Summary:

- Extended-stay hotels held ground during the 7-month industry downturn.

- Occupancy fell 1.9 percent in October, the 10th consecutive monthly decline.

- Room revenues rose 1.4 percent YoY in October.

EXTENDED-STAY HOTELS SHOWED resilience during the 7-month industry downturn in October, particularly at lower price points, according to The Highland Group. Economy extended-stay hotels had smaller RevPAR declines than all economy hotels for five consecutive months, while mid-price extended-stay RevPAR fell half as much as all mid-price hotels over the past two months.

The Highland Group’s “US Extended-Stay Hotels Bulletin – October” found that upscale extended-stay hotels recorded larger RevPAR losses than all upscale hotels in October but posted smaller declines in three of the past five months.

“Extended-stay hotels are expected to see a negative change in RevPAR for the rest of 2025, but the decline should not be as large as in the corresponding classes of all hotels, especially at lower price points,” said Mark Skinner, a partner at The Highland Group.

Extended-stay room nights available rose 4.3 percent in October compared with October 2024, partly due to Executive Residency by Best Western being added to the database in January.

Key metrics trends

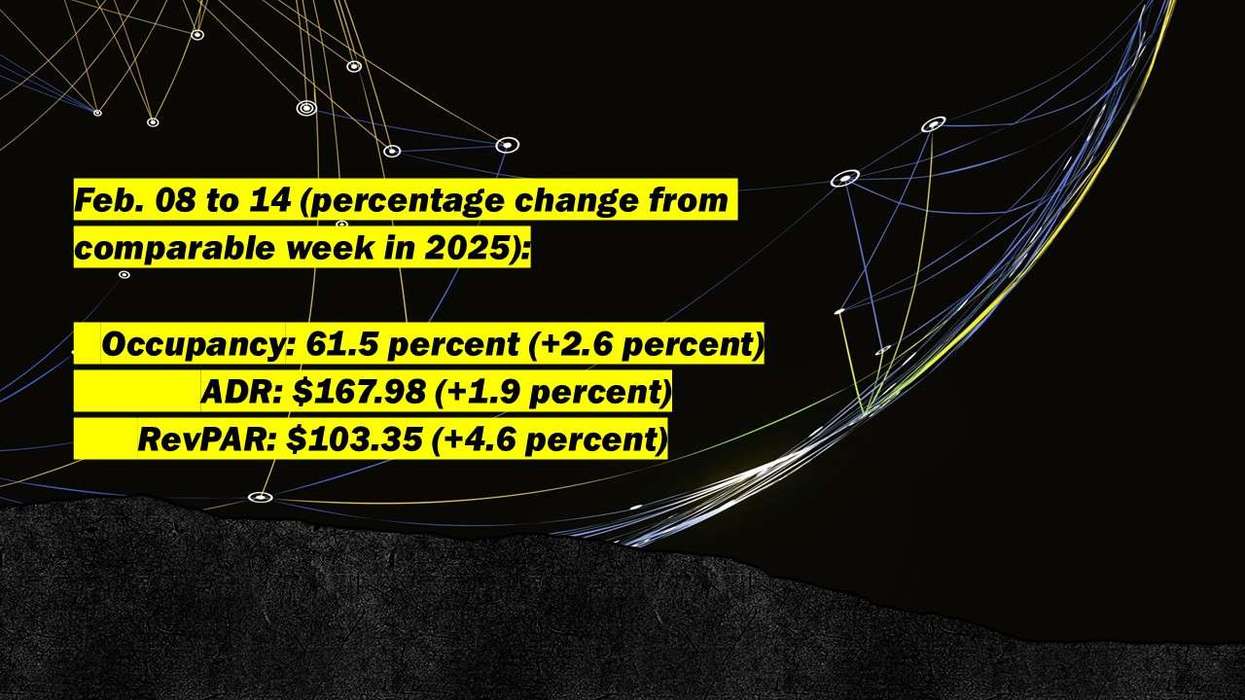

Extended-stay hotel occupancy fell 1.9 percent in October, marking the 10th consecutive monthly decline. This drop was smaller than the 2.6 percent decline reported by STR/CoStar for all hotels. Extended-stay occupancy remained 10.7 percentage points above the total hotel industry, within the long-term average range.

ADR for extended-stay hotels fell in October for the seventh consecutive month. Economy extended-stay ADR declined for the third time since May 2024, compared with a 4.2 percent drop for all economy hotels, according to STR/CoStar. Mid-price extended-stay ADR increased, while all mid-price hotels fell 1.1 percent. ADR for all upscale hotels declined 0.5 percent, slightly less than for upscale extended-stay hotels.

Extended-stay hotel RevPAR fell 2.8 percent in October, the seventh consecutive monthly decline. The overall drop was larger because lower-priced extended-stay hotels accounted for a bigger share of supply in October than the same month last year. STR/CoStar reported RevPAR declines of 7.7 percent for economy, 4.5 percent for mid-price and 1.7 percent for upscale hotels.

Supply growth

October marked the fourth consecutive month in four years with supply growth above 4 percent. Supply has risen steadily in 2025 and is up 3.4 percent year to date. The calendar-year change ranged from 1.8 percent to 3.1 percent over the past three years, below the long-term average of 4.9 percent annually.

The 6 percent increase in economy and mid-price extended-stay supply reflects conversions, while new construction in these segments accounts for 4 to 5 percent of rooms compared with last year. Comparisons are influenced by rebranding, de-flagging of hotels that no longer meet brand standards and sales of some hotels to apartment companies and municipalities. Total extended-stay supply in 2025 is expected to remain below the long-term average.

Revenues, demand rise

Extended-stay hotel room revenues rose 1.4 percent in October year over year, led by the economy and mid-price segments. STR/CoStar reported overall hotel room revenues fell 0.1 percent over the same period. Excluding luxury and upper-upscale segments, all hotel room revenues declined 2.4 percent.

STR/CoStar data shows October room revenues fell 7.7 percent for all economy hotels and 2.9 percent for all midscale hotels, while total upscale hotel room revenues declined 0.1 percent.

Extended-stay hotel demand rose 2.2 percent in October, slightly above the trailing 12-month average but below the long-term trend. By comparison, total hotel demand fell 1.3 percent. Adjusting for the extra day in February last year, extended-stay hotel demand has increased in 34 of the past 35 months.

The Highland Group recently reported that extended-stay hotels outperformed comparable classes in Q3 versus 2024, with occupancy 11.4 points higher and smaller ADR declines.