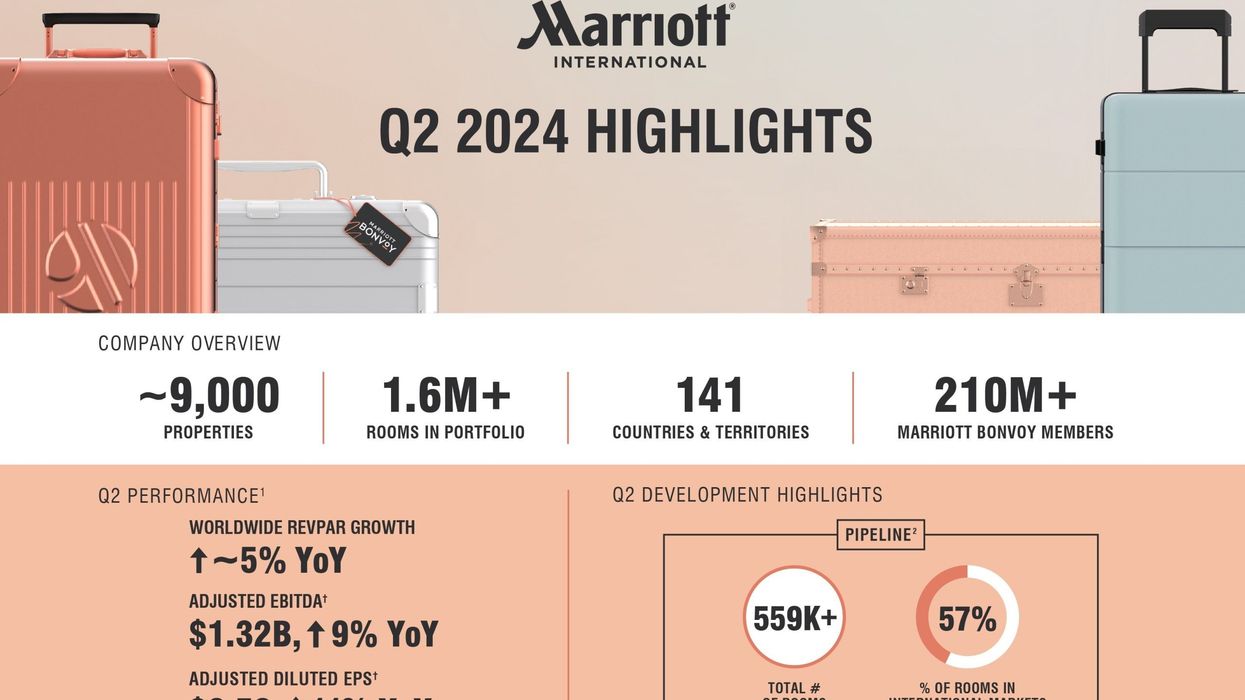

MARRIOTT INTERNATIONAL REPORTED 4.9 percent year-over-year global RevPAR growth in the second quarter of 2024, with U.S. and Canada RevPAR rising 3.9 percent and international RevPAR increasing 7.4 percent. The company’s net income grew to $772 million from $726 million a year ago, Marriott said in a statement.

“Marriott reported strong second quarter results, with net rooms up 6 percent year-over-year and worldwide RevPAR growth of nearly 5 percent, as consumers continued to prioritize travel,” said Anthony Capuano, Marriott International’s president and CEO. “International RevPAR increased more than 7 percent, with Asia-Pacific excluding China leading the way, posting an impressive 13 percent RevPAR increase from the year-ago quarter.”

RevPAR for the U.S. and Canada grew nearly 4 percent during the quarter, Capuano said, and all customer segments grew versus the prior year quarter.

“Group RevPAR rose nearly 10 percent year-over-year, with both rate and occupancy increasing in the mid-single digits,” Capuano said.

Marriott's diluted EPS was $2.69, up from $2.38 a year ago, while adjusted diluted EPS rose to $2.50 from $2.26 in the second quarter of 2023. The company’s adjusted EBITDA was $1.324 billion for the quarter, up from $1.219 billion in the previous year.

The company’s operating income was $1.195 billion for the quarter, up from $1.096 billion in the second quarter of 2023. Net income rose to $772 million, compared to $726 million a year ago. Adjusted operating income was $1.120 billion, up from $1.043 billion in the previous year. Adjusted net income totaled $716 million, compared to $690 million a year ago, while adjusted EBITDA was $1.324 billion, up from $1.219 billion during the same period in 2023.

Marriott repurchased 1 million shares of common stock for $1.0 billion in the second quarter. Year-to-date through July 29, the company returned $2.8 billion to shareholders through dividends and share repurchases. It expects to return approximately $4.3 billion to shareholders in 2024 through share repurchases and dividends.

Growing pipeline

Marriott’s global system reached nearly 9,000 properties and about 1.659 million rooms at the end of second quarter. The company added around 15,500 net rooms during the quarter, and its development pipeline now includes about 3,500 properties and more than 559,000 rooms, including roughly 33,000 approved but not yet contracted rooms. More than 209,000 pipeline rooms were under construction at the quarter’s end, with 57 percent located in international markets.

“Owner preference for our brands remains strong,” Capuano said. “We signed nearly 31,000 rooms in the quarter, 75 percent of which were in international markets. Our momentum around conversions continued, accounting for 37 percent of room additions in the quarter. We continue to expand our industry leading global portfolio, and our expectation for net rooms growth remains at 5.5 to 6 percent for full year 2024.”

Marriott reports a membership base of over 210 million, with Marriott Bonvoy serving as a key competitive advantage.

“We remain focused on enhancing the loyalty program’s benefits and finding new ways to engage with our members both on and off property,” Capuano said. “In June, we announced a collaboration with Starbucks. The number of members who have linked their accounts is already well exceeding our expectations.”

Franchise development

Marriott’s base management and franchise fees reached $1.148 billion in the second quarter, a 9 percent increase from $1.057 billion a year ago, the statement said. This rise is mainly due to RevPAR growth and unit expansion. Non-RevPAR-related franchise fees totaled $234 million for the quarter, up from $206 million the previous year, driven by a 10 percent increase in co-branded credit card fees and $13 million in higher residential branding fees.

Incentive management fees reached $195 million, up from $193 million in the second quarter of 2023, Marriott said. The increase was affected by weaker results in China and unfavorable foreign exchange.

The company said managed hotels in international markets accounted for more than 60 percent of the incentive fees earned.

Costs and outlook

Marriott’s owned, leased and other revenue, net of direct expenses, came in at $99 million during the quarter, down from $103 million a year ago. The company’s general, administrative and other expenses were $248 million for the quarter, up from $240 million a year ago. Its net interest expense was $164 million for the quarter, up from $141 million a year ago, primarily due to higher debt balances.

The company narrowed its RevPAR growth outlook due to a weaker operating environment in Greater China and slightly softer expectations in the U.S. and Canada. The company expects systemwide RevPAR growth of 3 percent to 4 percent for both the third quarter and the full year, and net rooms growth of 5.5 percent to 6 percent for the full year.

Marriott recently released its 2024 Serve 360 Report, highlighting progress toward its 2025 sustainability and social impact goals. The report covers data on sustainable operations, diversity and inclusion, volunteerism and other ESG activities by Marriott associates and hotels worldwide.