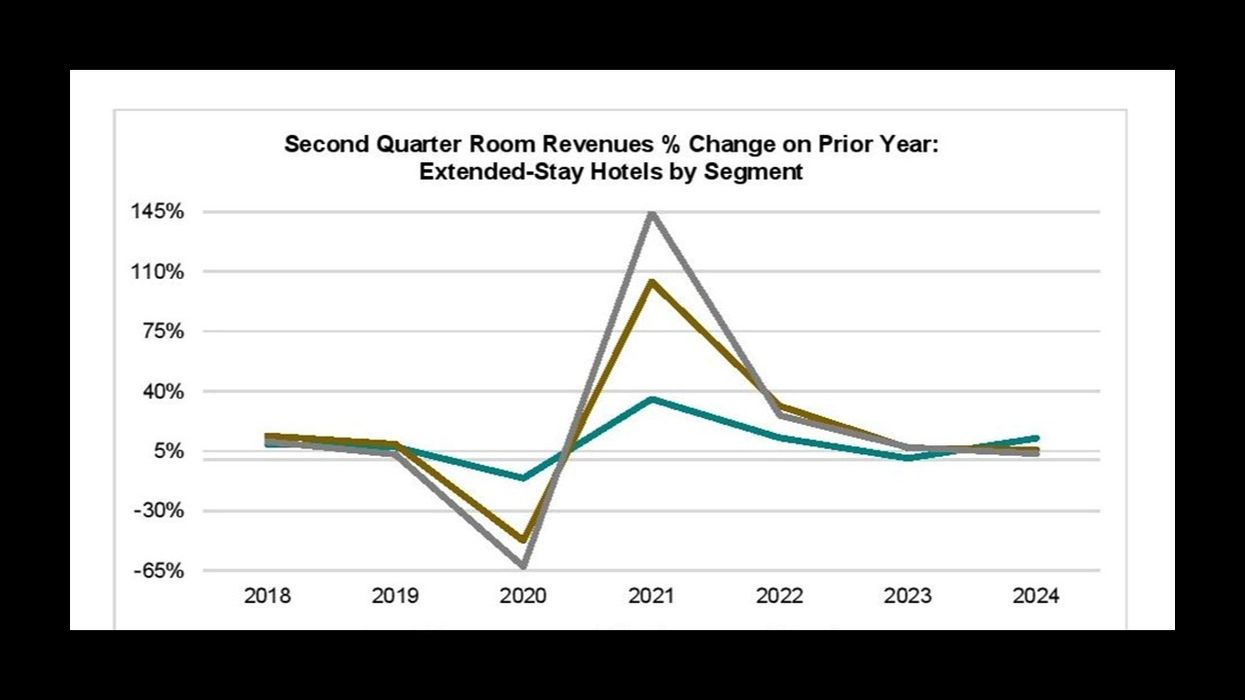

EXTENDED-STAY ROOM revenue rose 3.4 percent in the first half of 2024 and 5.1 percent in the second quarter, while occupancy decreased 0.2 percent in the first half but increased 1 percent during the second quarter, according to The Highland Group. The second quarter also saw the highest quarterly RevPAR increase in a year, an 11-point occupancy premium over all hotels and the most rooms under construction in four years.

The 2024 mid-year U.S. extended-stay Lodging Market report found that all three extended-stay hotel segments reported record-high room revenues in the first half and for the second quarter.

Revenue growth in extended-stay hotels is accelerating in 2024, with the second quarter’s increase more than three times that of the first quarter, the report said. The 5.1 percent revenue increase in the second quarter significantly outpaces the 3 percent gain reported for the overall hotel industry by STR/CoStar.

“Despite headline grabbing large increases in extended-stay rooms under construction, the annualized increase in room nights available over the next year should be well below the long-term average and the near-term risk of over supply nationally is very low,” said Mark Skinner, The Highland Group’s partner.

Demand growth accelerates

The 3 percent increase in extended-stay demand during the first half of 2024, compared to the same period in 2023, is up from the 1.9 percent growth in the previous period. Demand growth is accelerating in 2024, with the second quarter's increase more than doubling the first quarter's gain.

There were 48,703 extended-stay hotel rooms under construction at the end of the second quarter 2024, marking a 62 percent increase from a year ago and a 10 percent gain from the end of 2023, The Highland Group said. The significant rise in economy segment rooms is largely due to two new economy brands gaining distribution.

Mid-price brands have not yet achieved similar traction, the report found. Although the relative increase in mid-price rooms under construction is lower, the absolute change is the largest in the past year. At mid-year 2024, rooms under construction represented 8 percent of total rooms.

However, not all the reported rooms have begun construction, and the lengthy development process suggests that the near-term supply increase will be significantly below 8 percent. Due to new brand launches, supply growth forecasts through 2028 remain optimistic compared to recent years.

Supply growth subdued

Extended-stay rooms under construction increased by 62 percent over the past year and 10 percent over the last six months, The Highland Group said. More than 30,000 extended-stay rooms were under construction as of mid-2023, with a net increase of just 18,098 rooms over the following 12 months. If this trend continues, extended-stay supply growth will be less than 5 percent next year, falling below both the pre-pandemic four-year average and the long-term average.

The supply of extended-stay hotel rooms surpassed 591,000 by mid-2024, the report said. The 3.2 percent net increase in rooms over the past year is higher than the previous 12 months but remains well below the 6.4 percent average annual increase seen in the four years before the pandemic.

The 14 percent increase in economy extended-stay supply, along with modest gains in mid-price and upscale segments, is largely attributed to conversions. New construction in the economy segment accounts for an estimated 3 to 4 percent of rooms compared to a year ago.

Supply change comparisons have been affected by rebranding, de-flagging of hotels that no longer meet brand standards and the sale of some hotels to multi-family apartment companies and municipalities, the report said. This impact is expected to diminish in the second half of 2024, with the full-year increase in total extended-stay supply remaining well below the long-term average compared to 2023.

Economy occupancy slumps

Economy extended-stay occupancy continued to decline in 2024 following record-high levels in 2021 and 2022. However, it remains 19 percentage points higher than all economy hotels, according to STR/CoStar. The decline in year-to-date occupancy is also evident in the mid-price segment, where lower-priced brands have struggled to maintain occupancy following a more than 35 percent increase in ADR since 2020.

The economy segment’s occupancy decline moderated in the second quarter, during which mid-price and upscale segments reported gains and total extended-stay occupancy was nearly restored to its second quarter level in 2022.

Key metrics overview

After declines in February and March—the first monthly drops in ADR in three years—extended-stay hotel ADR turned positive, showing a slight increase year-to-date through June, the report said. The economy segment reported its first monthly ADR gain in June after five months of declines, with only minimal contraction in the second quarter. In comparison, STR/CoStar reported a 1 percent ADR contraction for all economy class hotels in the second quarter.

Extended-stay hotel ADR is rising more slowly than the overall hotel industry, driven by the upper upscale and luxury segments, The Highland Group said. Excluding these segments, which have few extended-stay rooms, STR/CoStar reported a 1.4 percent ADR increase for the overall market in the second quarter. This matches the increase for upscale extended-stay hotels but is less than that for the mid-price segment.

With both occupancy and ADR rising each month in the second quarter, extended-stay hotel RevPAR reversed its declining trend, finishing slightly higher in the first half of 2024 compared to the same period in 2023. The economy segment reported a slight year-to-date decline, but if recent trends continue, it is expected to turn positive in the second half of the year.

The 1.9 percent increase in extended-stay hotel RevPAR for the second quarter lagged behind the 2.4 percent gain estimated by STR/CoStar for the total hotel industry. However, excluding upper upscale and luxury hotels, overall hotel RevPAR increased slightly less, at 1.8 percent, in the second quarter.

The Highland Group recently reported U.S. extended-stay room supply grew 3.5 percent in June, exceeding the average monthly increase of the past two years. This marks the 33rd consecutive month of supply growth at 4 percent or less, with annual changes staying below 2 percent for the past two years.