U.S. EXTENDED-STAY hotels registered an increase in occupancy and ADR in the first quarter of this year, according to hotel investment advisors report The Highland Group. Record high demand, low supply growth and rising overall ADR are driving the strong performance.

Economy and mid-price extended-stay hotels recovered RevPAR to their nominal 2019 values and the former is leading the recovery, the U.S. Extended-stay Hotels: First Quarter 2022 report said. However, the upscale extended-stay segment is lagging the overall recovery but reporting slightly better recovery performance as demand is at an all-time high, the report added.

"There were 564,257 extended-stay hotel rooms open at the end of the first quarter. However, the 17,165 net gain in rooms open over the last year was the lowest annual increase since 2014, excluding 2020. Room nights available increased 3.1 percent over 2021, but supply growth dropped 50 percent from 2016 across all three segments," the report said.

"The total extended-stay demand increased at almost four times the rate of supply over the last 12 months. Economy extended-stay was the only segment to report a gain in demand during the period and further increases were reported over the next two years. Demand for the upscale segment fell 12 percent, though it led the demand growth."

According to the report, upscale extended-stay hotels was the only segment to report a fall in revenues in the first quarter, but the revenue fall was lower than the overall hotel industry and all upscale hotels. It reported a 43 percent gain in revenues. Total extended-stay room revenue was up 18 percent when compared to the same period in 2019.

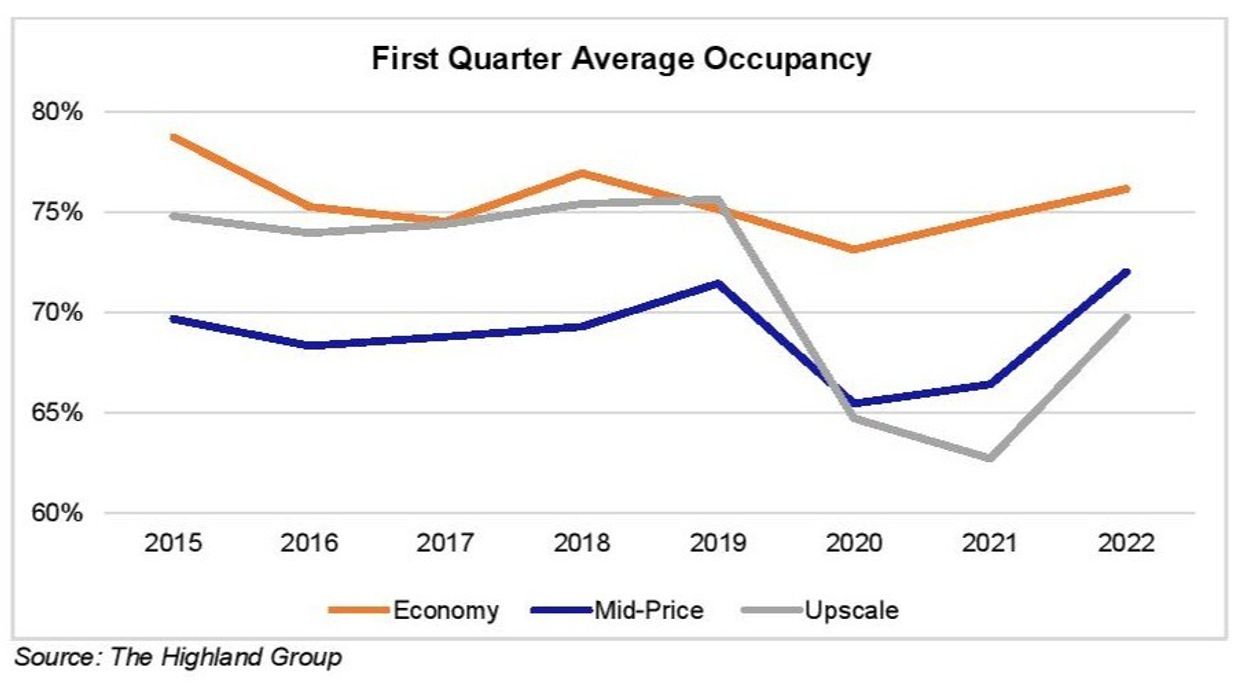

"Occupancy for extended-stay hotels was very close to the first quarter levels reported in 2016 and 2017 but below its peak years since 2015. Mid-price extended-stay hotels reported their highest first quarter average occupancy in 20 years. Upscale is the only extended-stay segment not to have recovered occupancy to 2019 and it remains well under its first quarter level in the years preceding 2019. Extended-stay hotel’s occupancy premium above the overall hotel industry was up 16 percent in the first quarter of 2022," the report said.

"The first quarter extended-stay hotel ADR was the highest ever reported in 2022, but the upscale segment has not recovered to its 2019 nominal value. The economy segment did not see a reduction in ADR in the first quarter of 2020 compared to the same period in 2019. Consequently, its ADR gains have not been as rapid as mid-price or upscale segments. Extended-stay hotels increased ADR faster than the overall hotel industry from 2015 through 2019. Relative growth accelerated in 2021 with the ratio peaking at 83 percent before declining to 77 percent in the first quarter this year."

According to the report, economy and mid-price segments reported record high RevPAR for a first quarter in 2022 with respective levels of 21 percent and 13 percent above their nominal values in the first quarter of 2019. Upscale extended-stay hotels reported the strongest RevPAR gain over the last year at more than 42 percent, but lower than 10 percent it was in Q1 2019.

As the overall hotel industry recovered RevPAR more quickly, extended-stay hotel’s RevPAR ratio declined to 99 percent in the first quarter but stayed higher than the period from 2015 through 2019, the report said.

The report revealed that extended-stay supply growth should be relatively low nationally for three to four years with interest rates and construction costs rising.

In an earlier report, The Highland Group said that ADR growth for U.S. extended-stay hotels reached a record high in February.