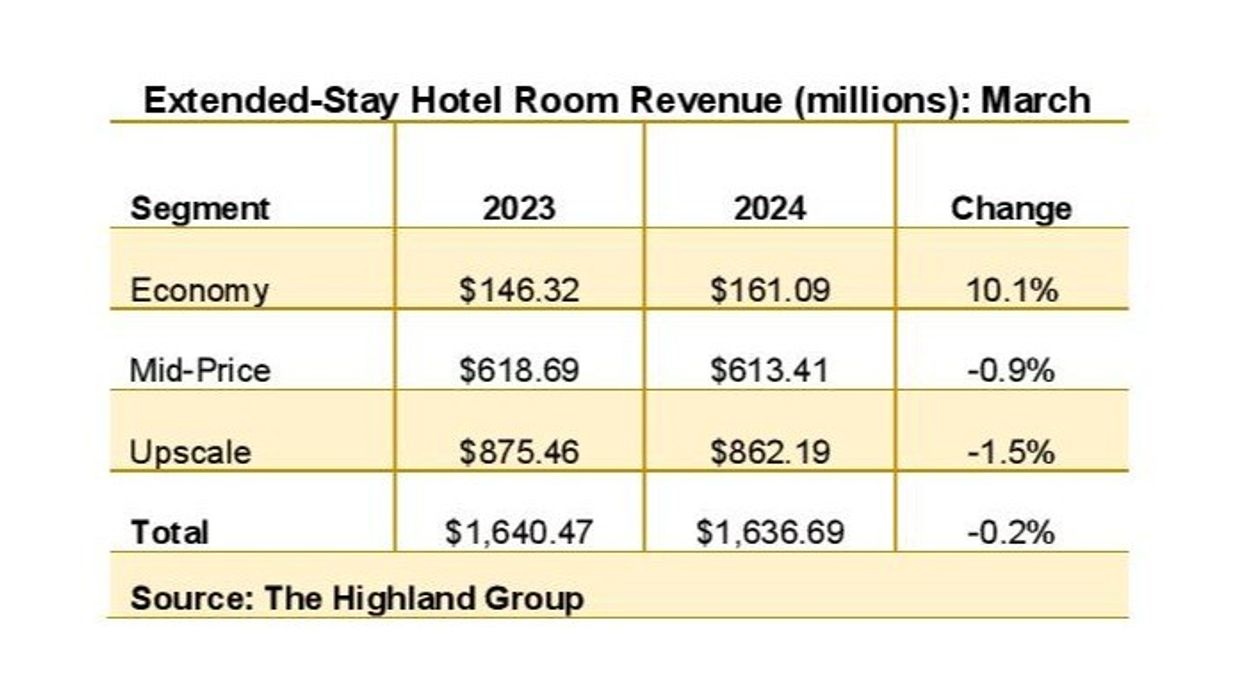

TOTAL REVENUES FROM extended-stay hotel rooms fell by 0.2 percent in March, marking the first monthly decline in over three years, according to The Highland Group. However, the revenue decline was smaller than the 1.6 percent contraction estimated by STR/CoStar for the overall hotel industry.

Meanwhile, extended-stay room supply increased by 2.7 percent in March, a slight uptick compared to the average monthly growth over the past two years, the report said. This marks the 30th consecutive month of supply growth at 4 percent or less, with the annual change remaining below 2 percent for two years. However, both these figures lag behind the long-term average.

The 14.2 percent rise in economy extended-stay supply, coupled with a small increase in mid-price segment rooms, primarily stems from conversions, The Highland Group said. New construction in the economy segment is estimated to account for approximately 3 percent of open rooms compared to one year ago.

Supply change comparisons have been influenced by re-branding, room reclassification between segments in our database, de-flagging of hotels not meeting brand standards and sales to multi-family apartment companies and municipalities, The Highland Group said. This trend is expected to persist at least through the first half of 2024, particularly as several older extended-stay hotels remain on the market.

However, the total year-over-year increase in extended-stay supply compared to 2023 will continue to fall significantly below the long-term average.

Decline in revenue and key metrics

March marked the initial monthly decrease in extended-stay room revenues in over three years, The Highland Group said. However, it was relatively smaller than the 1.6 percent contraction reported by STR/CoStar for the overall hotel industry.

Total extended-stay demand increased by 0.8 percent in March, marking positive demand shifts in 15 out of the last 16 months. While modest, March's uptick contrasts favorably with the 1.4 percent decline in demand reported by STR/CoStar for the overall hotel industry.

The decrease in extended-stay hotel occupancy in March marked the second highest contraction since occupancy began declining over the past year, the report said. However, it was smaller than the occupancy decline reported for the overall hotel industry by STR/CoStar, leading to a slight increase in extended-stay's relative occupancy premium. In March, extended-stay hotel occupancy was 11.1 percentage points higher than that of the total hotel industry, consistent with the historical long-term average occupancy premium.

In March, total extended-stay hotel ADR declined monthly for the second time in three years, the report added. Only the economy extended-stay segment reported an ADR decrease. Upscale segment ADR remained unchanged, while the mid-price segment saw gains that were insufficient to raise total extended-stay ADR. However, compared to corresponding classes of all hotels, as estimated by STR/CoStar, the change in extended-stay hotel ADR was equal to or better over the same period.

Since February 2021, all extended-stay segments experienced a monthly decline in RevPAR for the first time, it said. The economy segment saw the most significant decrease, although it remained well below the 8.8 percent contraction reported by STR/CoStar for all economy hotels.

The Highland Group recently reported a 1.8 percent increase in extended-stay room supply in February, consistent with the past two years. This marks the 29th consecutive month of growth below 4 percent, remaining under 2 percent for over two years, significantly below the long-term average.