Summary:

- Occupancy fell to 60.9 percent from 64.2 percent the previous week, CoStar reported.

- New Orleans recorded the steepest declines across all key metrics.

- Tampa posted the second-largest drops in occupancy and RevPAR.

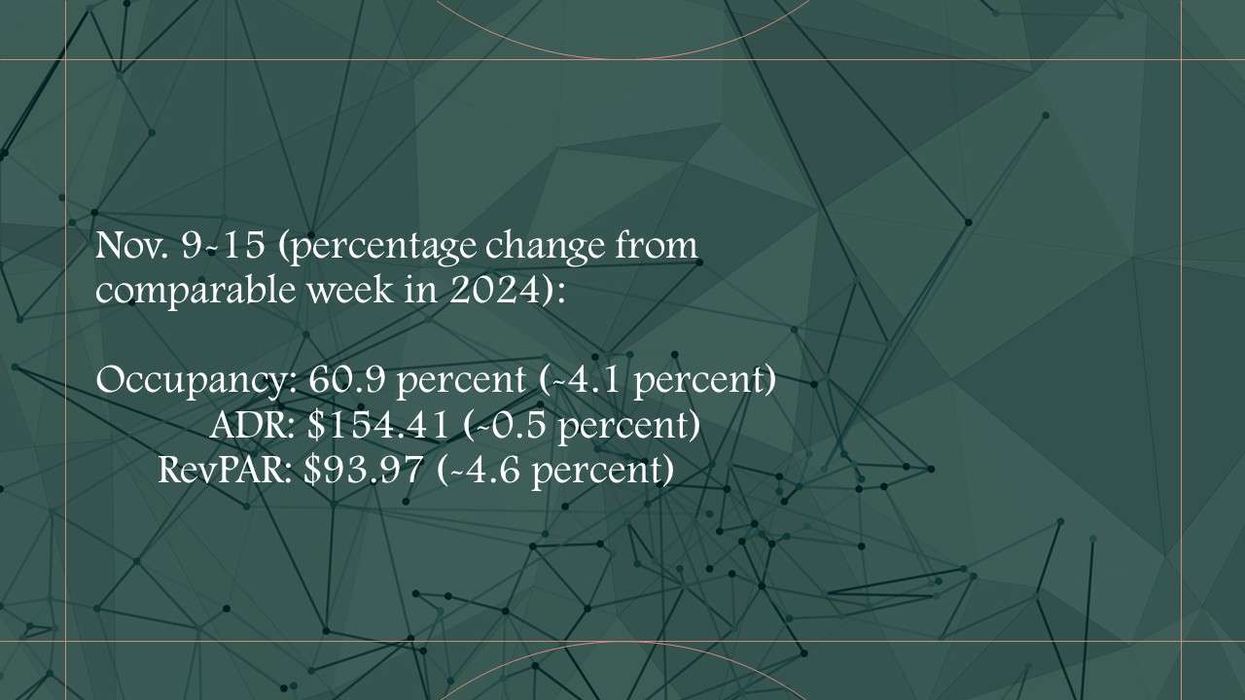

U.S. HOTEL METRICS fell for the week ending Nov. 15, reaching weekly and yearly lows, according to CoStar. A Veteran’s Day calendar shift caused a double-digit drop in group demand, lowering performance across the U.S.

Occupancy fell to 60.9 percent for the week ending Nov. 15, down from 64.2 percent the previous week and 4.1 percent below last year. ADR dropped to $154.41 from $162.70, a 0.5 percent decline year-over-year. RevPAR declined to $93.97 from $104.42, down 4.6 percent from the same week in 2024.

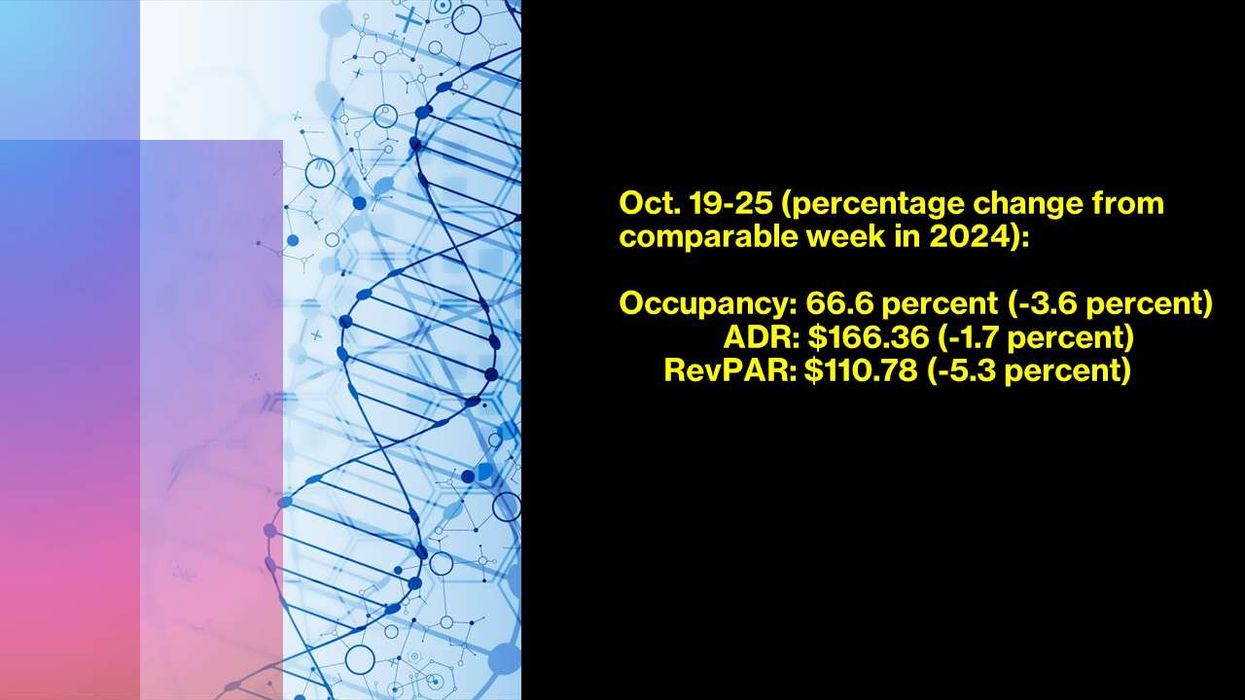

Among the top 25 markets, New Orleans reported the steepest declines across all three key performance metrics: occupancy fell 23.9 percent to 59.4 percent, ADR dropped 9.6 percent to $174.13 and RevPAR declined 31.2 percent to $103.42.

Tampa posted the second-largest declines in occupancy and RevPAR, falling 19.7 percent to 70 percent and 25 percent to $115.66, respectively, due to the elevated displacement demand period following Hurricane Milton in 2024.