IN 2020 AND 2021, U.S. hotel operators did a praiseworthy job controlling expenses to offset the significant declines in revenue. Based on data from CBRE ’s Trends in the Hotel Industry survey of annual operating statements from thousands of properties across the U.S., not only have we seen a reduction in the variable expenses associated with the drop in business volume (i.e., occupied rooms, restaurant covers), but also in cuts among what were previously thought to be fixed expenses.

During this time period, insurance costs were out of operators’ control. Per the 11th edition of the Uniform System of Accounts for the Lodging Industry (USALI), insurance expenditures are classified as a non-operating expense and reported on the summary operating statement below gross operating profits. The insurance expense line item includes property insurance for building, contents, and business income from all perils, as well as general liability and excess liability insurance. The insurance expense category does not include workers compensation insurance, which is allocated to the operated and undistributed departments.

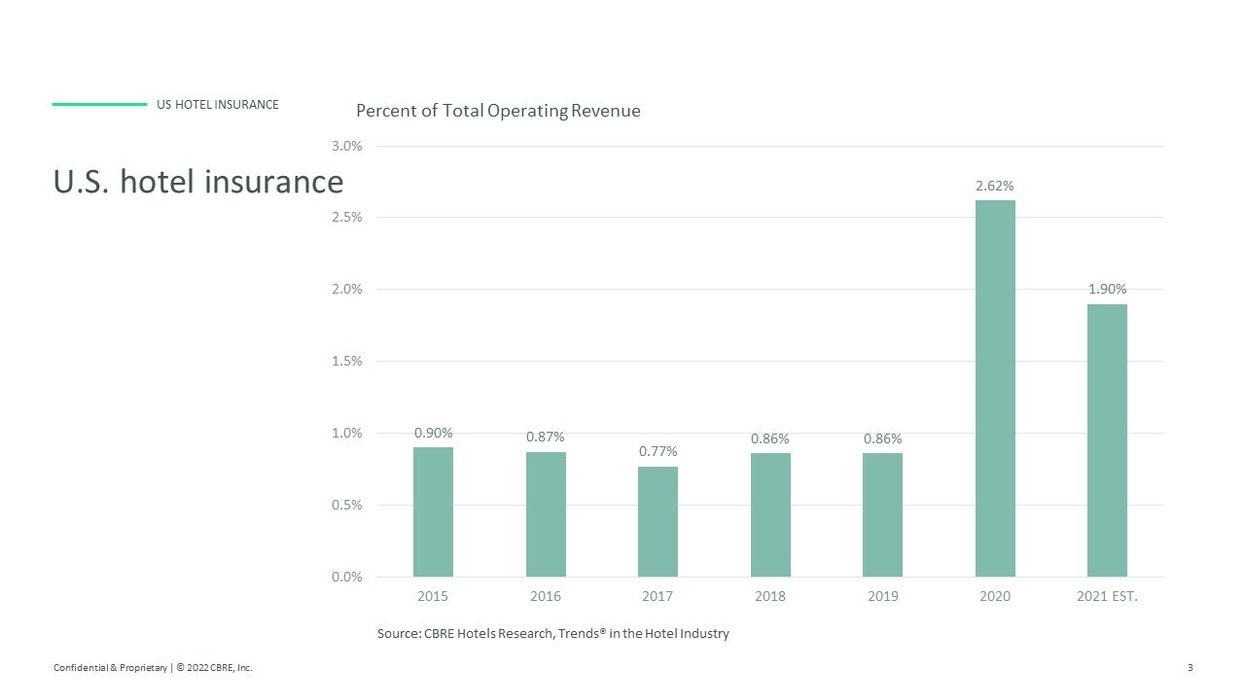

To analyze recent changes in hotel insurance costs, and the factors that influence those changes, we examined the operating statements of 3,156 U.S. hotels that reported insurance expenses for the Trends survey each year from 2015 through 2021 (estimated). The following paragraphs summarize the findings from our analysis.

Uncontrollable

From 2019 to 2021, the hotels in our study sample suffered a decline in total revenues of 40.0 percent. Concurrently, operating expenses were reduced by 37.6 percent. Contrary to the other expenses, insurance expenditures increased by 33.1 percent during the past two years.

According to the American Insurance Institute, total U.S. commercial insurance premiums were $600 billion in 2020. The lodging industry is a fraction of the “total insurance costs” for all businesses and does not statistically influence the overall market.

In general, there are four factors that influence the pricing policies of insurance companies for hotels:

- Location: Insurance companies have identified numerous catastrophic zones throughout the U.S. Hurricanes and floods impact properties located along the coast in the southeast and along the gulf coast, while fires and earthquakes are present in California. These natural disasters increase the underwriting risk in each respective region.

- Amenities: Many properties are stepping up their amenities to compete. Resorts in particular offer the greatest variety of amenities and are currently adding potentially dangerous activities such as water parks, zip lines, and axe throwing.

- Return on Investments: Insurance companies make a wide variety of investments. These range from the stock market to real estate. When the return on these investments is either low or in decline, the companies will raise their premiums to make up the difference. Unfortunately, we have rarely seen insurance companies lower premiums when investment returns rise.

- Claims: Of the $600 billion in total industry premiums, $450 billion were paid out, or reserved for claims. Insurance is underwritten for a 1 in 100-year loss, to make sure the insurance company can afford it. That said, claims on your account are held against you for at least three years.

COVID-19

COVID-19 has yet to contribute to the rise in hotel insurance expenditures. Being “the deep pocket”, guests and employees have alleged that poor hotel health practices caused them medical issues. However, this has proven to be difficult to demonstrate. To mitigate liability, insurance companies are now specifically excluding COVID on their Insurance Service Offices (ISO) forms.

Claims for business interruption (BI) insurance have proven to be unsuccessful. Attempts to create a link between the presence of the disease and resulting decline in travel do not meet the standards of most BI policies. The impact of a government mandated hotel closure has yet to be vetted.

Geography and Property Types

While the amount paid for insurance is only somewhat impacted by management, there are variances in insurance expenditures based on property type and geography. In 2021, the average insurance expenditure for the hotels in the study sample was $784 per-available-room (PAR). This ranged from a high of $2,224 PAR at resort hotels, to lows of $413 PAR at extended-stay properties and $482 PAR at limited-service hotels. As mentioned before, the quantity and nature of amenities offered at a hotel will influence the premiums charged. Obviously, the services and amenities offered at resorts are greater than those provided at extended-stay and limited-service properties.

Insurance expenditures vary among U.S. regions over time. From the period 2015 through 2020 (latest geographic data available), hotel insurance expenditures increased the most in the Mountain/Pacific and South Atlantic regions. Hotels in these regions are susceptible to hurricanes, fires, and earthquakes. Conversely, insurance expenditures for hotels in the sample located in the New England/Mid-Atlantic region have benefited from a 1.7 percent decline in insurance costs.

Guidance

While hotel owners and operators have limited abilities to influence insurance costs, they need to be prepared when evaluating the purchase of hotel insurance.

- Know the important data: What is the revenue and value of your hotel? What would the insurance cost be as a percent of these values?

- Changes: What are the differences between the new and old policies? Get this in writing.

- Worst case scenario: What is the maximum cost to you under different worst-case scenarios?

- Understand the insurance company: What is the company’s financial rating? Ask to see their balance sheet. Ask if the company makes money underwriting risks, or from their investments.

- Understand your risk tolerance: How prepared are you to handle routine claims versus reliance on the insurance company? Your premium payment will be lower based on the risk you are willing to take.

Indicators point toward a continuation of increased insurance premiums in the near-term. Unfortunately, insurance companies don’t consider the health of the lodging industry when establishing prices for hotels. Looking forward, hotel insurance will most likely continue to rise on a dollar PAR basis, but hopefully decline as a percent of revenue as travel recovers and hotel sales volume increases.

Related story: Last year, former AAHOA chairman and California hotelier Tarun Patel filed suit against his insurance company, for denying coverage on his business interruption insurance policy in connection with losses incurred from the COVID-19 pandemic.