U.S. HOTELS CONTINUED to show profits in May as travel resumed, according to HotStats. However, revenue labor costs also continued to eat into revenue.

Globally, travelers were returning to hotels after months of isolation during the COVID-19 pandemic, HotStats said.

“The hotel industry is happy to welcome them back, but a continued revenue shortfall—the product of some segments still not returning with gusto, such as corporate and group—complemented by expense creep and an all-too-difficult labor market, are having consequence on the bottom line,” HotStats said.

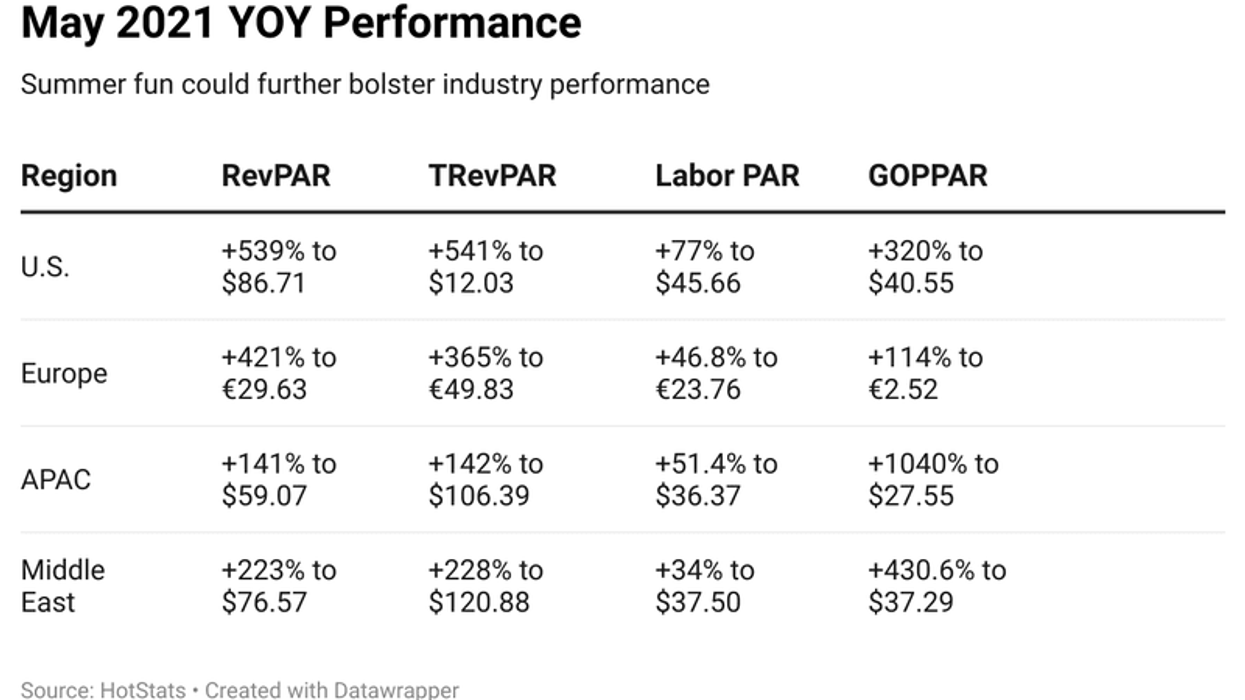

GOPPAR hit $40.55 in May, a 319 percent increase over the same time a year ago, but 63 percent lower than May 2019.

“In the U.S, where many states and municipalities continue to relax COVID protocols, revenue continued its march forward in May, with RevPAR up 539 percent over the same time a year ago, but still 51 percent lower than May 2019,” HotStats said. “With rooms revenue buoyed by the leisure segment, total revenue followed suit, up to $127 per available room, a 541 percent increase over the same time a year ago.”

In one sign of a return in travel, on June 25, 2,137,584 people passed through U.S. airports, according to the Transportation Security Administration, 78 percent of the total seen on June 25, 2019, and 237 percent more than on June 25, 2020.

“Labor costs are up nearly $20 per available room since last May, a cost that should continue to escalate as hoteliers find that they have to shell out more and add incentives to lure employees who are either still reticent to return to hospitality jobs or have switched career paths,” HotStats said.

HotStats also reported steady increases in U.S. hotels’ profit in April and in March. During the latter month, GOPPAR for the U.S. was up 328.9 percent over the same time last year to $30.63 compared to negative $13.38 in March 2020.