U.S. HOTEL REVENUE and profitability saw a rise in October, propelled by increased group demand across the top 25 markets, according to CoStar’s October 2023 Profit & Loss data. Meanwhile, the U.S. hospitality industry also witnessed its largest year-over-year increases in GOPPAR and TRevPAR since March 2023.

In October, GOPPAR reached $97.45, marking a 3.7 percent increase from the same month in 2022. TRevPAR stood at $240.74, indicating a 4 percent increase, whereas EBITDA PAR amounted to $69.60, down 1.2 percent from September 2022. Labor costs notably rose to $74.48, reflecting a 5.9 percent increase.

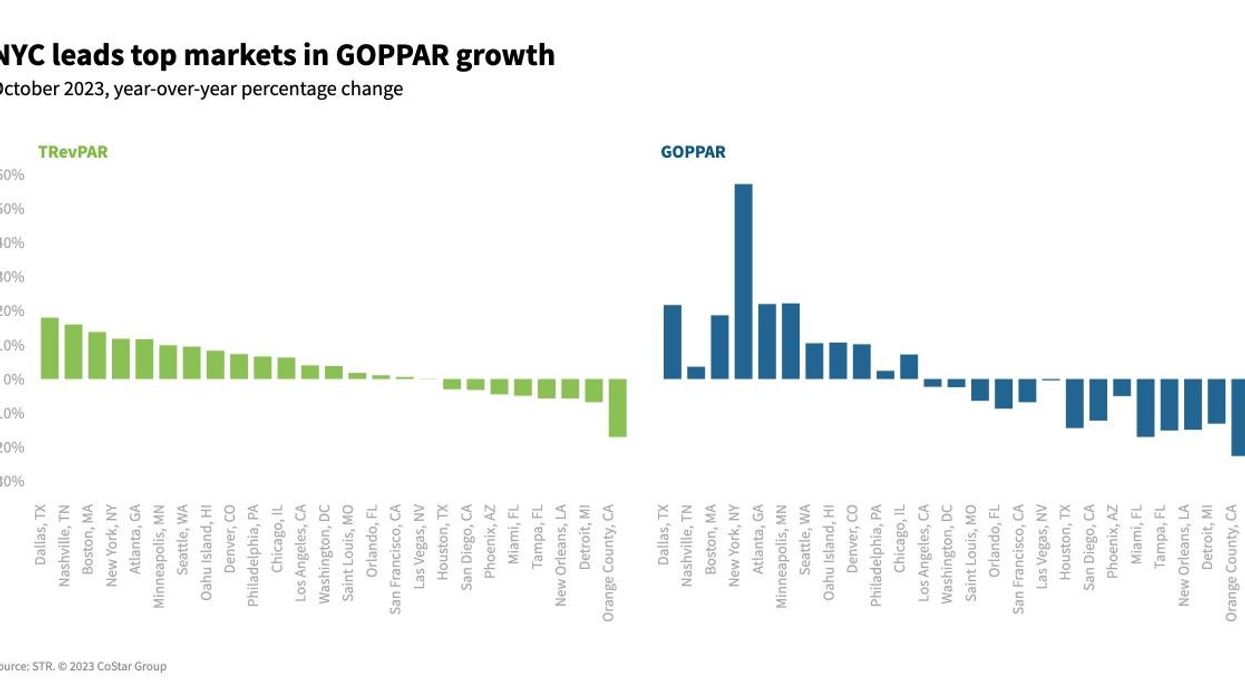

“The top 25 markets have demonstrated an 11 percent year-to-date increase in GOPPAR, surpassing a 14 percent rise in labor costs,” said Audrey Kallman, research analyst at STR. “This double-digit GOPPAR growth is over 10 times the level observed in all other markets. New York City, a prominent business-centric market, spearheaded growth in the metric across major markets both on a year-to-date and monthly basis.”

In total, eight out of the top 25 markets recorded double-digit increases in GOPPAR.

“Reflecting the uptick in corporate demand, F&B labor costs on a per-occupied-room basis showed the largest year-to-date growth of any department,” Kallman said. “This aligns with weekday group performance rebounding across the topline.”

In September, U.S. hotel GOPPAR increased by 6.2 percent to $75.74 compared to the same month in 2022, according to CoStar. TRevPAR rose by 8.6 percent to $208.34, and EBITDA PAR increased by 5.1 percent to $52.95 from September 2022. Labor costs, depicted in the chart, saw an uptick to $69.36, indicating a 13.1 percent year-over-year increase.