Summary:

- U.S. Senate narrowly passes “One, Big, Beautiful Bill Act.”

- AAHOA thanks lawmakers, cites tax certainty and flexibility for small business owners.

- Bill faces tougher path in House amid divisions within Trump’s party.

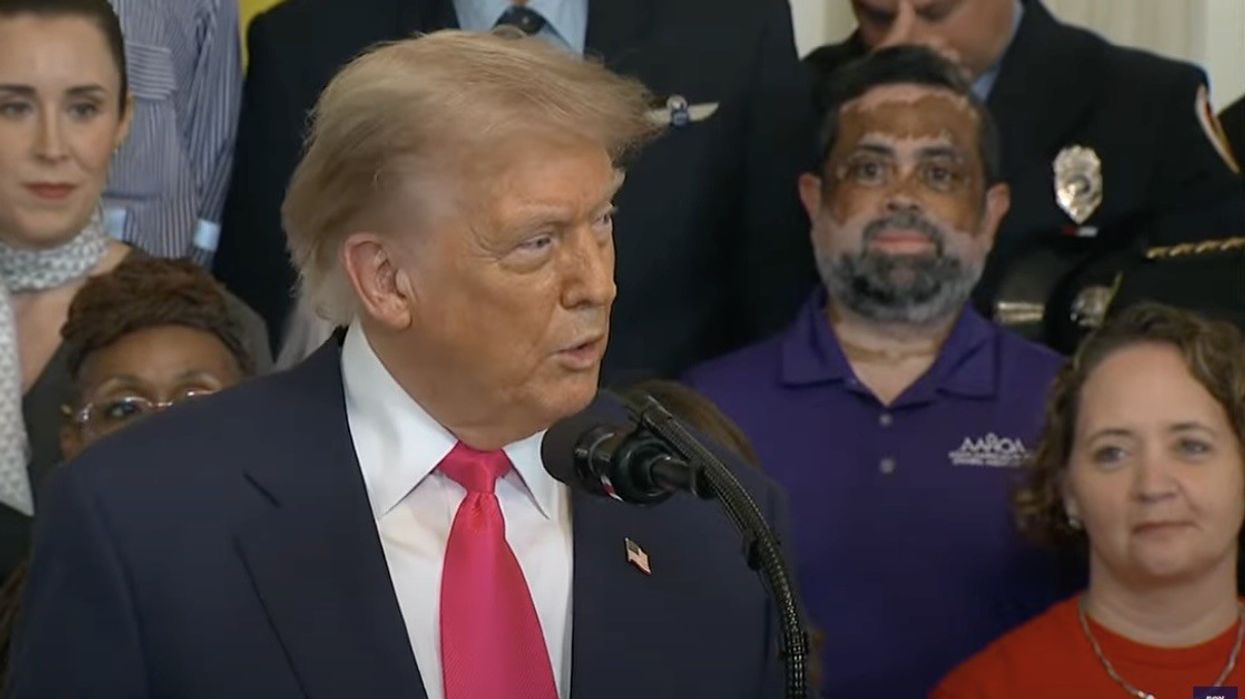

THE U.S. SENATE on Tuesday narrowly passed President Donald Trump’s flagship legislation, the ‘One Big Beautiful Bill Act’ (H.R. 1), which includes tax breaks and spending cuts the administration says will benefit U.S. citizens. AAHOA backed its final passage in both chambers of Congress, although concerns remain about the inclusion of a remittance tax that could impact Indian Americans.

The Senate approved the bill by a narrow margin after closed-door negotiations and pressure from the president, according to the BBC. The legislation now faces a more difficult path in the House of Representatives, where divisions persist within Trump’s party.

Trump pushed for the final version to reach his desk by July 4, calling it a milestone for his administration. Still, he signaled flexibility, telling reporters, “I’d love to do July 4th, but it’s very hard… maybe somewhere around there,” before leaving for Florida.

The bill’s fate remains unclear as it returns to the House, which earlier passed a different version by one vote. House Republicans must now approve the Senate’s amendments, including changes that have drawn opposition from both sides.

AAHOA supports the bill

AAHOA thanked lawmakers for advancing the legislation and noted its potential to offer tax certainty and flexibility for small business owners. The bill’s provisions—including tax relief and reinvestment incentives—reflect the needs of hotel owners focused on business growth and local employment.

"We thank members of Congress who supported this bill in earlier stages and encourage continued support for its final passage," said Kamalesh “KP” Patel, AAHOA chairman. "Hotel owners across the country benefit from policies that support long-term planning and economic stability."

The association said it remains committed to advocating for policies that support entrepreneurship, small business growth and job creation nationwide.

"As small business owners facing complex economic challenges, our members rely on stable, forward-looking tax policy," said Laura Lee Blake, AAHOA president and CEO. "We urge lawmakers to advance this legislation so our members can keep investing in their businesses, employees and the communities that support their livelihoods."

Deadline and proposals

The 50-50 tie was broken by Vice President J.D. Vance, pushing the bill through, the BBC reported. The tie followed Senate Majority Leader John Thune convincing two members who had considered siding with the Democrats, according to AFP.

Trump has set a July 4 deadline for Congress to pass the bill, which includes a $150 billion increase in military spending and funding for his deportation program. It also extends $4.5 trillion in tax cuts from his first term.

The bill proposes up to $1.2 trillion in cuts to the Medicaid program, which could remove health coverage for about 8.6 million low-income and disabled Americans. It also withdraws billions from green energy tax credits, including those for electric vehicles, drawing criticism from environmental groups.

The bill passed after an overnight session, facing opposition from both Democrats and some Republicans, the Associated Press reported.

Republican Senators Thom Tillis of North Carolina, Susan Collins of Maine and Rand Paul of Kentucky opposed the bill.

Democrats and some Republicans in the House concerned about cuts to health care and food aid could oppose it, AFP reported.

Concern about remittance tax

In May, when the Ways and Means Committee advanced the package, a remittance tax in the legislation that could affect overseas Indians who send money or invest in India raised concerns.

The proposed 5 percent tax on all remittances sent outside the U.S. by non-citizens raises concerns among migrant workers, including millions of Indians, India’s Firstpost reported. No minimum exemption is proposed, meaning even small transfers for family support or investments would be taxed.

The bill defines a verified sender as a U.S. citizen or national, so the tax would apply to most visa holders and green card residents.

According to India’s Ministry of External Affairs, about 4.5 million overseas Indians live in the U.S., including 3.2 million persons of Indian origin. If enacted without exemptions, the tax could generate $1.6 billion annually from the Indian diaspora, according to media reports.

If enacted, the remittance tax would take effect immediately, according to media reports. Financial institutions would need to withhold 5 percent at the time of transfer. The tax would apply regardless of the remittance’s amount or purpose, including payments for education, healthcare, or emergency support. This could significantly affect the financial planning of overseas Indians, according to Indian media outlets.

It's unclear if the remittance tax remains in the current version of the bill.

Musk eyes new party

Billionaire Elon Musk, who split with Trump over the legislation, said Monday he would launch a new party if the ‘One Big Beautiful Bill’ passes.

“If this insane spending bill passes, the America Party will be formed the next day,” Musk said in a post on X. “Our country needs an alternative to the Democrat-Republican uniparty so that the people actually have a VOICE.”

Musk also criticized members of Congress who had campaigned to reduce government spending but supported the bill.

“They will lose their primary next year if it is the last thing I do on this Earth,” Musk said.

The bill has drawn criticism from fiscal conservatives in the Republican Party. The House Freedom Caucus warned that the Senate’s version could add $650 billion a year to the national deficit.

“That’s not fiscal responsibility,” the group wrote in a statement. “It’s not what we agreed to.”

Some House Republicans are also concerned that the Senate’s proposed Medicaid cuts go far beyond what they originally endorsed.

Democrats have opposed the bill, criticizing its proposed welfare cuts and accusing Republicans of prioritizing tax breaks over support for the working class. With Trump’s deadline approaching and divisions in Congress, the coming days could determine the bill’s outcome.