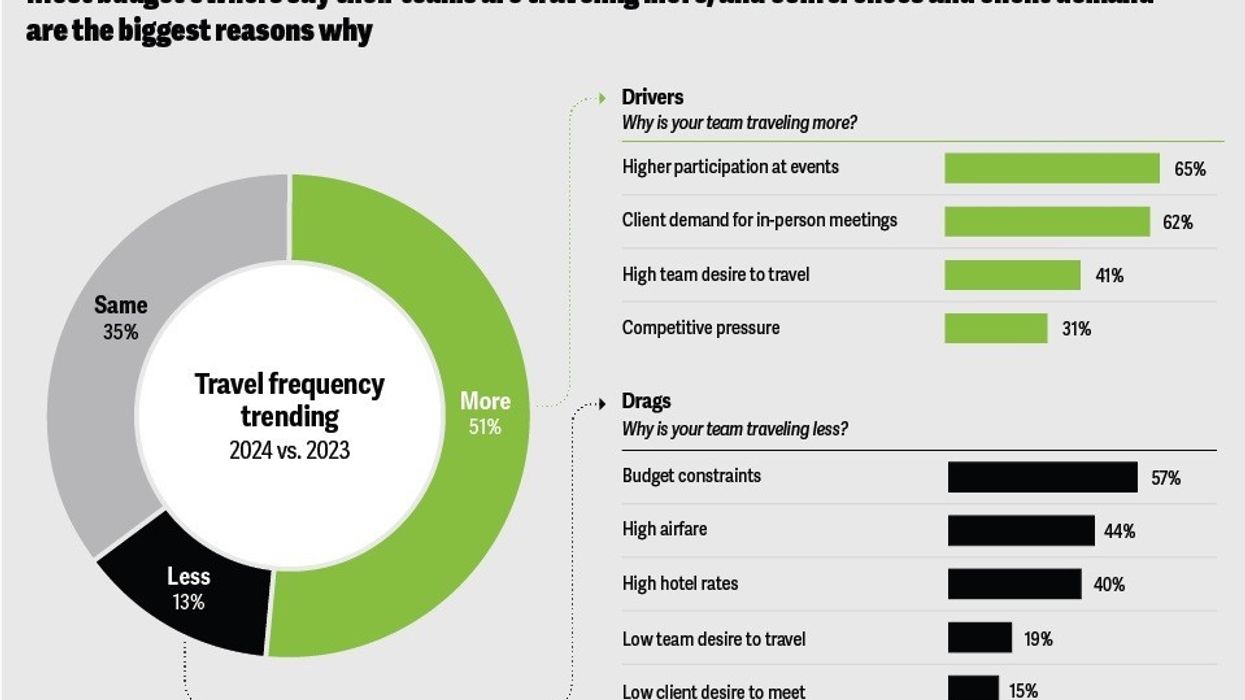

CORPORATE TRAVEL SPEND by U.S. companies is expected to grow 8 to 12 percent, reaching or exceeding pre-pandemic levels by the end of 2024, according to a recent Deloitte study. Around 73 percent of travel managers expect their companies’ travel spend to increase in 2024, while 58 percent expect further increases in 2025, with projected gains averaging 14-15 percent each year.

Deloitte's 2024 corporate travel report, "Upward Climb with Uphill Struggles," found that live events are a top growth driver, with 6 in 10 business travelers expecting to attend a conference, trade show or exhibition this year.

“Business travel has been slower to come back following pandemic slowdowns, but this could be the year that it accelerates to new heights," said Eileen Crowley, Deloitte’s vice chair and U.S. transportation, hospitality and services attest leader. "More employees are traveling for business—and enjoying it—underscoring that in-person connection often remains a critical component. As companies see a renewed benefit in the opportunities business travel provides, business leaders can capitalize on the enthusiasm and prioritize travel experiences that are valuable to both the organization and employee.”

Deloitte's “2024 Corporate Travel Report” is based on two surveys. The first, conducted between May 16 to 18, surveyed 104 U.S.-based corporate travel managers and executives with travel budget oversight. The second, conducted between May 28 and June 3, surveyed 1,389 U.S.-based corporate travelers, 834 of whom oversee travel budgets or approve travel requests for their teams.

Corporate travel on the rise

About 20 percent of travelers expect to take 6 to 10 trips in 2024, up from 15 percent in 2023 and 10 percent expect to take more than 10 trips, up from 7 percent in 2023. Those projecting gains expect an average rise of 14 to 15 percent each year, but this growth is expected to slow by a few percentage points in 2025. The report found that client-related travel is a top driver of trip frequency, with 1 in 5 frequent travelers reporting monthly trips for sales or project work.

Amid the return to conference rooms and airport lounges, 83 percent of those surveyed find business travel "enjoyable" and see both professional and personal value in it. About half, 51 percent, rank networking opportunities and 47 percent cite exploring different cities among the top three benefits of business travel. Many travelers surveyed also find opportunities to enjoy trips without the business: two-thirds of corporate travelers extended a business trip for leisure in 2023, with 1 in 7 doing so three or more times.

Around 63 percent of business travelers expect to attend at least one conference in 2024, while half of travel managers rank industry events as one of the top two growth drivers. While more employees are traveling to attend conferences, they are traveling more frequently for clients. Among frequent travelers, about 23 percent say they traveled once a month or more in the first half of 2024 for client project work or sales and 21 percent for client relationship building, compared to just 13 percent for conferences and exhibitions.

International travel is also on the rise, with growing demand for trips beyond North America, the study revealed. Travel managers surveyed expect the share of total spend on international trips to increase slightly through 2025, citing the easing of entry requirements as the third-biggest driver of trip growth in 2024, behind live event attendance and budget increases.

Cost impacts on the bottom line

Nearly 22 percent of travel managers surveyed say high prices are the biggest drag on trip volume for their companies, with 40 percent ranking prices among the top two concerns. Higher costs also pose challenges for travel suppliers, as many travel managers report that suppliers are adopting tougher negotiating stances.

In an effort to mitigate costs, 55 percent of travel managers surveyed cite booking compliance as a top cost control measure, ahead of all other options. Another half of travel managers report that their companies are encouraging or mandating lower-cost flights. Meanwhile, only 56 percent of travelers who are aware their company has a corporate booking tool or agency say they always book trips through these managed channels.

While frequent travelers might seem less likely to use compliance tools, responses indicate that age is a stronger predictor of booking compliance than travel frequency: Gen X and Boomers are significantly less likely to always use managed channels.

According to the report, flexibility and loyalty are key for those booking directly. The main driver for booking directly with suppliers is the easier management of trip changes, followed by the opportunity to earn loyalty points. Surveyed travelers use online travel agents primarily to find the best deals, 56 percent for airfares and 61 percent for hotels.

‘2030 sustainability goals’

Most travel managers believe companies need to reduce travel to meet 2030 sustainability goals. Over half say they need to cut trips by 10 percent to 20 percent. Meanwhile, more travel managers report that their companies are adopting travel-related sustainability measures, encouraging employees to make greener travel choices. One-third of travelers confirm that their companies are urging them to select more sustainable providers for business travel.

“The stabilization of corporate travel holds both opportunities and challenges as the industry adapts to new norms and priorities,” Kate Ferrara, Deloitte’s vice chair and U.S. transportation, hospitality and services non-attest leader. “Travel buyers and suppliers should work together to navigate these shifting dynamics. As companies manage pricing pressures, suppliers who lean into flexibility to help companies meet employee expectations can build loyalty and be well-positioned for the road ahead.”

Overall, companies are more prepared and proactive in their approach to sustainable travel this year: 46 percent report having a strategy to assign travel emission budgets to teams and individuals, up from 30 percent in 2023. Nearly half of travel managers surveyed say they want more assurance that travelers will take action before investing in a more integrated approach to sustainability in their travel purchasing process.

A recent Jenius Bank report found that about 29.3 percent of Americans refuse to cut back on travel despite its non-essential status, while 20.1 percent made their largest one-time payment in 2023 for a vacation.