U.S. EXTENDED-STAY HOTELS ended 2024 strong after a slow start, with supply, demand and room revenue growth outpacing the overall industry, according to The Highland Group. However, ADR and RevPAR growth lagged yet stayed positive, with stronger gains in the latter half.

The Highland Group’s report on the U.S. Extended-Stay Hotel Market 2025 found that although below the long-term average, extended-stay supply growth in 2024 was the highest since 2021 and is set to accelerate over the next one to three years.

“Fundamental differences, such as far higher interest rates and real construction costs, exist between the current and most recent extended-stay hotel growth cycles, but a substantial increase in room revenues remains likely over the next one to three years,” said Mark Skinner, The Highland Group’s partner.

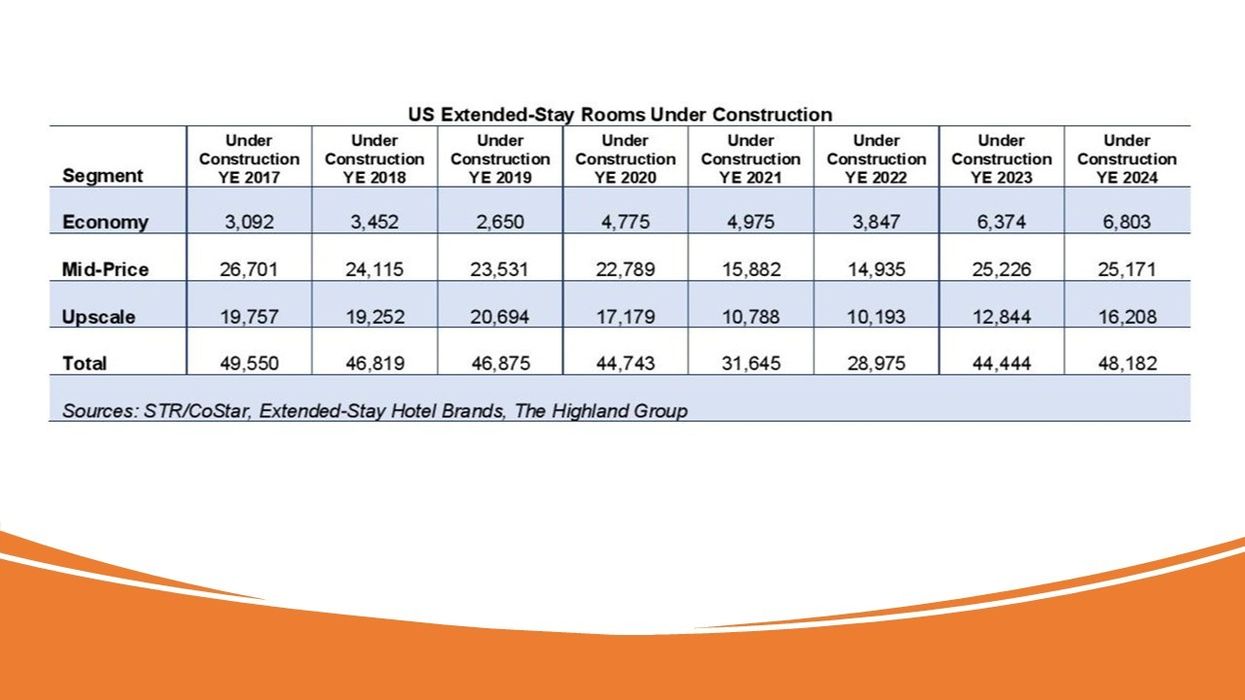

Extended stay supply and demand growth accelerated in 2024, with rooms under construction rising 8 percent to over 48,000, the report said. The 2025 growth cycle mirrors 2015-2019, when 100,000 rooms were absorbed, and room revenue grew by $4.5 billion. However, higher interest rates and construction costs set this period apart. While extended-stay performance remains closely tied to the broader hotel industry, strong demand signals a positive growth outlook.

Supply & distribution

Extended-stay supply grew 3.1 percent in 2024, the highest in three years but still below the long-term average for the third consecutive year, The Highland Group said. Economy segment supply rose 13.2 percent, driven by conversions, while mid-price and upscale saw smaller gains. New economy construction accounted for about 3 percent of rooms opened year over year.

Supply changes have been influenced by rebranding, de-flagging, and hotel sales to apartment firms and municipalities. These factors should decline in 2025, while new construction accelerates, though growth will likely remain below the long-term average.

Rooms under construction rose 8 percent year over year, reaching levels similar to 2017-2019. Economy and upscale segments saw the largest gains, while mid-price remained stable, the report said. Reporting inconsistencies mean some listed projects may not materialize, but the pipeline is set to expand, driving supply growth over the next one to three years.

Meanwhile, extended-stay companies project a 4.2 percent annual room growth through 2029, driven partly by new economy and mid-price brands. This aligns with 2011 to 2017 growth following the 2010 to 2011 construction trough. Extended-stay rooms made up 9.3 percent of total room nights in 2019, rising to 10.3 percent by 2024.

Demand & occupancy

Extended-stay demand hit a record high in 2024, rising 3.3 percent year over year—one of the decade’s smallest gains but ahead of the overall industry's 0.8 percent growth, the report found. Demand grew every month except January, with the strongest increases in the second half. Occupancy also rose each month after the first quarter.

Economy extended-stay occupancy saw positive growth only in the last two months of 2024 and ended the year down one point from 2023. Total extended-stay occupancy remained 11.8 points above the overall industry, consistent with its long-term premium.

Revenue, ADR & RevPAR

Extended-stay room revenues hit record highs in 2024. The 4.2 percent annual increase, though the smallest since 2003, excluding 2002, 2009, and 2020 declines, outpaced the overall industry's 2.4 percent growth, The Highland Group said. Revenue gains were significantly stronger in the second half of the year.

Extended-stay ADR rose every month after the first quarter, with growth accelerating throughout 2024. While segment trends mirrored the broader industry, total extended-stay ADR increased just 0.8 percent, trailing the overall industry's 1.7 percent gain. This was partly due to the economy segment expanding its share of extended-stay supply, while its share of total hotel supply declined.

Extended-stay RevPAR trends in 2024 followed occupancy and ADR, with positive gains every month after the first quarter except September, the report said. The fourth quarter saw the highest quarterly growth at 3 percent. Economy extended-stay RevPAR lagged, with strong fourth-quarter gains failing to offset a slight annual decline. Excluding 2020, the 1 percent annual increase was the smallest since 2019 and below the overall industry's 1.9 percent growth.

The Highland Group recently reported that U.S. extended-stay hotels saw strong fourth-quarter 2024 results, with six-quarter highs in RevPAR and room revenue as supply grew over 3 percent and demand rose 4.6 percent.