U.S. Hotel Performance Shows Mixed Results for Holiday Week

U.S. HOTEL PERFORMANCE showed mixed results for the week ending with Memorial Day weekend, according to CoStar. Occupancy rose from the previous week, while ADR and RevPAR decreased slightly, though year-over-year metrics remained subdued.

Demand for the Friday and Saturday of the holiday weekend was the third highest on record, behind only 2022 and 2019.

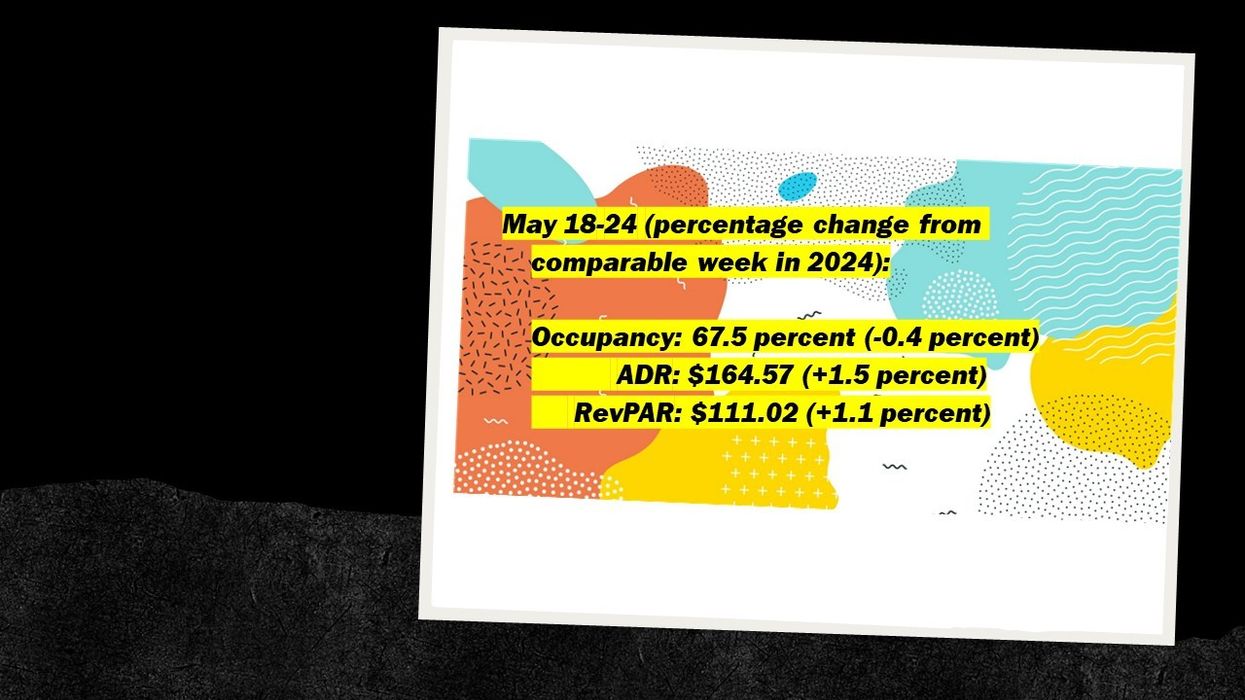

Occupancy increased to 67.5 percent for the week ending May 24, up from 67.2 percent the previous week but down 0.4 percentage points year over year. ADR decreased to $164.57 from $166.31 but still reflected a 1.5 percent year-over-year gain. RevPAR edged down to $111.02 from $111.80, up 1.1 percent from the same period in 2024.

Among the top 25 markets, St. Louis recorded the largest occupancy increase, up 19.3 percent to 76.7 percent. The highest ADR gain was in New York City, rising 12.6 percent to $358.57, while San Francisco/San Mateo posted the largest RevPAR increase, up 24.3 percent to $169.87.

Houston saw the steepest occupancy decline, down 16.2 percent to 62.1 percent. New Orleans reported the largest decreases in ADR and RevPAR, with ADR declining 7.3 percent to $155.45 and RevPAR falling 17.8 percent to $94.78.