U.S. EXTENDED-STAY hotels experienced their first quarterly decline in RevPAR since the first quarter of 2021, according to The Highland Group. In the first quarter, the segment saw a 1.6 percent drop in RevPAR, despite a 1.5 percent increase in revenues. Demand increased by 1.7 percent, contrasting with a 2.8 percent fall in total hotel demand when excluding upper upscale and luxury segments.

STR/CoStar estimated that overall hotel RevPAR, excluding upper upscale and luxury segments, which have minimal extended-stay room supply, increased by 1.3 percent in the first quarter of 2024 compared to the same period in 2023.

The Highland Group’s 2024 First Quarter U.S. Extended-Stay Hotels report indicated that overall hotel RevPAR and room revenues declined by 1.1 percent and 0.9 percent year-to-date, respectively, excluding upper upscale and luxury segments.

The report said that extended-stay supply growth is expected to remain relatively low nationally in the foreseeable future, as interest rates are anticipated to stay high in the near term and construction costs continue to rise.

“If most forecasts for overall hotel industry performance are realized, extended-stay hotels are likely to reverse the trend of declining occupancy in the near future because demand has increased for 13 consecutive quarters and supply growth is very low,” said Mark Skinner, The Highland Group’s partner.

First quarter highlights:

- ADR declines for the first time in three years

- Lowest occupancy for 11 years

- Second lowest supply growth in a decade

- Demand gains 1.7 percent

- Room revenues up 1.5 percent over last year

- Average occupancy 13 points higher than all hotels

Hotel pipeline and supply dynamics

According to the report, approximately 585,403 extended-stay hotel rooms were operational at the end of the first quarter. Over the past year, excluding the pandemic-affected year of 2020, there was a net increase of 11,583 rooms, marking the second-lowest growth since 2013. This increase represents less than 40 percent of the average annual gain observed from 2016 to 2019.

The Highland Group said room nights available increased by 3.2 percent over the last year. However, when adjusting for the leap year in 2024, the increase was approximately 2 percent. Notably, there was a 15 percent surge in economy extended-stay supply, contrasting with a relatively modest gain in the mid-price segment, primarily due to conversions. New construction in the economy segment is estimated to be around 3 percent of rooms open compared to a year ago.

The report highlighted that supply change comparisons have been influenced by various factors, including rebranding, room reallocations across segments, de-flagging of hotels failing to meet brand standards, and sales to multi-family apartment companies and municipalities. This trend is expected to persist, especially through the first half of 2024, as several older extended-stay hotels remain on the market.

Furthermore, the report predicts that the full-year increase in total extended-stay supply compared to 2023 will remain well below the long-term average.

Peak demand

The first quarter witnessed peak demand in the economy and upscale extended-stay hotel segments, the report said. Total extended-stay demand increased by 1.7 percent over the past 12 months, inclusive of the leap year in 2024. This stands in stark contrast to STR/CoStar’s reported 0.4 percent decline in demand for the overall hotel industry during the same period.

STR/CoStar estimated a 2.8 percent decline in total hotel demand, excluding luxury and upper upscale segments, in the first quarter compared to the same quarter in 2023.

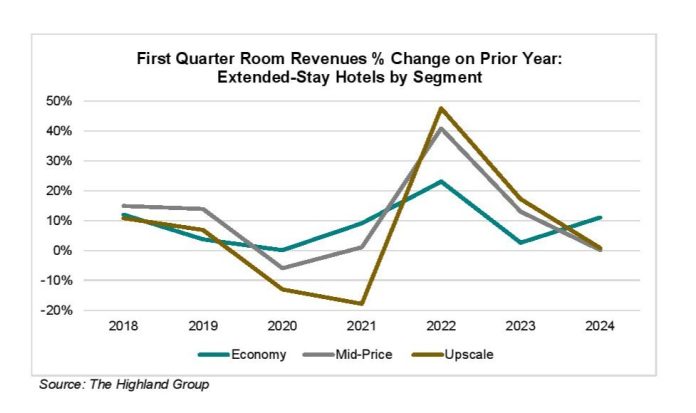

Minimal revenue increase

The report highlighted that the 1.5 percent increase in extended-stay room revenues in the first quarter marked the lowest quarterly gain since the upward trend began in mid-2022. Meanwhile, STR/CoStar noted a 1.9 percent increase in total hotel industry room revenues for the same period. However, this figure dropped to a 0.9 percent decline when excluding upper upscale and luxury segments.

According to the report, total extended-stay hotel occupancy in the first quarter stood at 71.5 percent, a level not seen since 2013. Average occupancy was one half to two and a half points lower compared to first quarters from 2016 through 2019, with extended-stay hotels reporting lower occupancy in six of the last seven quarters.

The Highland Group also said that the economy extended-stay segment was the only segment to see a decrease in ADR in the first quarter. Coupled with the segment’s supply growth affected by conversions, this decline led to a drop in total extended-stay hotel ADR in the first quarter, marking the first contraction in quarterly ADR in three years. In contrast, STR/CoStar reported a 2.3 percent increase in total hotel industry ADR for the same period.

Furthermore, the quarterly RevPAR change mirrored the ADR pattern, with the economy segment spearheading the decline and influencing the overall change in total extended-stay RevPAR from the first quarter of 2023 to first quarter of 2024.

Trends in performance metrics

The report said that extended-stay hotels maintained an average occupancy premium over the overall hotel industry, averaging 11.7 percentage points from 2017 to 2019, a trend consistent over the last 25 years. This premium typically widens during economic downturns, notably peaking at 20 percent in the first quarter of 2021. By the first quarter of 2024, the extended-stay hotel’s occupancy premium stood at 12.5 percentage points.

During the period from 2017 to 2019, extended-stay hotels experienced a slightly faster rise in ADR compared to the overall hotel industry. The relative growth spiked to 83 percent in 2021 before receding to 77 percent in the first quarter of 2022. After a minor increase last year, the ADR ratio fell to 75 percent in the first quarter of 2024.

The upper upscale and luxury segments have contributed somewhat to the overall hotel ADR growth. The relative RevPAR mirrored the ADR trends, accelerating gains from 2017 to 2019 and reaching a peak ratio of 119 percent in the first quarter of 2021. However, as the broader hotel industry rebounded in RevPAR more swiftly, the extended-stay hotel’s RevPAR ratio dipped to 91 percent in the first quarter of 2024, slightly below its level compared to 2017.

Excluding the upper upscale and luxury segments from the estimate, the RevPAR ratio has shown a relatively modest decline over the past two years, with a slightly higher first-quarter ratio in 2024 compared to the same period in 2017. Although economy extended-stay hotel RevPAR declined in the first quarter of 2024 compared to the same period in 2023, the contraction was less severe than observed across all economy class hotels, maintaining an upward trend relative to all economy hotels.

Mid-price extended-stay hotels have made notable advancements compared to all mid-price hotels. In the first quarter of 2019, the ratio of mid-price extended-stay hotel RevPAR to all mid-price hotel RevPAR stood at 102 percent. Five years later, it rose to 111 percent, despite considerably higher supply growth over the period.

However, upscale extended-stay hotels, largely due to a high concentration of rooms in urban sub-markets, have lagged behind the overall extended-stay recovery since 2019. These hotels have also experienced a decline in RevPAR relative to all upscale hotels, although the gap has narrowed over the past year.

In April, The Highland Group reported a 0.2 percent decrease in total revenues from extended-stay hotel rooms for March, marking the first monthly decline in over three years. Despite facing challenges since the beginning of 2024, the segment experienced declines in most metrics compared to March 2023 but generally outperformed other hotel classes.