Marriott posts 5% Q4 RevPAR surge, adds 123K new rooms in 2024

MARRIOTT INTERNATIONAL REPORTED five percent global RevPAR growth in the fourth quarter of 2024, with a four percent increase in the U.S. and Canada and 7.2 percent in international markets. However, net income fell to $455 million from $848 million in the prior year.

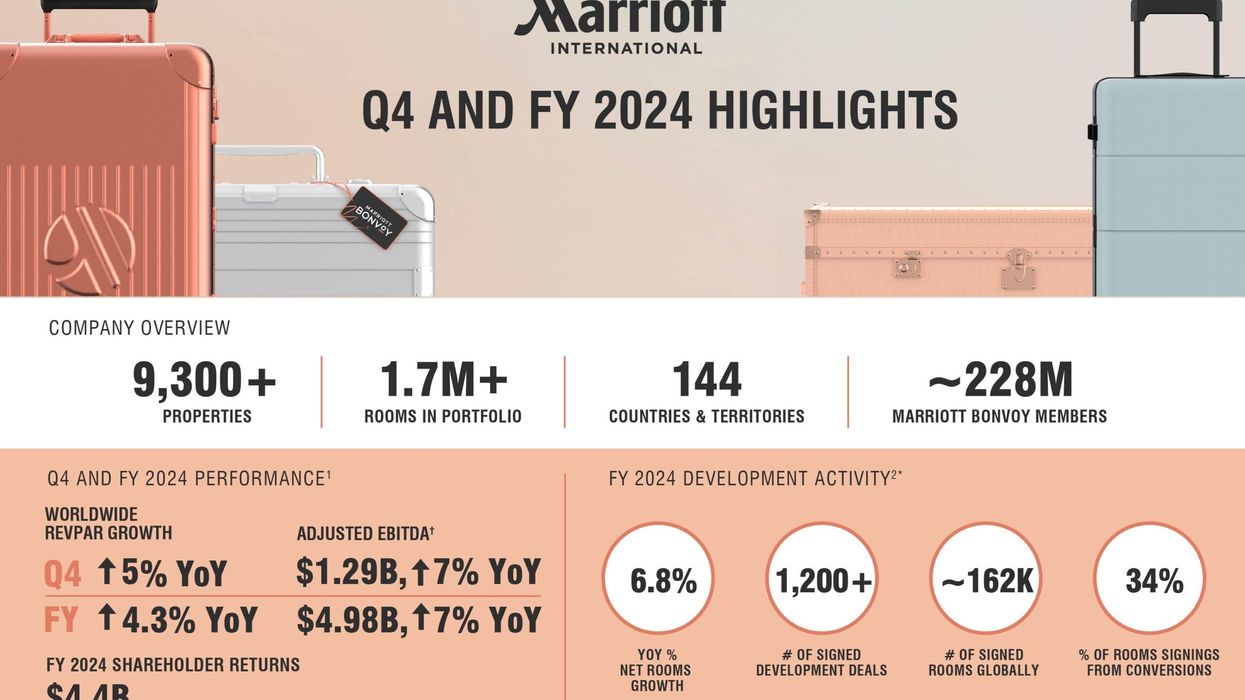

The company added more than 123,000 rooms in 2024, achieving 6.8 percent net rooms growth from year-end 2023, Marriott said in a statement.

“Marriott achieved excellent results in 2024, as we delivered best-in-class experiences that helped drive strong demand for our industry-leading portfolio of brands,” said Anthony Capuano, Marriott’s president and CEO. “Full-year global RevPAR rose 4.3 percent, and with record gross room additions, net rooms grew 6.8 percent to more than 1.7 million worldwide.”

Capuano said fourth quarter RevPAR growth was driven by gains in ADR and occupancy.

“International RevPAR increased by more than seven percent, with APEC and EMEA leading the way, benefiting from strong leisure demand,” he said. “RevPAR in the U.S. and Canada rose more than four percent, the region’s highest increase of the year, with all customer segments growing.”

Key highlights:

- Reported diluted EPS in fourth quarter: $1.63; adjusted diluted EPS: $2.45.

- Fourth quarter reported net income: $455 million; adjusted net income: $686 million.

- Adjusted EBITDA in fourth quarter: $1.286 billion.

- Net rooms grew 6.8 percent from year-end 2023, with record gross additions of 123,000.

- Development pipeline at year-end: nearly 3,800 properties and more than 577,000 rooms.

- Returned more than $4.4 billion to shareholders in 2024.

Capuano said 2024 was a terrific year for the company’s development team.

“We signed a record number of new deals, and conversions accounted for more than one-third of signings and over half of room additions,” he said.

Review and forecast

Base management and franchise fees rose 10 percent to $1.128 billion, driven by RevPAR growth, unit expansion, and higher residential and co-branded credit card fees. Incentive management fees totaled $206 million, down from $218 million, as APEC growth was offset by declines in the U.S. and Canada and Greater China.

“We continued to enhance our portfolio to deliver new travel experiences to our guests around the world,” Capuano said. “We expanded our presence in the midscale segment with the opening of 28 Four Points Flex hotels across EMEA and APEC. The City Express by Marriott brand also debuted in the U.S. and Canada. We also strengthened our non-traditional offerings with foundational deals in the outdoor lodging segment with key players Postcard Cabins and Trailborn.”

Owned, leased, and other revenue, net of direct expenses, totaled $100 million, down from $151 million, primarily due to a $63 million termination fee from a prior-year development project.

Marriott’s fourth quarter reported operating income rose to $752 million from $718 million, while adjusted operating income increased to $1.072 billion from $992 million. Adjusted net income fell to $686 million from $1.055 billion, and adjusted diluted EPS declined to $2.45 from $3.57.

By year-end, Marriott’s global system comprised over 9,300 properties and approximately 1.706 million rooms. The development pipeline included 3,766 properties with more than 577,000 rooms, including 1,381 properties under construction. International markets accounted for 55 percent of the pipeline.

The company forecasts worldwide RevPAR growth of three to four percent in the first quarter and two to four percent for the full year. Net rooms are expected to grow four to five percent in 2025. Adjusted EBITDA is projected between $1.170 billion and $1.196 billion for the first quarter and $5.295 billion to $5.435 billion for the year.

“Looking ahead, I am optimistic about Marriott’s future,” said Capuano. “With our unparalleled global rooms distribution and brand portfolio, our leading loyalty program with nearly 228 million Marriott Bonvoy members, and our dedicated associates, I believe Marriott is well-positioned to take advantage of the continued momentum in travel. With our powerful, cash-generating, asset-light business model, we look forward to delivering strong, valuable growth as we continue to connect people around the world through the power of travel.”

Marriott recently reported signing a record 608 deals in the U.S. and Canada last year.