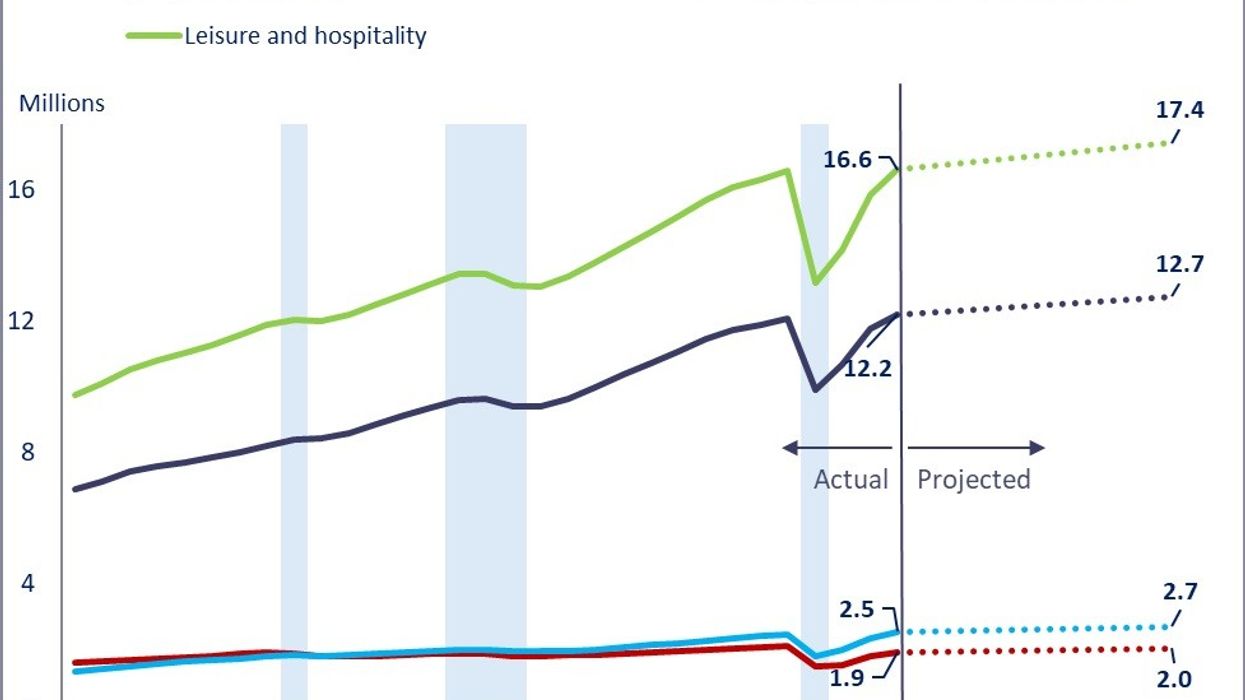

ONE IN EIGHT new jobs created over the next nine years will be in the hospitality and leisure sector, according to the Bureau of Labor Statistics. The U.S. hospitality industry is projected to add about 822,700 jobs between 2023 and 2033.

This growth marks the third-largest increase among all major sectors, following business services and healthcare and social assistance.

“As of 2023, leisure and hospitality recovered all jobs lost during the pandemic in 2020,” BLS stated in a blog post. “Employment is projected to grow from 16.6 million today to 17.4 million by 2033. The sector comprises three main industries: accommodation; food service and drinking places; and arts, entertainment, and recreation.”

Accommodation employment is expected to grow by 124,700 jobs, driven by increased leisure travel demand. Most of these roles will be in hotel, motel and resort desk clerks and food service positions such as cooks.

More than 200 hoteliers from more than 30 states attended the American Hotel & Lodging Association's 'Hotels on the Hill' event on May 18 to lobby Congress for an H-2B Returning Worker Exemption. The association also released an economic analysis showing that U.S. hotels support 8.3 million jobs, or nearly one in 25 American jobs.