Summary:

- U.S. hotel performance rose week over week but remained below year-ago levels, CoStar reported.

- St. Louis led year-over-year gains among top 25 markets: occupancy up 21 percent to 81.3 percent, ADR up 8.1 percent to $145.21, RevPAR up 30.8 percent to $118.10.

- Houston posted the largest declines: occupancy down 20 percent to 57.7 percent, ADR down 17.6 percent to $114.55, RevPAR down 34.2 percent to $66.05.

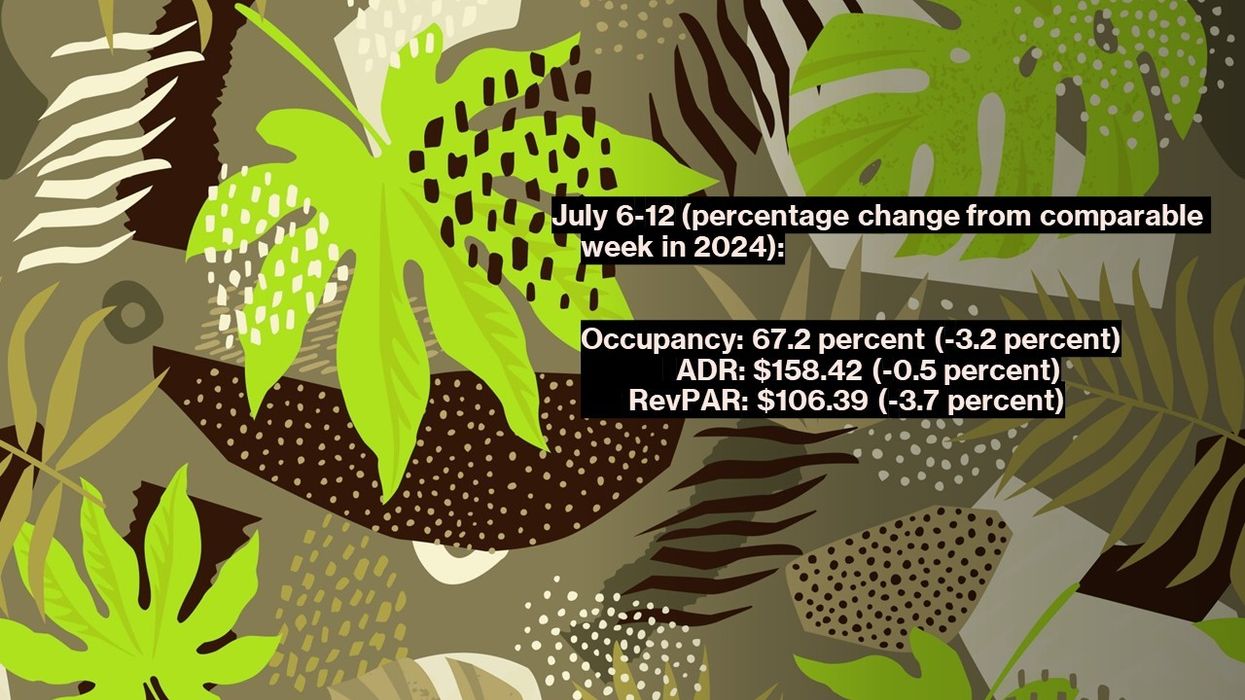

U.S. HOTEL METRICS rose for the week ending July 12 but remained below year-ago levels, according to CoStar. St. Louis posted the largest gains among the top 25 markets across all three key performance metrics.

Occupancy rose to 67.2 percent for the week ending July 12, up from 61.1 percent the previous week but 3.2 percentage points lower year over year. ADR increased to $158.42 from $156.71, a 0.5 percent decline from the same week in 2024. RevPAR rose to $106.39 from $95.80, down 3.7 percent year over year.

Among the top 25 markets, St. Louis posted the largest year-over-year gains across all metrics. Occupancy rose 21 percent to 81.3 percent, ADR increased 8.1 percent to $145.21 and RevPAR rose 30.8 percent to $118.10, driven by the 62nd General Conference Session of the Seventh-day Adventist Church.

Houston posted the largest declines across the three metrics: occupancy fell 20 percent to 57.7 percent, ADR dropped 17.6 percent to $114.55 and RevPAR declined 34.2 percent to $66.05, reflecting comparison with post-Hurricane Beryl impacts in 2024.